NAGA shares jump 5% after Q1 Revenues, funded accounts rise

Shares of online brokerage and investment group NAGA (ETR:N4G) traded up by 5% on Thursday, after the company reported its financial results for Q1 2025.

The provider of the all-in-one financial SuperApp NAGA also said that it is expanding its capital market activities, and will publish regular interim announcements on its quarterly results starting with the results for Q1 2025. In addition, the Company will disclose monthly key performance indicators on its website.

Financial KPIs highlight sustained growth as revenue scales

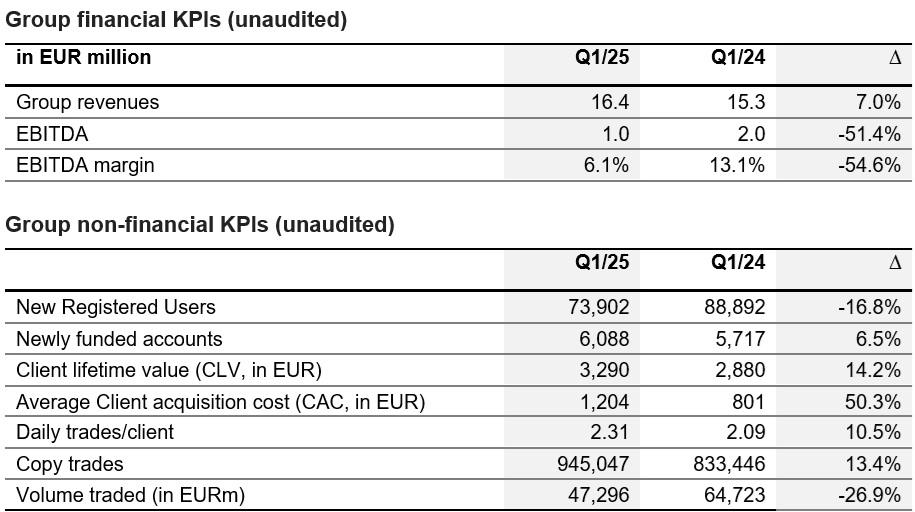

- Group revenue up 7% to EUR 16.4 million (Q1 2024: EUR 15.3 million).

- EBITDA at EUR 1.0 million despite strategic increase in marketing spent to strengthen growth and brand building initiatives – EBITDA margin at 6% temporarily affected (Q1 2024: 13%).

- Newly funded accounts up 6.5% to 6,088 reflect a positive trajectory as the Group activates its post-merger marketing engine.

- Q1 results bolsters full-year 2025 forecast.

According to unaudited figures, NAGA Group – formed by last year’s merger of NAGA and CAPEX.com – said that revenues increased by 7% to EUR 16.4 million (Q1 2024: EUR 15.3 million), driven by higher commission income, the onboarding of new clients, and elevated trading activity amid heightened volatility in global capital markets.

On the cost side, realized synergies in personnel and operating expenses contributed positively. Group EBITDA amounted to EUR 1 million (Q1 2024: EUR 2 million) despite a strategic increase in marketing spend – up by EUR 1.6 million compared to Q1 2024 – resulting in a temporary decline in EBITDA margin to 6% (Q1 2024: 13%). This planned investment marks a deliberate step toward strengthening NAGA’s growth trajectory and scaling potential in the upcoming quarters.

Non-financial KPIs develop positively

In Q1 2025, The NAGA Group AG welcomed 73,902 new registered users (Q1 2024: 88,892) This decline was anticipated, as the Group strategically shifted its Q1 marketing focus from direct performance campaigns to broader brand-building initiatives. This repositioning is expected to strengthen NAGA’s long-term visibility and drive more sustainable, organic user growth in the coming quarters.

Despite the shift in strategy, the number of newly funded accounts increased to 6,088 as of 31 March 2025, up 6.5% from 5,717 in Q1 2024. This reflects an improved conversion rate from registrations to active clients. Furthermore, Client Lifetime Value (CLV) rose by 14.2% to EUR 3,290 (Q1 2024: EUR 2,880), underscoring stronger client engagement and higher revenue generation per user.

Octavian Patrascu, CEO of The NAGA Group said,

Octavian Patrascu, CEO of The NAGA Group said,

“With our quarterly reporting and our monthly updates, we are strengthening our capital market communication and offering the international investor community a high degree of transparency and clarity. As CEO, I have set out to truly create a new NAGA Group and show through action that we are leaving the past behind. Our aim is to go beyond the legal requirements and provide real insight into our strategy, mindset and business activities.”

Outlook 2025 confirmed

For the 2025 financial year, The NAGA Group is on track to return to its 2023 revenue levels (pro forma), driven by solid organic growth, efficient marketing spend and operational focus. Management also anticipates a substantial improvement in EBITDA margin – expected to reach the mid double-digit percentage range – supported by the continued realization of synergies across the Group.