Infinox sees 12% rise in 2020 Revenues, return to profit

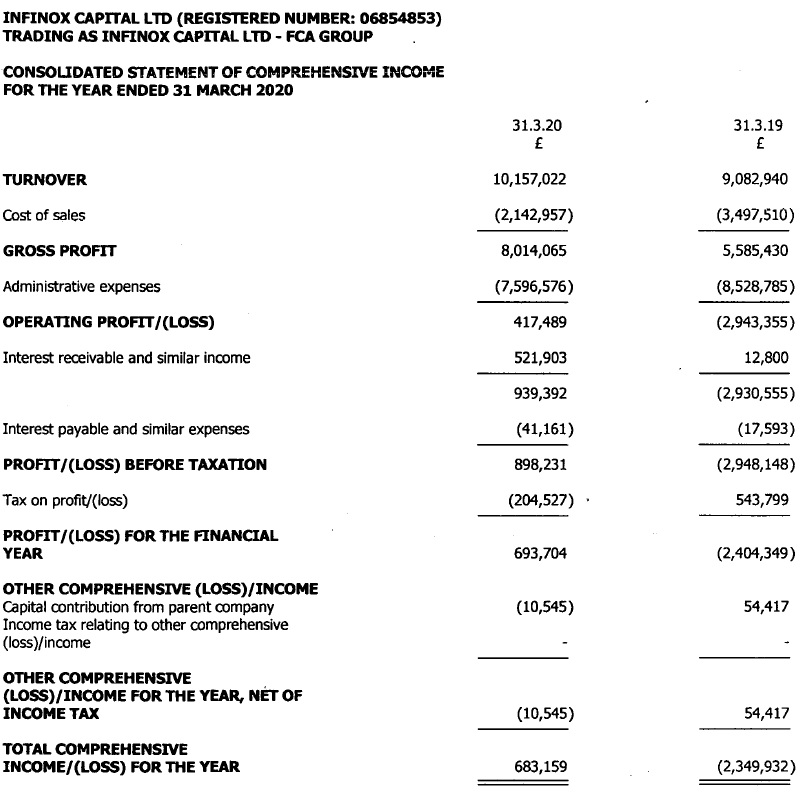

FNG has learned via regulatory filings that FCA regulated Retail FX and CFDs broker Infinox Capital Ltd has posted a modest 12% increase in Revenue in 2020 (fiscal year ended March 31, 2020), alongside a profit of £683,159. The company’s Revenues of £10.2 million were up from £9.1 million in 2019, and the profit compared nicely to a loss of £2.9 million in 2019.

We’d note, however, that the £10.2 million Revenue figure for Infinox was still down significantly from the £41.7 million in Revenue the company brought in during 2018. That occurred, the company said at the time, as a result of a “real transformation” in the business due to the introduction by ESMA of CFD product intervention measures in August 2018. Infinox stated at the time that the ESMA moves, which were primarily geared toward cutting leverage used by retail CFD traders to 30x, saw the majority of Infinox’s Asian client base moving to other jurisdictions that had not imposed similar product restrictions, i.e. Australia and offshore. (Infinox has a large number of Chinese and Far East based clients, the company is ultimately controlled by Chinese entrepreneur Xueniu Zhang).

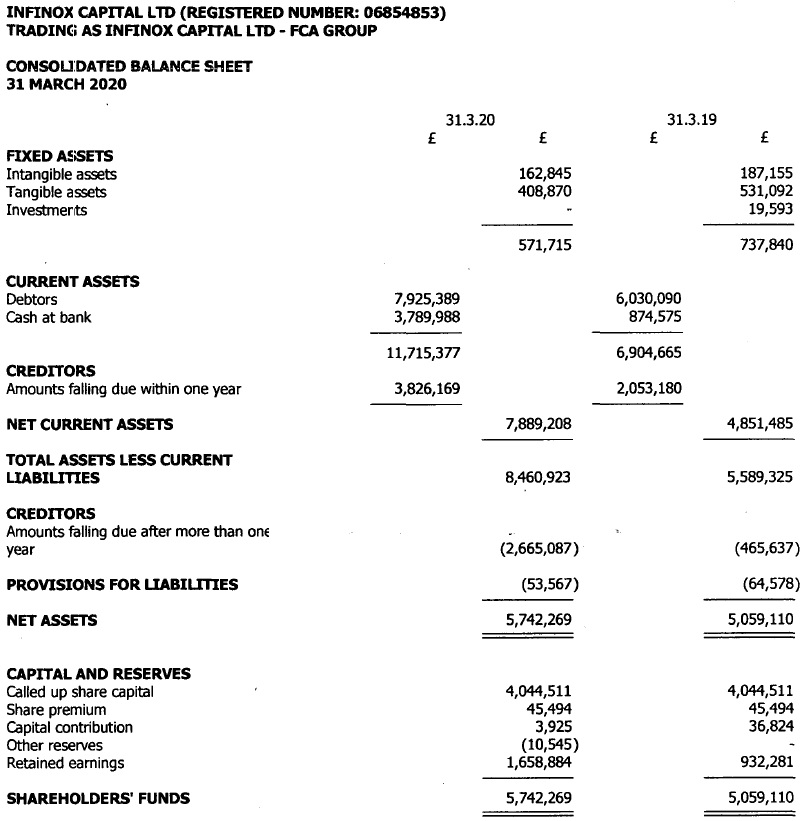

Infinox’s client assets under management fell during the year, down to £11.5 million from £14.2 million in 2019. (Client assets were as high as £27.8 million in 2018, before the aforementioned Asia client migration offshore).

Following the end of Fiscal 2020 Infinox has been somewhat in expansion mode, which has included the launch of its IX Social trading app. Following the receipt of a South Africa financial services license the company hired longtime FXCM executive Dany Mawas, as Regional Director for South Africa, as was exclusively reported by FNG. Infinox also added CFI executive Swati Saxena as Head of Institutional Sales for the company’s IX Prime market making and liquidity unit, and ATFX/CMC vet Mike O’Sullivan as Head of Technology.

Infinox’s 2020 income statement and balance sheet follow: