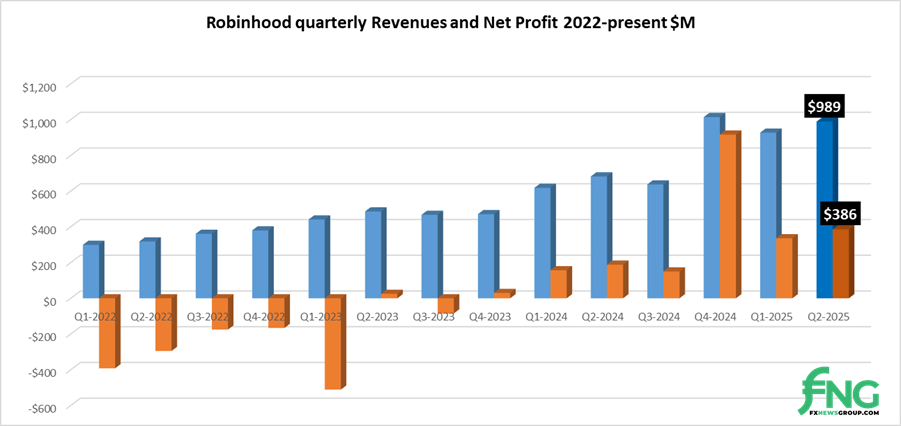

Robinhood revenues rise 7% ($989M) and profits up 15% ($386M) in bounceback Q2 2025

Following a somewhat disappointing Q1, US neobroker Robinhood Markets Inc (NASDAQ:HOOD) saw much-improved results in the second quarter of 2025, with the company reporting modestly improved Revenues and Profit figures, although still below record results from Q4-2024.

Revenues at Robinhood came in at $989 million in Q2 2025, up 7% from $927 million in Q1. Interestingly, the Revenue increase came as Crypto trading Revenue fell at Robinhood from $252 million in Q1 to just $160 million in Q2, with the slack more than picked up by increased Options trading, and growing Interest income.

Robinhood shares, which have been trading at near-record levels since first crossing the $100 mark at the beginning of July, barely reacted to the news, with aftermarket trading seeing a slight (0.6%) decline from Robinhood’s Wednesday closing price of $106.10. At that price, Robinhood is valued at nearly $94 billion.

Vlad Tenev, Chairman and CEO of Robinhood said,

“We delivered strong business results in Q2 driven by relentless product velocity, and we launched tokenization—which I believe is the biggest innovation our industry has seen in the past decade.”

Jason Warnick, Chief Financial Officer of Robinhood added,

“Q2 was another great quarter as we drove market share gains, closed the acquisition of Bitstamp and remained disciplined on expenses. And Q3 is off to a great start in July, as customers accelerated their net deposits to around $6 billion and leaned in with strong trading across categories.”

Second Quarter Results

Total net revenues increased 45% year-over-year to $989 million.

- Transaction-based revenues increased 65% year-over-year to $539 million, primarily driven by options revenue of $265 million, up 46%, cryptocurrencies revenue of $160 million, up 98%, and equities revenue of $66 million, up 65%.

- Net interest revenues increased 25% year-over-year to $357 million, primarily driven by growth in interest-earning assets and securities lending activity, partially offset by lower short-term interest rates.

- Other revenues increased 33% year-over-year to $93 million, primarily due to increased Robinhood Gold subscribers.

Net income increased 105% year-over-year to $386 million.

Diluted earnings per share (EPS) increased 100% year-over-year to $0.42.

Total operating expenses increased 12% year-over-year to $550 million.Adjusted Operating Expenses and Share-Based Compensation (SBC) (non-GAAP) increased 6% year-over-year to $522 million, which includes costs related to Bitstamp.

- Adjusted EBITDA (non-GAAP) increased 82% year-over-year to $549 million.

Funded Customers increased by 2.3 million, or 10%, year-over-year to 26.5 million.

- Investment Accounts increased by 2.6 million, or 10%, year-over-year to 27.4 million.

Total Platform Assets increased 99% year-over-year to $279 billion, driven by continued Net Deposits, acquired assets, and higher equity and cryptocurrency valuations.

Net Deposits were $13.8 billion, an annualized growth rate of 25% relative to Total Platform Assets at the end of Q1 2025. Over the past twelve months, Net Deposits were $57.9 billion, a growth rate of 41% relative to Total Platform Assets at the end of Q2 2024.

Average Revenue Per User (ARPU) increased 34% year-over-year to $151.

Robinhood Gold Subscribers increased by 1.5 million, or 76%, year-over-year to 3.5 million.

Cash and cash equivalents totaled $4.2 billion compared with $4.5 billion at the end of Q2 2024.

Share repurchases were $124 million, representing 3 million shares of our Class A common stock at an average price per share of $41.52. Over the past twelve months, share repurchases were $703 million, representing 21 million shares of our Class A common stock at an average price per share of $34.24.

Robinhood Accelerates Global Crypto Expansion

Despite the aforementioned decline in Crypto trading Revenue in Q2 2025, Robinhood seems to be “all in” for Crypto. At the company’s recent event Robinhood Presents: To Catch a Token in June 2025, the company unveiled a suite of new crypto products, expanded into 30 European countries, launched Stock Tokens in Europe on over 200 US stocks and ETFs, and offered Crypto staking to eligible US customers.

Also in June 2025, Robinhood closed its acquisition of Bitstamp, a crypto exchange with over 50 active licenses and registrations globally, and significantly expanded Robinhood’s institutional business. Robinhood has also entered into an agreement to acquire WonderFi, a Canadian leader in digital asset products and services. The transaction is expected to close in the second half of 2025, subject to customary closing conditions, including regulatory approvals.

Additional Q2 2025 Operating Data

- Robinhood Retirement AUC increased 118% year-over-year to a record $19.0 billion.

- Cash Sweep increased 56% year-over-year to a record $32.7 billion.

- Margin Book increased 90% year-over-year to a record $9.5 billion.

- Equity Notional Trading Volumes increased 112% year-over-year to a record $517 billion.

- Options Contracts Traded increased 32% year-over-year to a record 515 million.

- Robinhood App Crypto Notional Trading Volumes increased 32% year-over-year to $28 billion.

- Bitstamp Exchange Crypto Notional Trading Volumes were $7 billion following the closing of the acquisition of Bitstamp in June 2025.

Robinhood’s full results release for Q2 2025 can be seen here.