NAGA reports Revenues of €11.6M in Q1-2023, return to (EBITDA) profitability

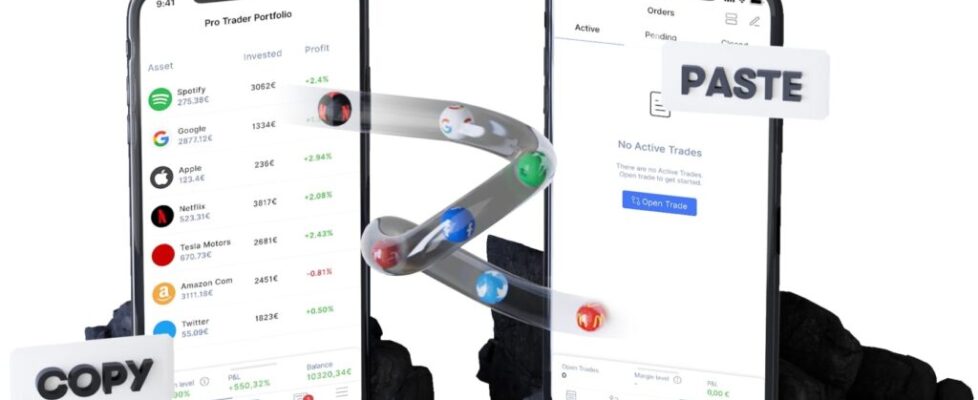

Social and copy trading focused Retail FX and CFDs broker NAGA Group (ETR:N4G) has released a brief summary of its Q1 results, indicating that after a loss-making 2022 the company returned to above breakeven, following a series of cost cutting measures.

NAGA Group Revenues

On the top line, NAGA – which operates offshore (St Vincent & The Grenadines) site naga.com and CySEC-licensed nagamarkets.com – indicated that the company brought in €11.6 million in Revenues in Q1 2023. That seems to be both good and bad news. Good, in that NAGA saw Revenues of about €10 million in each of the past two quarters, Q3 and Q4 2022. (Note that NAGA has yet to release its full 2022 annual results).

But bad, in that NAGA revealed in early February that it had a good start to the year with about €6 million in Revenues in the first 5+ weeks of the year, meaning that things have again slowed down in the second half of Q1.

NAGA Trading Volumes

In terms of client trading volumes, NAGA saw total trading volumes of €37 billion in Q1, which translates into about $13.5 billion of monthly volumes. That is basically identical to the $13.6 billion in monthly volumes that NAGA averaged in 2022.

NAGA Profitability

NAGA said that it earned preliminary EBITDA of €1.7 million in Q1-2023. (It didn’t make any statement regarding “real” net profit). The company said that it has brought its monthly cost down to an average of €3.3 million, which is 40% lower compared to Q1 2022 (average of €5.5 million) and expects a further cost decrease by around 20% during Q2 2023 whilst keeping its growth trajectory.

For the first quarter 2023 NAGA reported 2.9 million trades with a trading volume of €37 billion. The number of active traders as of the end of this quarter is standing at 21,250 which is 30% higher than in the same period of last year (16,300). The assets under custody have grown to €35 million which is 45% more than the last reported HY1 2022 figure (€24 million).

In Q1 2023 NAGA spent €3.5 million in marketing expenses which is 70% less than compared to €11.5 million in Q1 2022 whilst in Q1 2023 around 11% more new users were acquired than in Q1 2022. The improvement in the core acquisition metrics is driven by the focus on marketing efficiency and AI-driven marketing intelligence combined with a fully restructured marketing strategy.

NAGA Group CEO and founder Ben Bilski said:

NAGA Group CEO and founder Ben Bilski said:

“We are satisfied with how we performed over the last months especially looking at growing user activity and well improved user acquisition metrics. The costs are under control and we have a good grip on the business expansion. We are creating a foundation to run this business profitably and the past month’s trend proves that. However, given the fact that we incurred significant losses last year and despite the current merger discussions, we are keeping our eyes open for opportunities to strengthen our capital base to ensure we can execute our plans.”

NAGA Pay

With its full launch as of January 2023, NAGA also reported initial KPIs for its neo-banking app NAGA Pay. As of Q1 2023, the card programme counts over 2,500 active users and a transaction volume of close to €3 million in Q1. Revenues from the card programme and associated fees stood at EUR 30,000 in the first quarter.

“It’s still early for NAGA Pay, however we have consistent growth month over month in all core KPIs. Our current marketing spend on NAGA Pay is minimal, so most of the growth is organic and referral driven. The product is being adapted very well by the users and we believe that NAGA Pay will contribute to our financial success throughout this year”, adds Bilski.