Plus500 touts Q1-2021 Customer Income ahead of Q4

CFDs broker Plus500 (LON:PLUS) issued a Trading Update on its performance in Q1-2021 to date, ahead of the company’s shareholder meeting today.

The Trading Update (see full text below) gave out some mixed messages. It did indicate that client trading activity during Q1 “remained strong”, and that there was “continued outperformance” tracking ahead of Q4-2020 in Customer Income – i.e. revenue from customer spread. However Plus500 also noted that “monthly trading results remain volatile”.

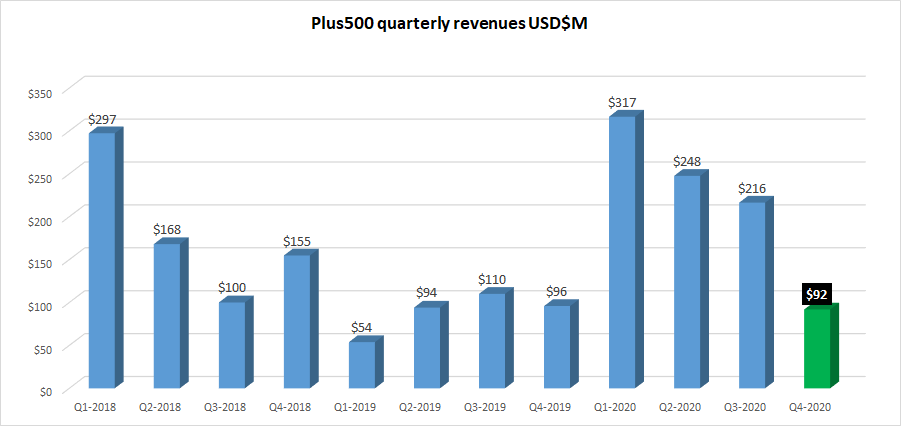

Plus500 had some issues late last year which led to a severe decrease in revenue and profitability in Q4 (see chart below). The problem wasn’t trading volumes – those remained strong. It was that clients were making large gains against Plus500, which acts as market maker, and those gains hadn’t been hedged outside by the company. Unhedged market making activity saw Plus500 customers “win” $109 million in Q4 against the company, a direct reduction in Plus500 revenues. Plus500 seems to have a policy of doing little hedging of its client book, believing that what it calls “Customer Trading Performance” will be broadly neutral over time.

It remains to be seen if the same phenomenon has continued into early 2021.

Shares of Plus500 reacted positively to the Trading Update, with LON:PLUS trading up by more than 3% in early Tuesday activity.

Plus500’s full Trading Update reads as follows:

16 March 2021

Plus500 Ltd.

Trading Update

Plus500, a leading technology platform for trading Contracts for Difference (“CFDs”) internationally, issues the following trading update ahead of today’s EGM, which is taking place at 10.00am UK time.

Trading during Q1 2021 has remained strong, supported by continued outperformance of Customer Income, which is tracking ahead of Q4 2020, and across key operating metrics.

FY 2021 revenue will be driven through the Company’s continued underlying growth of Active Customers, its on-going success in attracting and retaining New Customers and supportive market conditions. At this early stage of the year, while these dynamics have continued to be favourable, monthly trading results remain volatile.

FY 2021 EBITDA will be supported by Plus500’s lean, flexible cost base and efficient business model, with continued investment in marketing technology to capture opportunities to drive attractive return-on-investment over time.

Given the Company’s continued robust performance, and supported by its market-leading proprietary trading platform, its flexible and scalable business model, its robust financial position and consistent track record, the Board remains confident about the outlook for Plus500.