Exclusive: Noor Capital UK sees 36% leap in Revenues in FY 2025

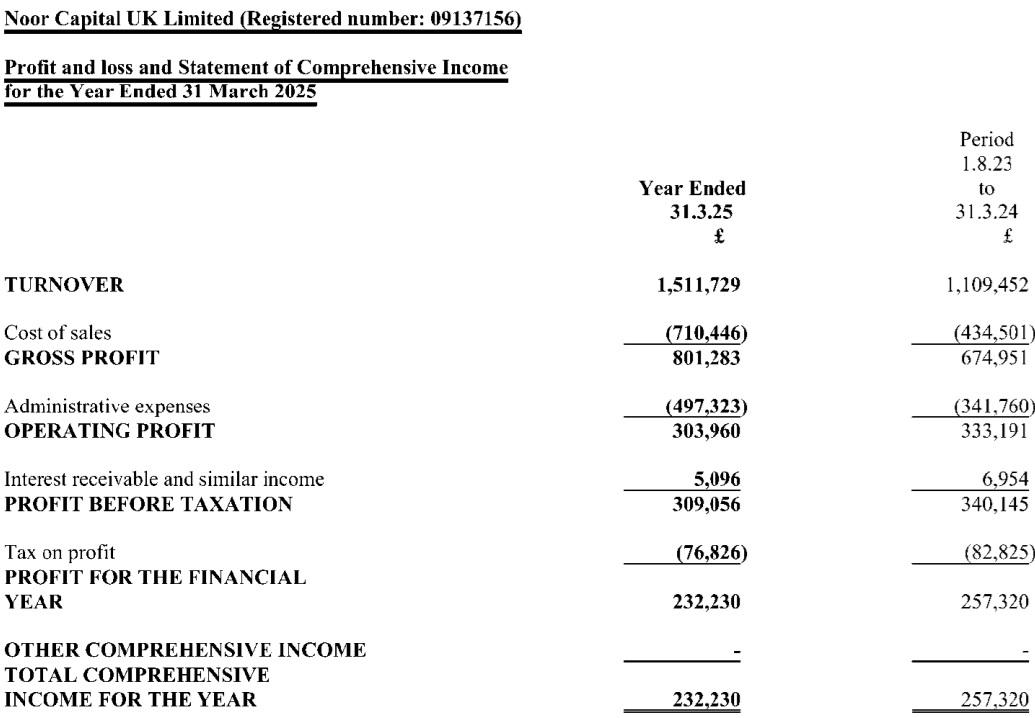

FNG Exclusive… FNG has learned via regulatory filings that Noor Capital UK Limited, the London based, FCA regulated arm of MENA focused broker Noor Capital, had a fairly successful fiscal year 2025 (year ended March 31, 2025), with Revenues rising by 36% although Net Profit declined.

Revenues at Noor Capital UK came in at £1.51 million in FY2025, up as noted by 36% from £1.11 million the previous year. Net Profit of £232K was 10% lower than FY2024’s £275K.

Noor Capital is part of UAE based conglomerate Al Sayegh Brothers Group, headed by Abu Dhabi businessman Abdul Jabbar Al-Sayegh. The Al Sayegh’s main business is consumer electronics, importing LG and Hitachi products to the UAE. Noor Capital has been operating since 2005, offering online trading on MT4/MT5 to a mainly Arabic speaking client base. The company has been run since 2016 by CEO Mohammed Ghousheh, who was CFO of Noor from 2007-2016.

In early 2023, Noor Capital bought FCA licensed broker House of Borse from Saudi Arabian businessman Mohammad Alkahtani, later renaming it Noor Capital UK. Noor Capital UK has been run by CEO and former Saxo Bank MENA executive Wahb Ahmed since 2015, who joined when it was operating under the House of Borse brand.

Back to Noor Capital UK’s FY2025 results, the company said that its performance in 2025 reflects a clear strategic improvement, building on the internal restructuring and operational enhancements undertaken during the previous year. Turnover increased by 36% driven by higher income from client trading activity. This strong growth in top-line revenue indicates rising client engagement and an expanding market share.

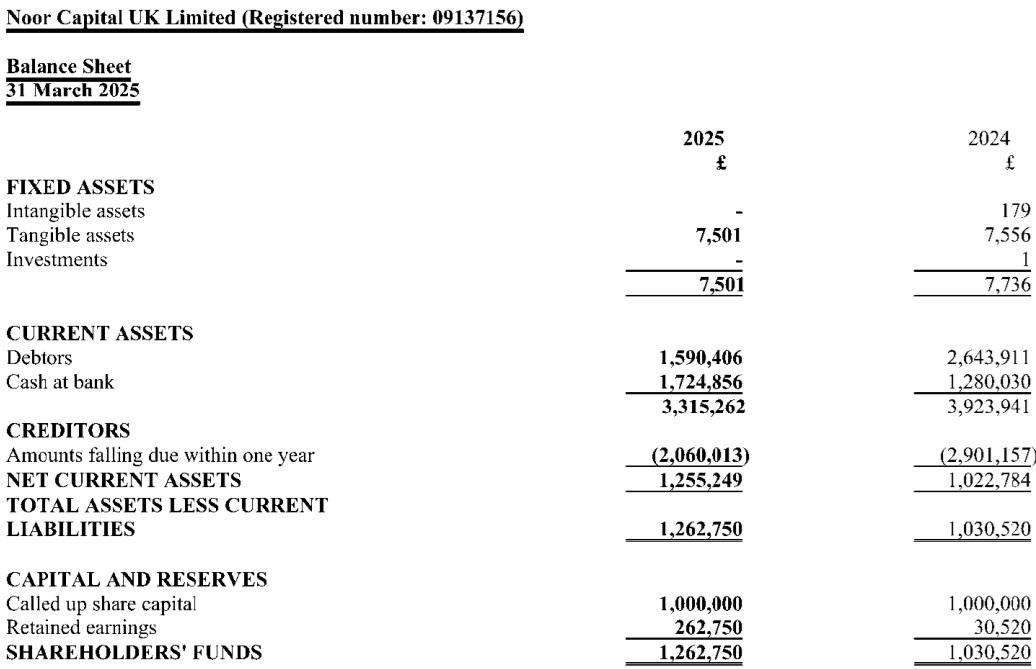

Noor Capital UK’s FY2025 income statement and balance sheet follow below.