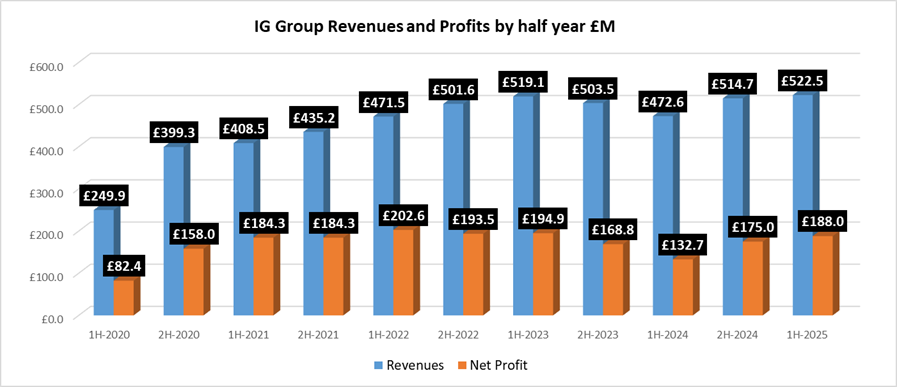

IG Group reports record Revenues, 7% Profit rise in H1 of FY2025

UK online trading brokerage leader IG Group (LON:IGG) has released its results for the six months ended 30 November 2024 (i.e., the company’s first half of fiscal 2025 which runs through to May 31, 2025), which included a nice rise in profits alongside record half-year Revenues of £522.5 million for the company.

IG Group Financial highlights

IG said that earnings growth on prior year levels reflected more supportive market conditions and lower costs.

- Total revenue of £522.5 million (H1 FY24: £472.6 million), up 11%.

- Net trading revenue of £451.7 million (H1 FY24: £402.4 million), up 12% driven by higher revenue per client.

- Net interest income flat at £70.8 million (H1 FY24: £70.2 million) as higher client money balances offset lower interest rates.

- Adjusted profit before tax of £266.8 million (H1 FY24: £205.7 million), up 30%, at a margin of 51.1% (H1 FY24: 43.5%). Statutory profit before tax of £249.3 million (H1 FY24: £176.4 million), up 41%.

- Adjusted basic EPS of 55.3 pence (H1 FY24: 38.9 pence), up 42% on H1 FY24. Statutory basic EPS of 51.7 pence (H1 FY24: 33.4 pence).

- Total capital return of £281 million split across dividends paid and shares repurchased in the period (H1 FY24: £276 million).

- Increased interim dividend to 13.86p per share (H1 FY24: 13.56p).

- Extending the share buyback programme by £50 million to £200 million to be completed in the second half of FY25.

Strategic and operational highlights

IG said it was making progress delivering against the initial priorities outlined in July 2024, to improve its product, embed a high-performance culture and enhance efficiency.

- Announced the acquisition of Freetrade, strengthening IG’s UK trading and investments proposition and providing access to new customer segments and capabilities.

- Implemented a decentralised organisational model to enhance client centricity.

- Taken decisive action to exit initiatives not delivering acceptable returns, including the Spectrum multilateral trading facility (“Spectrum”). Spectrum was broadly breakeven in H1 FY25, and its core products will be offered more cost efficiently over-the-counter.

- Total active clients of 295,300 were down fractionally on the prior year (H1 FY24: 296,300). First trades of 33,900 were flat (H1 FY24: 33,800).

- tastytrade total revenue increased 15% year-on-year, within which trading revenue reached a record $90.5 million (H1 FY24: $72.9 million). tastytrade interest income was stable at $45.3 million (H1 FY24: $44.9 million).

Financial summary

|

£ million (unless stated) |

H1 FY25 |

H1 FY24 |

% YoY |

H2 FY24 |

% HoH |

|

Net trading revenue |

451.7 |

402.4 |

12% |

442.6 |

2% |

|

Total revenue |

522.5 |

472.6 |

11% |

514.7 |

2% |

|

Adjusted operating costs |

(277.4) |

(281.1) |

(1%) |

(283.0) |

(2%) |

|

Adjusted profit before tax |

266.8 |

205.7 |

30% |

250.5 |

7% |

|

Adjusting items |

(17.5) |

(29.3) |

(40%) |

(26.1) |

(33%) |

|

Statutory profit after tax |

188.0 |

132.7 |

42% |

175.0 |

7% |

|

Basic earnings per share (p) |

51.7 |

33.4 |

55% |

45.1 |

15% |

|

Adjusted basic earnings per share (p) |

55.3 |

38.9 |

42% |

50.4 |

10% |

|

Interim dividend per share (p) |

13.86 |

13.56 |

2% |

– |

– |

Breon Corcoran, IG Chief Executive Officer, commented,

Breon Corcoran, IG Chief Executive Officer, commented,

“First half performance reflected more supportive market conditions, but we have work to do to grow active customers which will be necessary to deliver sustainably stronger growth.

“Our focus remains on executing against the priorities we outlined in July 2024, which are to improve our product, embed a high-performance culture across the business and enhance efficiency.

“Last week, we were delighted to announce the acquisition of Freetrade, the fast-growing, commission-free UK self-directed investment platform. The transaction will strengthen IG’s UK trading and investments offering and provide access to new customer segments and capabilities.

“We have made progress in the first half of the year and have much more to do. Our people are full of energy and committed to delivering stronger, more sustainable growth.

“Current trading has been satisfactory, and we remain confident of meeting consensus revenue and profit before tax expectations in FY25. I look forward to updating you on progress in the second half of the year.”

IG Group’s full results release for H1 of FY2025 can be accessed here.