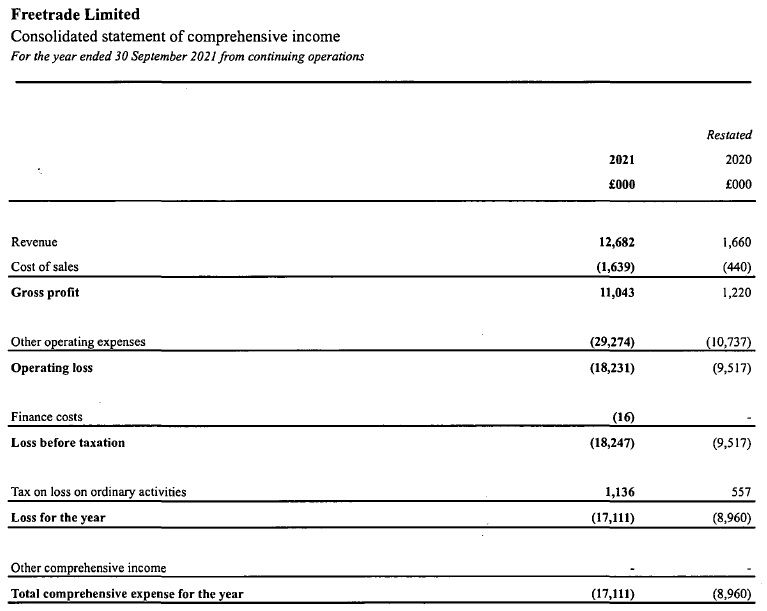

Exclusive: Freetrade posts £12.7M Revenue, £17.1M Net Loss in 2021

FNG Exclusive… FNG has learned via regulatory filings that UK/EU neobroker Freetrade brought in £12.7 million (USD $16.0 million) in Revenue for the year ended September 30, 2021. That was a fairly large increase from just £1.7 million in 2020, but still led to a Net Loss of £17.1 million for the year. The London based company said that Revenue is expected to continue increasing in the next financial year from an annualisation of new customer subscription revenue, new customer acquisition and higher trading volumes.

The Group’s loss is attributable to an increased level of costs. The most significant cost is headcount and there has been a significant investment in the Product and Engineering functions to drive the development of Freetrade’s investment app and to drive expansion into new markets. There has been a strategic investment in marketing activity throughout the year, compared with the previous financial year, further contributing to the Net Loss.

Over the financial year the total headcount across all locations increased by 121, to a total headcount of 201 at 30 September 2021 (2020: 80).

We had recently reported that Freetrade raised an additional £30 million in funding in the form of a convertible loan, and at the time Freetrade reported that its 2021 calendar Revenues topped £15 million – meaning that calendar Q4 2021 must have been a big improvement over Q1.

Freetrade also said earlier this month that its registered users have surpassed 1.3 million in the UK alone, while client assets under administration (AUA) have surpassed £1 billion. Both those figures also mark a healthy leap over its as-of-Sept-2021 fiscal year end figures, of 886,742 registered users and £897.5 million in AUA.

Freetrade is an app-based stockbroker, providing an execution-only trading platform to retail customers. Customers are able to purchase instruments listed on exchanges in the United Kingdom, United States and Europe, and hold these in either a General Investment Account (GIA), a Stocks and Shares Individual Savings Account (ISA) or a Self-Invested Personal Pension (SIPP).

In order to offer commission-free trading and an ever-improving feature set sustainably, the company has built our own engineering system called Freetrade Cloud Platform that allows Freetrade to execute customer trades comparatively cheaper and faster than using third-party solutions.

Overall trading volumes at Freetrade were more than three times higher in 2021 than the previous year at £3.3 billion (2020: £0.8 billion) as it added thousands of new stocks, exchange-traded funds and investment trusts across the financial year. The total value of assets under administration increased to £897.5 million (2020: £249.1 million) and as noted above shortly following the end of the financial year the total value of assets under administration surpassed the £1.0 billion mark.

The number of registered users increased significantly during the year, increasing by 637,895 users and shortly following the end of the financial year reached the milestone of having over one million registered users. There has been a strategic investment in marketing activity to drive the strong levels of new customer growth in the year, including brand awareness campaigns alongside initiatives such as the successful referral scheme, offering a free share for each successful referral.

In parallel with developing the products it offers to UK based users, the company’s recent fundraising has enabled Freetrade to begin expansion into international markets. During the financial year it established new locations in Stockholm, Brisbane and Vancouver to complement the existing London based team.

Freetrade’s 2021 income statement follows:

May 27, 2022 @ 8:13 am

so why is this company valued at a billion dollars?