Saxo Bank sees further 4% drop in trading volumes in June 2024

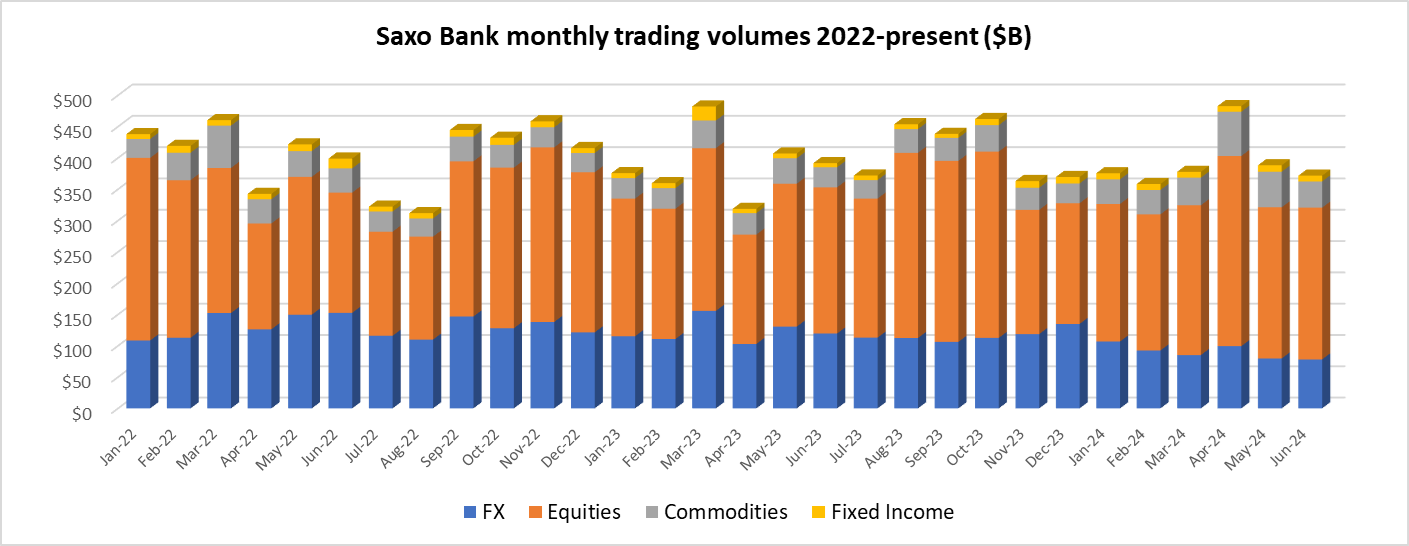

Following a 20% decline in May, client trading volumes at Copenhagen based Retail FX and CFDs broker Saxo Bank continued to fall in June 2024, with total trading coming in at $371.6 billion for the month, down 4% from the previous month.

While Equity trading was flat month-over-month at $242 billion, Saxo’s core FX trading volumes fell to another multi-year low, totaling $78.1 billion in June.

For the first half of 2024, Saxo Bank trading volumes averaged $392 billion monthly, down 2% from $399 billion in 2023.

We had reported exclusively earlier this week that the company began the second half of 2024 by sending a note to its institutional partners that Saxo Bank had made decision to stop onboarding clients in certain countries, including Brazil, Canada, China, Cyprus, Egypt, India, Indonesia, New Zealand, South Africa, Taiwan, and Turkey, among others. We’ll see in the coming months if this move has an effect on trading volumes moving forward.

The other major initiative we reported on during the first half of the year was that Saxo Bank had engaged investment bankers, to explore a possible sale of the company. Saxo Bank’s main shareholders are Chinese conglomerate Geely Group (known increasingly for its electric cars) which holds just under 50% of Saxo (49.88%), CEO Kim Fournais via his Fournais Holding company (28.09%), and Finnish company Mandatum (19.83%).

Client trading volumes at Saxo Bank in June 2024 were as follows:

- FX trading down 2% MoM to $78.1 billion.

- Equities flat at $242.4 billion.

- Commodities down 26% to $41.9 billion.

- Fixed income trading down 11% to $9.2 billion.