Swissquote targeting CHF 500M profit following record 2024 results

Leading Switzerland based online banking and trading provider Swissquote (SWX:SQN) has published its financial results for 2024, with the company seeing record Revenue and Net Profit figures for both the full year, as well as for the second half of the year, entering 2025 with strong momentum.

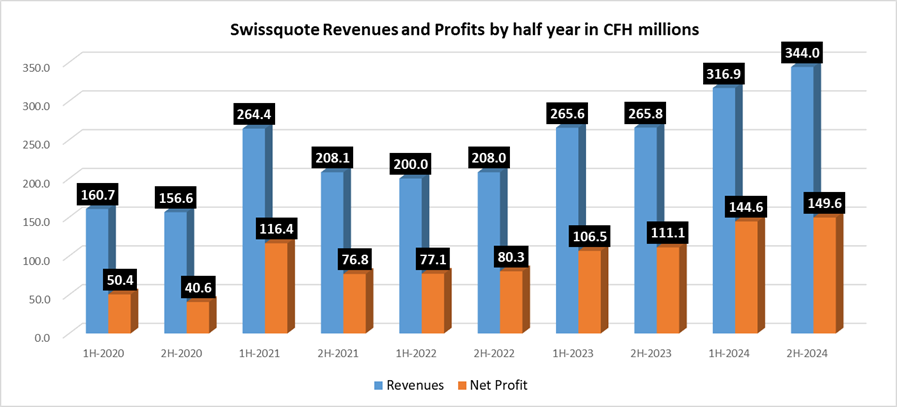

Starting with the second half of the year, Revenues at Swissquote totaled a record CHF 344.0 million (USD $392 million), up by 9% from CHF 316.9 million in the first half of 2024. The company’s Net Profit of CHF 149.6 million ($171 million) topped 1H-2024 by 3%.

For the full year, Swissquote reported record Revenue of CHF 661 million, and Net Profit of CHF 294 million – leading the company to boldly state that looking ahead to 2028, Swissquote expects to continue growing with a new pre-tax profit target set at CHF 500 million.

The company said that 2024 was the best year ever on multiple fronts for Swissquote. Client assets grew from CHF 58.0 billion to CHF 76.3 billion over the year, marking an impressive increase of +31.5%. This growth was supported by net new money inflows of CHF 8.3 billion, one of the best levels ever recorded.

Client trading volumes averaged $118 billion monthly at Swissquote during the second half of 2024, up slightly from $116 billion in 1H-2024. However crypto trading volumes were up 51%, from CHF 1.01 billion monthly in 1H-2024 to CHF 1.53 billion monthly during the second half of the year. In 2023 crypto trading volumes were under CHF 0.3 billion monthly at Swissquote.

Swissquote client accounts

The total number of client accounts at Swissquote increased by more than 75,000 in 2024, close to the combined growth of 2023 and 2022. Financially, 2024 was also a record-breaking year, with net revenues reaching CHF 661.0 million (+24.4%) and the pre-tax profit climbing to CHF 345.6 million (+35.3%). The diversification of the business model helped Swissquote navigate the pressure on net interest income following a 125 bps decline in CHF interest rates.

The total number of accounts increased during 2024 by more than 75,000 accounts, as noted above, reaching a total of 650,089 as of 31 December 2024. Client assets reached CHF 76.3 billion at the end of 2024, an increase of +31.5% thanks to net new money and positive market impact. The net new money reached CHF 8.3 billion (CHF 5.0 billion) and was purely organic. All geographies showed positive momentum, with particular growth in Switzerland and in Europe, where the net new money reached respectively CHF 5.1 billion and CHF 2.2 billion. In 2024, customer deposits increased by CHF 2.7 billion and the portion of such customer deposits remained stable (as a percentage of total client assets) at 15%. Interestingly, the relative importance of CHF customer deposits decreased down to 50% in 2024. The remaining 50% consisted mainly of USD and EUR customer deposits.

International expansion

Non-transaction-based revenues accounted for 48% of total net revenues, while net revenues from customers domiciled outside of Switzerland made up 42%, underscoring the evolution into not only a multi-asset-class platform but also an international one. The pre-tax profit at CHF 345.6 million is very close to the CHF 350 million target initially set for 2025 back in March 2022. This reflects an average annual pre-tax profit growth over 15%. For 2024, the Board of Directors is proposing a dividend of CHF 6.00 per share, corresponding to approximately 30% of the net profit.

Swissquote revenue mix

In 2024, net revenues reached CHF 661.0 million at Swissquote, an increase of +24.4% compared to the previous year (CHF 531.4 million). Most of the revenue categories showed growth. The crypto market benefitted from a global change of perception and the total crypto market capitalisation almost doubled during the year, as Bitcoin surpassed the threshold of USD 100,000 at the end of 2024. In that context, net crypto assets income increased by +353.2% to CHF 85.5 million, which represented approximately 13% of total net revenues.

Net fee and commission income increased by +24.7% to CHF 178.2 million, driven by growing investor appetite for foreign securities. Despite a declining interest rate environment, net interest income continued to grow (+5.2% compared to last year) supported by higher cash deposits of customers (total balance sheet up by +33.4%) and a more favourable currency mix in such cash deposits. Net eForex income remained affected by low FX volatility and decreased by -6.4% to CHF 94.7 million compared to last year. Net trading income increased by +41.3%, supported by a stronger foreign-currency-designated trading activity.

Yuh profitable ahead of plan

As at 31 December 2024, the mobile finance app Yuh increased the total number of accounts to more than 285,000 (+ 48.0% compared to last year) and its client assets to CHF 2.8 billion (+101.6% compared to last year). Ahead of its initial business plan, Yuh reached profitability (on a stand alone basis) already in 2024 and the contribution to Swissquote’s pre-tax profit was positive. For the time being, the primary focus of Yuh remains the consolidation of its leadership position in Switzerland. The pre-tax profit contribution is to remain positive in 2025.

Swissquote guidance for 2025 and new mid-term outlook 2028

Moving forward, Swissquote said it will further grow its net revenues and pre-tax profit. The new medium-term target puts pre-tax profit at CHF 500 million in 2028. By then, the diversification and the nature of net revenues should continue to improve, together with the pre-tax profit margin. For 2025, Swissquote will consolidate its successful year 2024 and grow net revenues to CHF 675 million (+2.1%) and pre-tax profit to CHF 355 million (+2.7%).

Changes in the corporate organisation

Swissquote also announced the following changes to its corporate organisation:

- Beat Oberlin, a long-standing member of the Board of Directors since 2016 and Chairman of the Nomination & Remuneration Committee, will not be standing for re-election at this year’s Annual General Meeting.

- Hans-Rudolf Kéng will be proposed as a new member of the Board of Directors at the upcoming Annual General Meeting. After more than 12 years as the CEO of PostFinance, he currently holds various board roles. He will bring to the Board his extensive banking and financial expertise, as well as executive experience in a systemic and AA-rated bank.

Markus Dennler, Chairman of the Board of Directors, commented,

Markus Dennler, Chairman of the Board of Directors, commented,

“We are convinced that Hans-Rudolf Kéng will be a valuable addition to our Board of Directors. His deep expertise and leadership experience will help us navigate future opportunities and challenges. At the same time, on behalf of the entire Board, I would like to sincerely thank Beat Oberlin for his many years of dedication and his significant contributions to Swissquote’s success. His insights and commitment have played an essential role in shaping the growth experienced in the last years.”

Swissquote’s summary financial and operating results for 2024 follow below.