Exclusive: ICM Capital posts £1M loss in 2022, withdraws from Retail

FNG Exclusive… FNG has learned that FCA licensed FX and CFDs broker ICM Capital Ltd had another loss-making year in 2022, as the company – the UK arm of the ICM.com brokerage brand – decided to withdraw from retail activity and focus on professional clients.

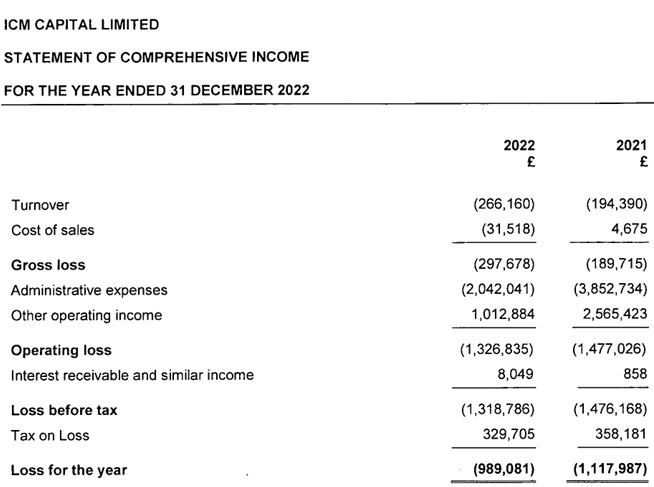

Overall, ICM Capital, which operates the icmcapital.co.uk website, actually booked negative revenues for the year of -£266,000, versus -£194,000 last year and £2.6 million in 2020. That was an accounting anomaly, as revenues (or “Turnover”) at ICM is composed of retail market-making profits earned from trading in spot foreign exchange and CFDs. Gains and losses are recognised on closed positions as they occur and on open positions using a mark-to-market valuation.

Admin expenses at ICM Capital were down to £2.04 million from £3.85 million in 2021, and the company posted a net loss for the year of £989,000, versus a somewhat similar £1.12 million net loss the previous year.

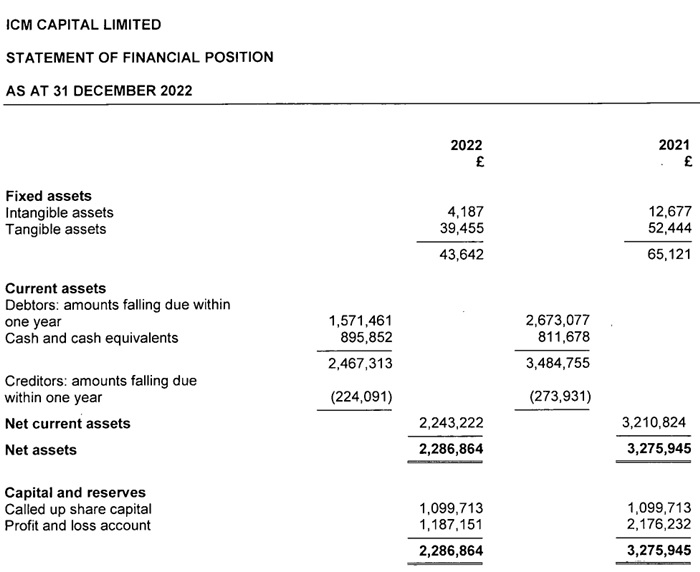

Client money held by ICM Capital fell as at year-end 2022 to just £530,791, down from £4.27 million in 2021 and £6.09 million the previous year, as the company stopped doing business with retail clients, as noted above.

ICM Capital Ltd is controlled by founder and CEO Shoaib Abedi, via Luxembourg holding company ICM Holding SARL.

ICM Capital’s 2022 income statement and balance sheet follow: