Swissquote revenues fall 3% in 2H-2020, profits off 19%

Gland, Switzerland based online brokerage and banking firm Swissquote released its 2020 results today. While the company led off with the bold headline “Record result and profit to double by 2024”, the numbers actually indicate that Swissquote saw a slowing of activity and sharp decrease in profitability in the second half of the year, after a stellar 1H-2020.

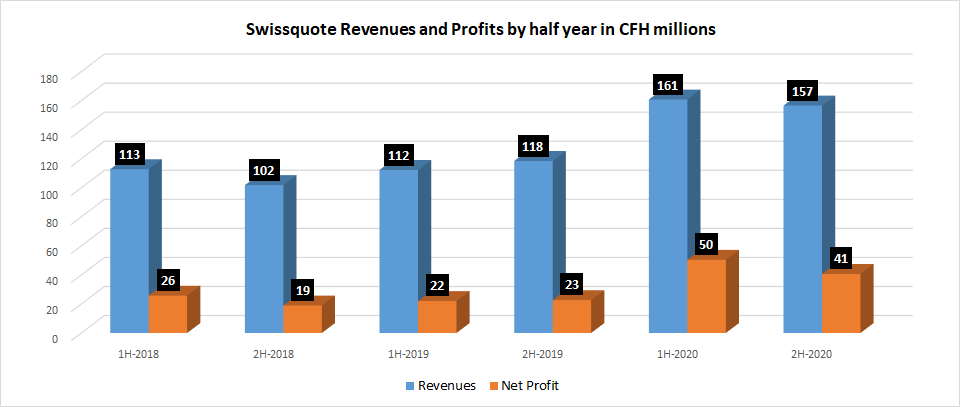

While 2020 as a whole was certainly a record year for Swissquote, revenues decreased by 3% from CHF 160.7 million to CHF 156.6 million from 1H to 2H 2020. Profits decreased by 19%, from CHF 50.4 million to CHF 40.6 million.

The company’s eForex trading volumes, which hit a record of $115 billion monthly in 1H, decreased slightly to average $113 billion per month from July to December 2020.

Swissquote also announced some management changes, with the company’s longtime CFO/CIO Michael Ploog departing although he will join the company’s board. CFO Yvan Cardenas will take over responsibility as CIO in addition to his existing role.

Additionally, Paolo Buzzi – a founding partner and CTO – will assume the newly created position of Deputy CEO. Alexandru Craciun, Director and long-time member of management, will be appointed CTO and member of the Executive Management.

Regarding the outlook for 2021, Swissquote said it is expecting to record about 15% growth in revenues and 23% growth in pre-tax profit, thanks mainly to high net new money inflows and positive trading activity since the beginning of the year. Net revenues and pre-tax profit are predicted to come in at CHF 365 million and CHF 130 million, respectively. The company added that this growth momentum should persist in the next few years thanks to an ambitious expansion strategy. Swissquote also noted that now that the initial medium-term targets for 2022 have been exceeded two years early, it aims to post further growth records: for 2024 it is targeting revenues of CHF 500 million and pre-tax profit of CHF 200 million.

But first, they will have to reverse the slowing activity the company saw in 2H-2020.

Swissquote shares (SWX:SQN) have traded up sharply over the past week, closing Wednesday at an all-time high of CHF 113.60 – this time last year SQN shares were at about CHF 45. It will be interesting to see how the shares react this morning, given the revelation about slowing activity in the second half of the year versus the company’s rosy projections.

As noted above, Swissquote pegs its future growth prospects to the healthy client money inflows it has seen recently – a phenomenon we are observing at a number of Retail FX brokers globally. The company saw net new money inflow of CHF 5.275 billion in 2020, attributable on the one hand to the faster pace of customer acquisition and, on the other, to the greater adoption of digital services in Switzerland and the increased interest in those services.

Client assets rose by 23.4% in 2020 to CHF 39.8 billion due to client growth and an 8.1% rise in average client assets. Per customer, this equates to an average of approximately CHF 100,000. As at the end of December 2020, clients held assets of CHF 38.7 billion in trading accounts, CHF 251.1 million in savings accounts, CHF 334.1 million in Robo-Advisory accounts and CHF 439.7 million in eForex accounts.

The total number of accounts at Swissquote grew by 50,636 (+14.1% YoY) in 2020 to a record 410,248. The breakdown of accounts is as follows: 338,330 trading accounts (+20.1%), 19,037 savings accounts (–3.4%), 4,540 Robo-Advisory accounts (+35.0%) and 48,341 eForex accounts (–11.7%).

More on Swissquote’s 2020 results can be seen here (pdf).