Saxo Bank FX trading volumes fall to lowest level in 8+ years in February 2024

After recently posting one of its worst financial periods in years with a net loss in 2H-2023, Copenhagen based Retail FX and CFDs broker Saxo Bank is not exactly enjoying a strong start to 2024.

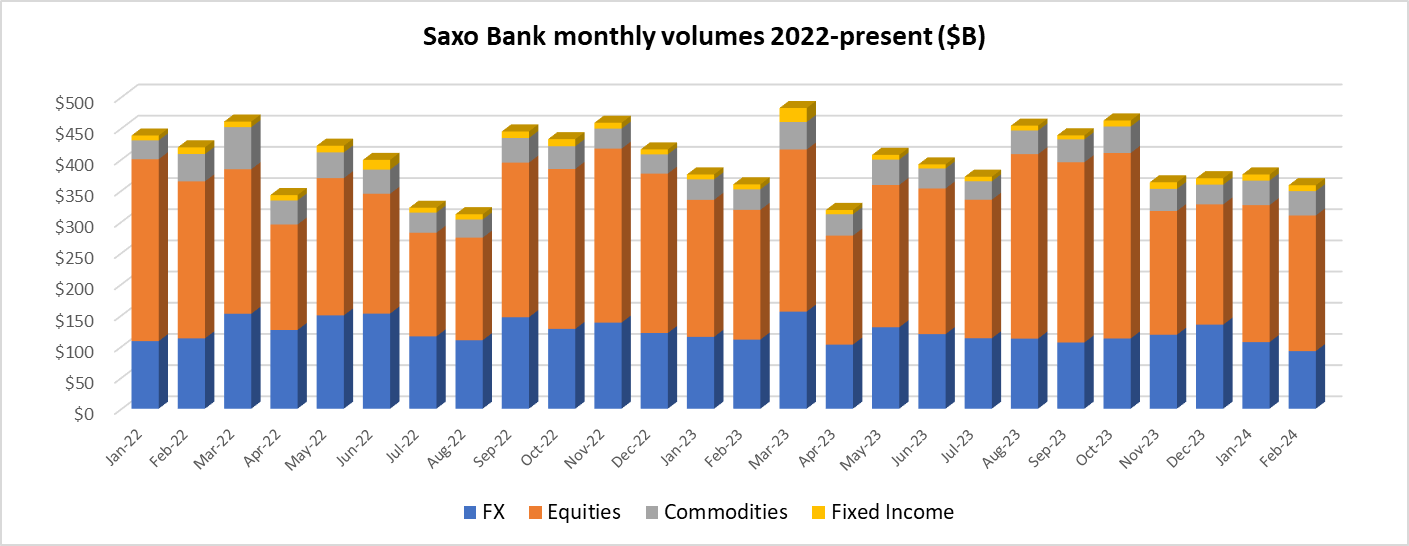

Following a fairly quiet January, trading volumes at Saxo Bank dropped by 5% MoM in February 2024, coming in at $358.3 billion, versus $375.5 billion the previous month. So far in 2024 Saxo client trading volumes are averaging $367 billion monthly, down by 8% from 2023’s average of $399 billion.

Saxo Bank saw declines in the trading volumes of all of its traded asset groups during February, led by a 13% drop in its core FX trading volumes. Saxo Bank’s FX trading volumes of $92.4 billion in February 2024 marks the first time that FX trading dropped below the $100 billion mark at the company since 2021, and is actually the lowest such reading at Saxo since the company started publishing volume stats in 2016.

Client trading volumes at Saxo Bank in February 2024 were as follows:

- FX trading down 13% MoM to $92.4 billion.

- Equities down 1% to $217.4 billion.

- Commodities down 1% to $39.0 billion.

- Fixed income trading down 3% to $9.5 billion.

Saxo Bank is controlled by China’s Geely Group.