Robinhood shares pop 6% after addition to S&P500 Index

Shares of US neobroker Robinhood Markets Inc (NASDAQ:HOOD) rose by more than 6% in aftermarket trading at the end of the week, after S&P Global unit S&P Dow Jones Indices announced late Friday that the company was going to be added to its benchmark S&P 500 index.

Robinhood’s addition to the S&P 500 index will become effective on Monday, September 22, coinciding with the index’s quarterly rebalance.

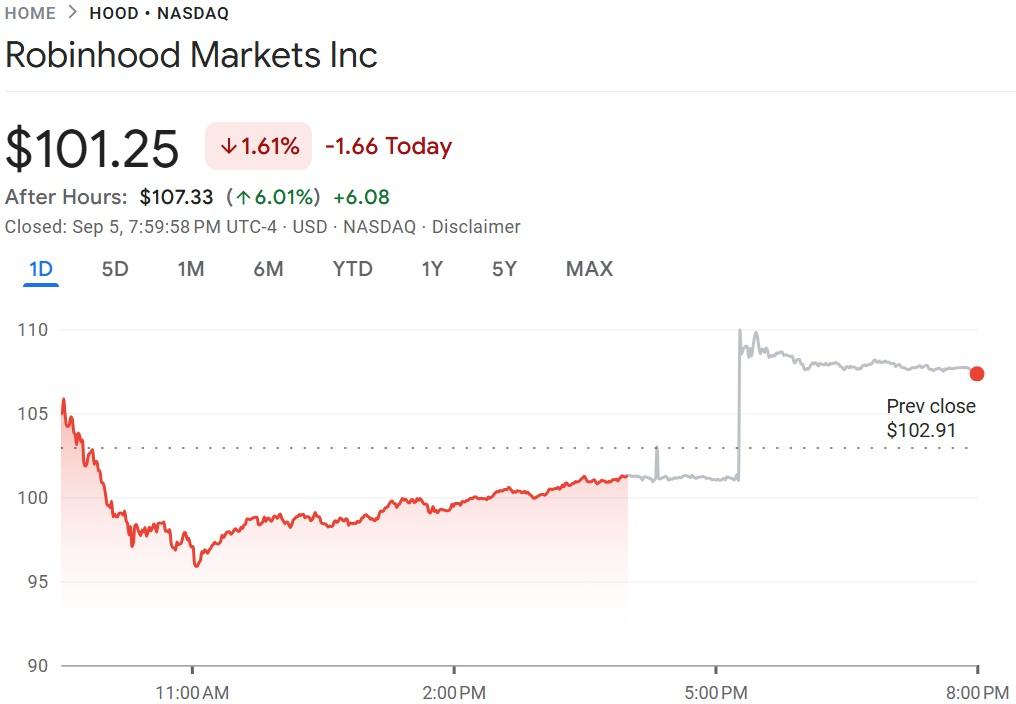

Beyond the prestige of being an “S&P 500 company”, all funds and investors who follow or try to mimic the S&P 500 will be buying Robinhood shares, leading to the immediate share price bump. After closing the day on Friday (September 5) at $101.25, down 1.6% on the day, Robinhood shares popped by more than 6% to above $107 after the S&P 500 announcement was released after 5:00pm EDT.

Trading in Robinhood shares on Friday Sept 5 2025. Source: Google Finance.

Robinhood shares are up by 172% so far in 2025 year-to-date, although slightly down from an all-time high hit at $117.70 last month, after Robinhood released its Q2 205 results.