Saxo UK sees 13% drop in Revenue, 32% fall in Profit in 2024

Saxo Capital Markets UK Ltd, the London based, FCA regulated arm of Copenhagen based online broker Saxo Bank, has reported its financial results for 2024 indicating a drop-off on both the top and bottom line, despite an increase in new clients.

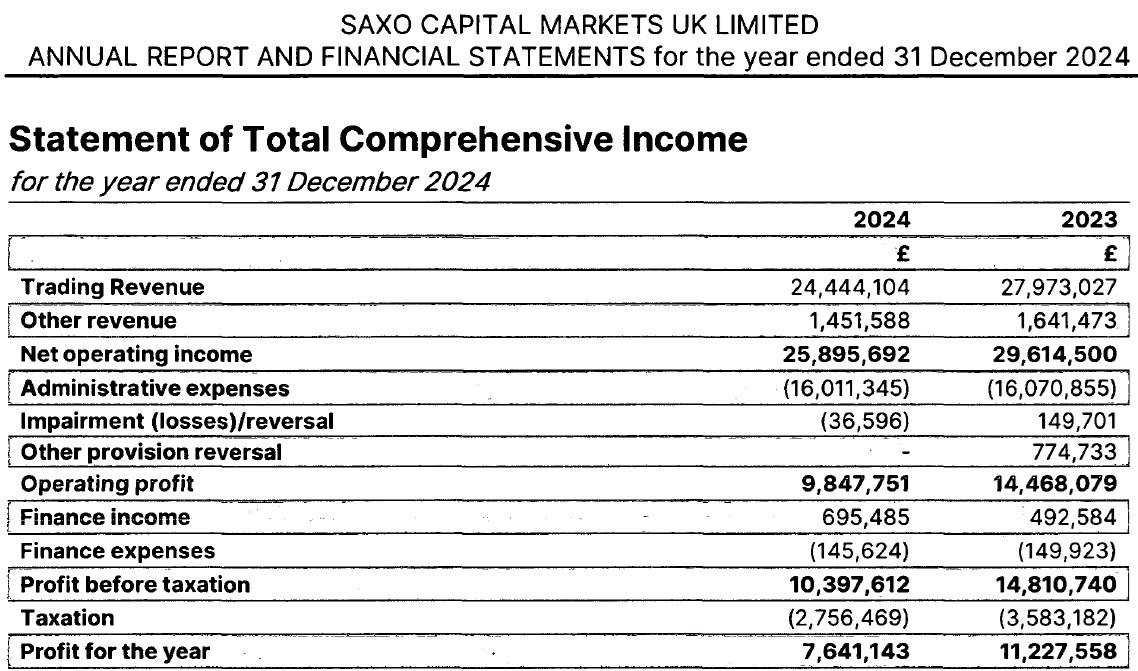

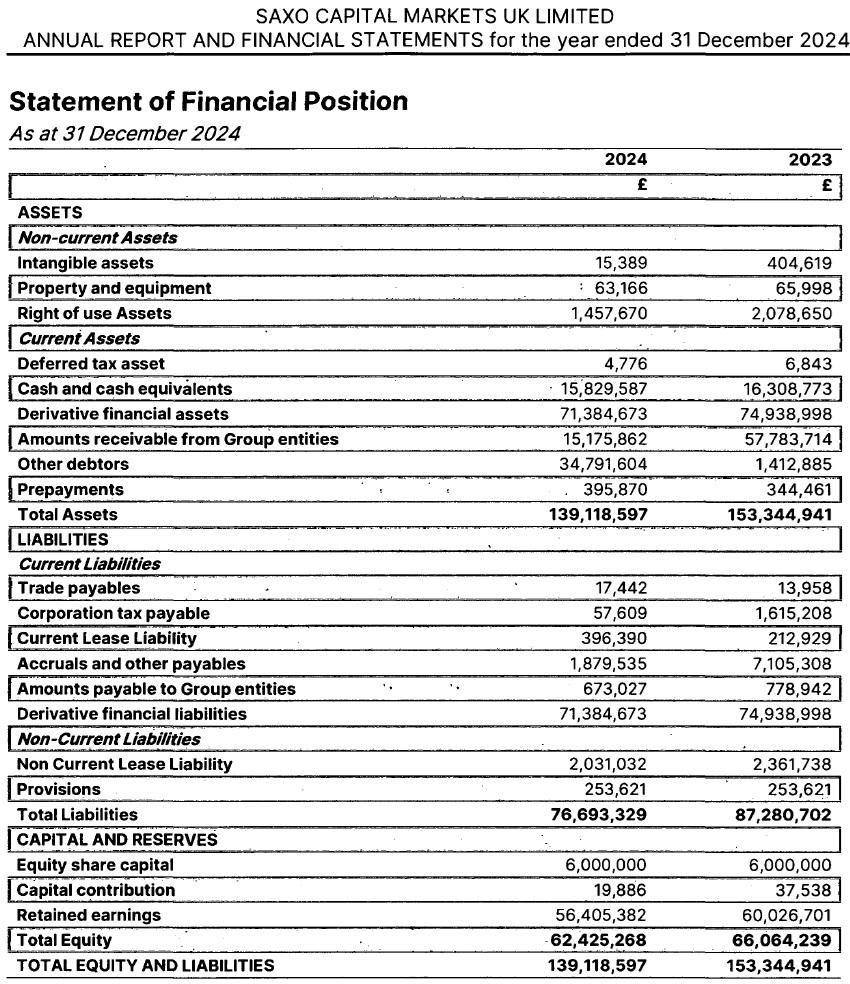

Saxo UK results 2024

Revenue at Saxo UK came in at £24.4 million (USD $33.1 million) in 2024, down by 13% from £28.0 million in 2023. Net Profit for 2024 at Saxo UK totaled £7.6 million, off 32% from £11.2 million the previous year.

The decreases at Saxo UK came with the backdrop of an overall improvement in both Revenue and Profits at parent Saxo Bank during 2024. Saxo UK accounts for approximately 5% of overall Saxo Bank company revenue.

Organizational change

The depressed results at Saxo UK also came amid a lot of organizational change at the company, with Saxo UK CEO Charles White-Thomson resigning early in 2024, replaced by former InvestCloud executive Andrew Bresler. Following the end of the year Saxo UK Chairman Richard Balarkas stepped down from the board, Saxo UK director Michael Ridley resigned, and the company’s longtime marketing head Anaam Raza left for BCG.

Saxo Bank was acquired in March 2025 by the Safra Group, at a $1.74 billion valuation.

Results in detail

Back to Saxo UK’s 2024 results, the company said that in 2024 it introduced a competitive pricing model for its direct retail clients and reduced commission on Stocks, ETFs, Options & Futures, and currency conversion fees, whilst also removing inactivity fees and minimum custody fees charged to clients.

The reduction in prices attracted 3,600 newly trading clients to the Saxo UK platform, which was an 79% uplift from the previous year (2023: 2,000). The company continued to benefit from high interest rates during the year, however, lower pricing combined with low market volatility throughout most of 2024 resulted in a drop in the trading revenue for the company, as noted above.

The Saxo UK management team said that it is focused on building a significantly larger client and asset base, accelerating digitisation of frictionless customer acquisition to “make it easy” to execute with Saxo, driving client retention, activating new and existing clients with timely relevant and engaging content, and improving service levels further to meet its own high expectations.

Saxo UK’s 2024 income statement and balance sheet follow below.