Exclusive: Gildencrest Capital (ex TeraFX) revenues soar 52% in 2023 as broker expands beyond CFDs

FNG Exclusive… FNG has learned that FCA regulated online broker Gildencrest Capital Ltd has seen a healthy uptick in its business during 2023, as the company has expanded its operations beyond FX and CFDs.

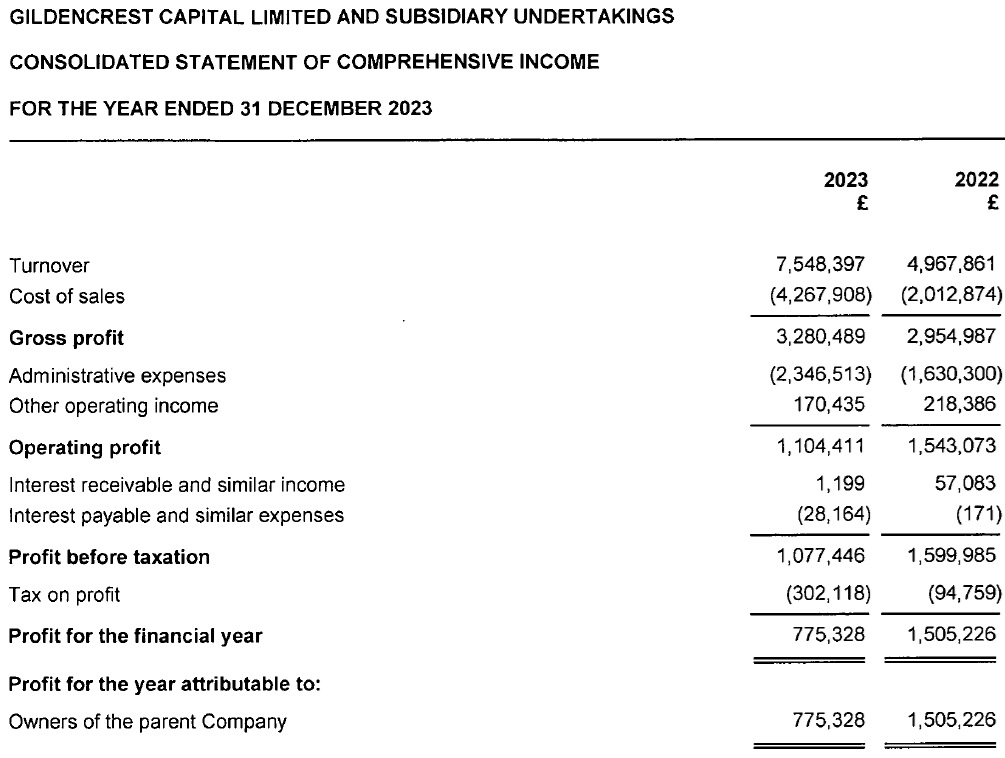

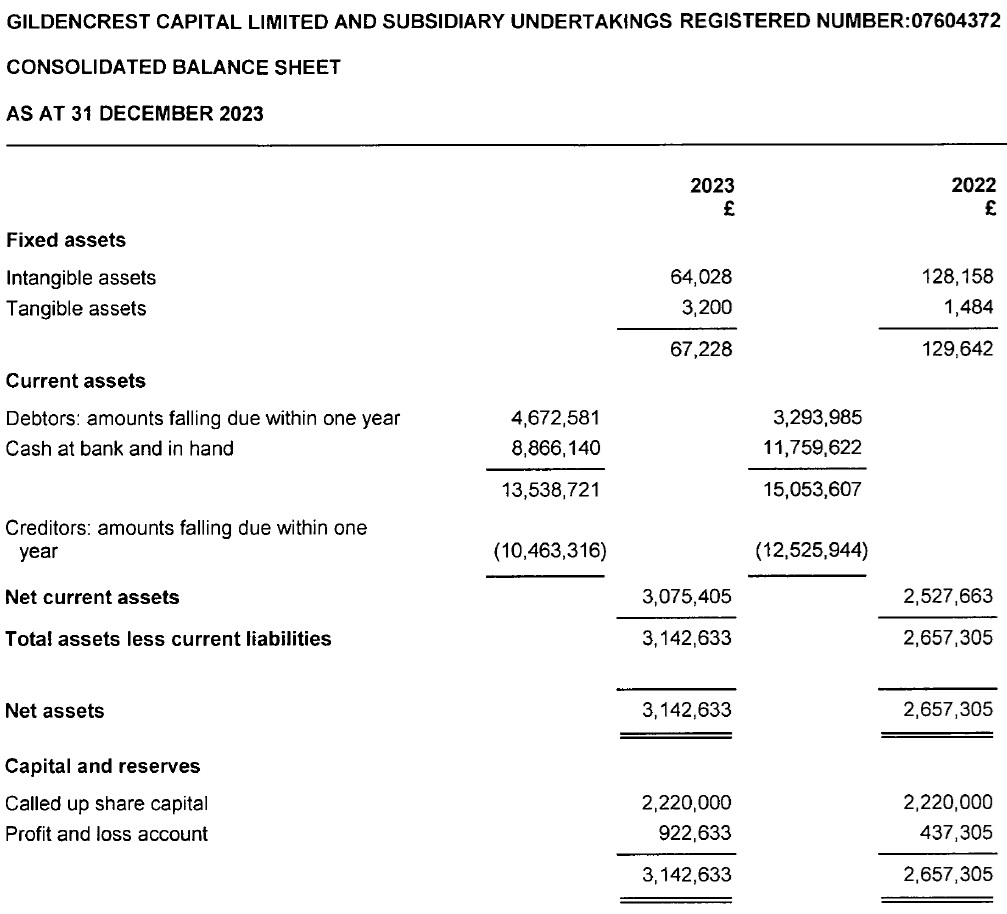

Revenues at Gildencrest came in at £7.55 million (USD $9.6 million) in 2023, up by 52% from £4.97 million in 2022. However due to an increased cost base the company’s Net Profit tailed off to £0.8 million, from £1.5 million the previous year.

TeraFX rebrand as Gildencrest

As we exclusively reported at the beginning of 2024, TeraFX rebranded as Gildencrest Capital (with the corporate name also changed from Tera Europe Ltd to Gildencrest Capital Ltd), as the longtime FCA regulated FX and CFDs broker is looking to make a strategic shift into Equities, to target professional clients, and to separate its brand from that of Turkish parent company Tera Yatirim.

Gildencrest ownership and management

Gildencrest is a subsidiary of Tera Financial Holdings Ltd, and ultimately of Turkish investment firm Tera Yatirim. Tera Yatirim is controlled by Turkish businessman and former politician Oğuz Tezmen, and his son Emre Tezmen. The Tezmens control Turkish investment bank Tera Yatirim with a more than 80% holding. The group’s UK entity (now of course called Gildencrest) has been licensed by the FCA since 2012, and the group also holds a Dubai DFSA license. Oğuz Tezmen was Turkey’s Minister of Transport in the mid-1990s. In 2021, the group hired former Renaissance Capital and Goldman Sachs executive David George as CEO of the UK entity in London.

Gildencrest 2023 results and volumes

But back to Gildencrest’s 2023 results… As noted above in 2023 the company shifted focus from Forex/CFDS business to other Capital market instruments, to broaden its product offering and brokerage activities. Management said it is pleased to report, that with some “fair winds behind us”, and with a generally better global macro environment, despite inflationary pressures, the Firm’s strategy paid off in 2023.

Equity volumes saw an increase of 83%. Equally as the Firm shifted away from retail to focus on smaller institutional Professional clients, the CFDs business also saw significant increases in volumes traded, almost doubling to ~$38bn (or about USD $3.2 billion monthly).The Company said it will continue to focus on the Equity business, and is hoping to add incremental products, such as Listed Turkish Futures, to its offering in 2024. The Firm is also exploring other avenues, such as JV’s, to grow its revenue in CFDs.

However, Gildencrest said that global markets remain on uncertain footings, with the outlook for interest rates uncertain and global tensions remaining elevated and political focus with elections in many major economies this year. The company expects general business conditions to be lackluster in the first half of 2024, because of global risk aversion, and political tensions are likely to remain as headwinds.

The trading volume in Gildencrest’s Forex/CFDs business increased by 94% year-on-year to $37.6 billion in 2023. The company recorded £4.7 million of income related to CFD trading services. Capital Market Securities Business volume recorded an increase of 83%, and the Firm traded over £1bn of volume. The Company recorded £2.13 million income related to Equity trading services in 2023.

Gildencrest EU plans

During 2023 the company continued to operate its DIFC licensed Branch in Dubai and discontinued its progress in opening a Polish Subsidiary and license application in Warsaw, whilst deciding to pursue a license and operations in Latvia. Gildencrest said that the Polish license application proved burdensome, time consuming and expensive, so the Board made the decision to withdraw the application to the KNF (the Polish regulator.) Instead, the Firm is applying for a license in Latvia, and in 2024 will hope to open a branch office in Riga to serve EU clients.

Gildencrest Capital’s 2023 income statement and balance sheet follow below.