iFOREX IPO prospectus details: Revenues $49M, EBITDA $4M

Following our recent coverage of the initial public offering (IPO) of Retail FX and CFDs broker iFOREX on the Main Market of the London Stock Exchange, FNG took a deep dive into iFOREX’s IPO prospectus, revealing some interesting facts and data about the broker, which has been around for quite a long time – 20 years – at least as far as “the industry” goes.

The iFOREX Group operates via two regulated subsidiaries: Formula Investment House Ltd, and iCFD Ltd. Formula Investment House Ltd is established in the British Virgin Islands (BVI) and is authorised by the BVI FSC. iCFD is established in Cyprus and is authorised as a Cyprus Investment Firm (CIF) by the Cyprus Securities and Exchange Commission (CySEC).

In 2024, more than 95% of iFOREX Revenue came in via the Group’s offshore (BVI) entity, and less than 5% from its CySEC licensed subsidiary.

iFOREX financial info

First, the financials.

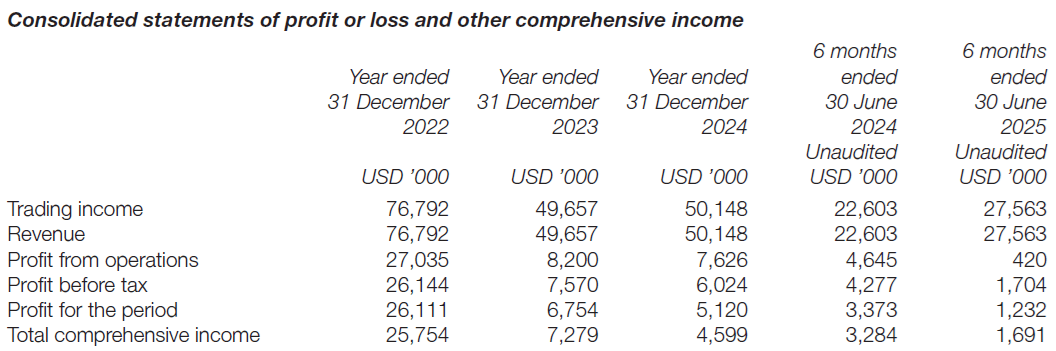

iFOREX released financial information up to and including the first half of 2025 in its IPO prospectus. For the most recent 12-month period (to June 30, 2025), iFOREX reported Revenues of USD $55.1 million, with the most recent six-month period (January-June 2025) being basically identical to the previous six months.

We’d also note that iFOREX Revenues are well down from their 2022 levels, which were $76.8 million.

On the bottom line, iFOREX earned $3.0 million in Profit over the most recent 12-month period, down from 2022’s $25.8 million.

Outlook

iFOREX reported having “positive momentum” into FY26, with “encouraging trading” leading to Revenue of approximately USD 13.5 million in Q4 2025, and adjusted EBITDA of approximately USD 2 million being achieved in the quarter. Performance in Q3 2025 was impacted by three main factors which resulted in revenue of approximately just USD 7.7 million, and an adjusted EBITDA of approximately USD -3.1 million for the period:

- the quarter saw very low global market volatility;

- the IPO delay created disruption including the increased marketing spend in prior months not benefitting from being a listed company; and

- in light of the low market volatility, the Company implemented a short-term revenue initiative which was ineffective and it was promptly reversed.

The company expects to report full year 2025 Revenue of approximately USD 49 million, which is similar to FY24 (USD 50.1 million). Adjusted EBITDA for 2025 is expected to be approximately USD 4 million (FY24: USD 9.7 million).

The Board said it is confident in the company’s prospects and its ability to benefit from being a listed company. The Company’s balance sheet remains strong with a net cash balance as at 31 December 2025 of approximately USD 6.7 million, and no debt.

iFOREX IPO valuation

As noted in our IPO-pricing article, iFOREX went public at a valuation of £43.3 million, or $58.3 million. So, basic valuation metrics (based on 12-month results to June 30, 2025) are 1.1x Revenues, and 19.4x earnings.

Based on the iFOREX 2025 “Outlook” figures above, the IPO valuation is at 1.2x Revenues.

Reasons for IPO

iFOREX released what is a fairly standard “reasons for admission to trading” explanation in its IPO prospectus. The company said that it will benefit the Group in several important ways, and will assist the Group with achieving its strategy and position it to compete more directly with its global listed competitors.

In particular, iFOREX said that that admission to the equity shares (commercial companies) category of the FCA’s Official List and to trading on the London Stock Exchange’s main market for listed securities will raise the profile of the Group in its existing and targeted geographic jurisdictions. Which, together with the enhanced corporate governance and transparency of a public listing, will assist the Group with attracting new clients and leveraging its existing client base, contributing to growth in transaction volume and value, to access new markets and regulatory authorisations and seek strategic M&A opportunities.

iFOREX also believes that the public status will provide enhanced access to capital and allow the company to continue to attract and retain leading talent.

Use of proceeds

The total offer size of iFOREX’s IPO was £8.75 million, or USD $11.8 million. However after expenses and fees, net proceeds of the offering are expected to be approximately $6.07 million. The company said it intends to use the net proceeds received from the IPO as follows:

- up to approximately USD 1,500,000 towards implementing self-activation processes for new and existing clients, to enable efficient, scalable, and fully automated customer onboarding and growth;

- up to approximately USD 1,000,000 towards investing in further automation software and products in connection with the Group’s onboarding and AI risk management systems;

- up to approximately USD 500,000 towards penetrating new markets and accelerating growth in existing markets;

- up to approximately USD 500,000 attracting and rewarding new talent in existing as well as new markets; and

- the balance towards other general corporate purposes.

iFOREX shareholders

After the IPO, iFOREX continues to be controlled by the company’s founder Eyal Carmon, who was previously a dealer at Bank Hapoalim (Israel’s largest bank), and at other Israeli investment firms. Eyal Carmon holds (post-IPO) 13.07 million shares, representing a 58.91% ownership in the company.

An employee share ownership plan (ESOP) trust, on behalf of iFOREX employee shareholders, holds 4.63 million shares, or 20.86%.

The company disclosed that Eyal Carmon has a long-term objective to sell down his stake in the company, over a ten-year period.

iFOREX client base

For the year ended 31 December 2024, the iFOREX Group had 28,863 Active Clients, with an ARPU of USD 1,737. This compares to 29,467 Active Clients in the year ended 31 December 2023 with an ARPU of USD 1,685. The Group also managed to bring 13,632 New Clients onto the Trading Platform in the year ended 31 December 2024 at a CAC of USD 401 per client, which is one of the lowest in the industry, and 93 per cent of these New Clients deposited in the same period. This compares to 13,430 New Clients at a CAC of USD 418 per New Client in the year ended 31 December 2023.

Revenue by geography

(i) East Asia

East Asia is the Group’s largest geographical market by trading income, representing USD 19.6 million or 39 per cent of revenue in the year ended 31 December 2024. The Group considers East Asia, notably Japan (35.3 per cent of trading income), to be its core market. The Directors and the Proposed Directors believe that the Asian market continues to represent an attractive opportunity for the Group driven by growth of the middle class, wide adoption and usage of mobile devices and availability of online payment solutions and the strength of the Group’s brand.

For the year ended 31 December 2024, East Asia had 9,299 Active Clients registered with FIH.

(ii) Middle East and Africa

The Group’s operations in the Middle East and Africa region represented USD 15.1 million or 30.3 per cent of trading income in the year ended 31 December 2024. As this region’s increasing population, especially in developing Gulf Cooperation Council countries, becomes more exposed to financial trading, the Group is seeing increased demand for its services and is planning to apply for a licence in the UAE, following Admission.

(iii) South Asia

The South Asia region contributed USD 8.4 million or 16.7 per cent of trading income in the year ended 31 December 2024, with India being the most prominent country. At this time, India does not have a legal framework that facilitates the trading of CFDs by investment firms onshore.

For the year ended 31 December 2024, South Asia had 7,932 Active Clients registered with FIH.

(iv) Latin America

Clients within Latin America account for USD 4.4 million or 8.8 per cent of trading income in the year ended 31 December 2024.

For the year ended 31 December 2024, Latin America had 3,921 Active Clients registered with FIH.

(v) Europe

The Group accepts clients from EEA member states (with the exception of Cyprus and Belgium) through iCFD’s CySEC licence and passporting rights granted to iCFD. Clients from European countries that are not members of the EEA (for example, Switzerland), are onboarded through FIH. Revenue from clients in Europe represent USD 2.6 million or 5.2 per cent of trading income in the year ended 31 December 2024. The Group believes that in a highly competitive and evolved market such as Europe, which is also highly regulated, size and reliability plays a pivotal role in the ability to succeed in the market and therefore the Group intends to invest considerably in brand awareness which will assist in the growth of the Group’s European operations.

iFOREX’s IPO prospectus can be downloaded here (pdf).