Plus500 sees steady Revenue and Profit in 2025 as client deposits soar

Israel based CFDs broker Plus500 Ltd (LON:PLUS) reported its preliminary results for 2025, indicating single digit percent increases across the board in Revenues, EBITDA, and Net Profit in what looks like a fairly steady if unspectacular year.

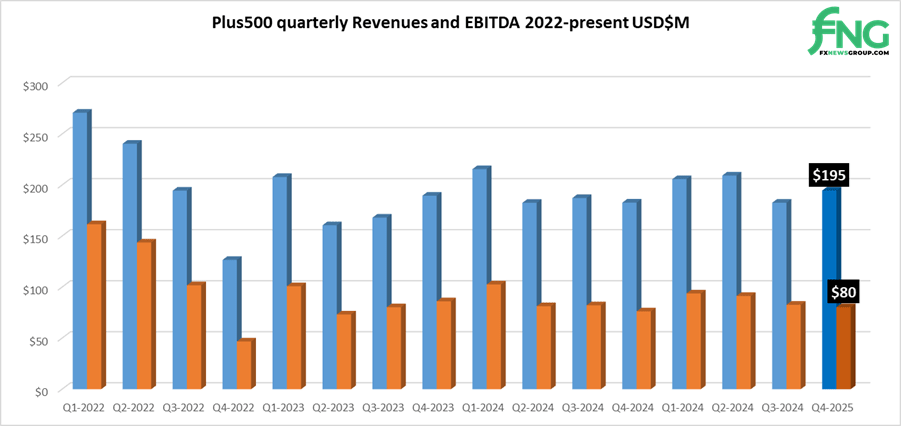

Q4 Revenues at Plus500 came in at $195 million, up 6.5% over Q3, although both of Q3 and Q4 were below Q1 and Q2 levels, which were each north of $200 million. EBITDA in Q4 was down 1.2% from Q3 at $80 million.

For the year, Plus500 Revenues of $792.4 million in 2025 were up 3% over 2024’s $768.3 million. Net Profit of $281.3 million was up 3.0% over 2024’s $273.1 million.

We would also note, as demonstrated in the Revenue/EBITDA graph above, that both top and bottom line quarterly results at Plus500 have been fairly steady for the past two years, with much less variance than in previous years.

Client data

Plus500 said that it delivered a strong operational performance during 2025, reflecting its continued focus on attracting and retaining higher value customers as well as the benefits of its increasingly diversified platform offering.

Active Customers were actually down slightly at 242,440 for FY 2025 (FY 2024: 254,138), supported by improved customer retention and engagement across the Group’s platforms and reflecting its focus on long term, higher value customers. The number of Active Customers in Q4 2025 was 123,122 (Q4 2024: 136,658).

ARPU grew 8% year-on-year and reached a record annual level of $3,268 in FY 2025 (FY 2024: $3,023), including $1,580 in Q4 2025 (Q4 2024: $1,338), which highlights the depth of the Group’s product offering and the quality of its intuitive trading platforms.

New Customer acquisition was 104,902 during the year (FY 2024: 118,010), including 26,093 in Q4 2025 (Q4 2024: 36,329), with a positive year-on-year improvement in AUAC, declining by 13%, supported by the Group’s sophisticated multi-channel marketing approach. AUAC was $1,267 in FY 2025 (FY 2024: $1,456), including $1,264 in Q4 2025 (Q4 2024: $1,355).

Average deposit per Active Customer increased in FY 2025 to a record level of c.$26,900 (FY 2024: c.$12,000), reflecting the Group’s success in targeting higher value customer segments while also deepening engagement with existing customers. Customer activity also continued to grow, with total number of customer trades reaching approximately 69m during the year (FY 2024: approximately 56m), highlighting both the strength of the Group’s product offering and the scalability, performance and resilience of its proprietary trading platforms.

The company said that these operational metrics demonstrate the effectiveness of Plus500’s technology-led operating model and its ability to support growth across multiple products, markets and client segments. The Group leveraged its highly sophisticated marketing technology, powered by big data and AI and its strict Return on Investment parameters, to optimise customer acquisition costs during the period.

Outlook

Plus500 said that the significant strategic, operational and financial momentum achieved in 2025 has continued into 2026, with the Group’s trading being supported by positive momentum across global financial markets, as well as with strong operational results. This includes Plus500’s launch of its prediction markets offering for B2C customers in the US, and completing the acquisition of Mehta in India, setting a strong foundation for the year.

The Group’s positive outlook is underpinned by its diversified business model, its growing non-OTC business lines and its established position as a trusted provider of institutional market infrastructure. This is enabled by its robust balance sheet, proprietary technology and an expanding global regulatory footprint, all of which provide a strong foundation for continued execution against its strategic roadmap.

The Company’s Board of Directors stated that it remains confident in the Group’s prospects and expects 2026 performance to be ahead of current market expectations.

David Zruia, Chief Executive Officer of Plus500, commented,

David Zruia, Chief Executive Officer of Plus500, commented,

“2025 marked a year of accelerated strategic progress for Plus500. We successfully scaled our non-OTC business into a key growth driver, bolstered our position as a trusted provider of institutional market infrastructure, and continued to deliver a strong financial performance with significant shareholder returns.

“Reflecting this, we have started FY 2026 with the Group’s trading being supported by positive momentum across global financial markets, as well as with strong operational results including launching prediction markets products for B2C customers and completing the acquisition of Mehta Equities in India.

“The strategic milestones we achieved during the year highlight the enduring strengths of our proprietary technology, regulatory expertise and disciplined capital allocation framework. Supported by our robust balance sheet, highly cash-generative business model and multiple structural growth drivers across product verticals, including in new, rapidly growing segments such as prediction markets, we are well positioned to continue delivering strong operational execution, innovation, growth and attractive compounding shareholder returns over the medium- to long-term.”

Plus500’s full 2025 results release can be seen here.