Exclusive: Freetrade loss totaled £13.9M in 2023

FNG Exclusive… FNG has learned via regulatory filings that the 2023 Net Loss at UK based neobroker Freetrade was £13.9 million (USD $18 million), significantly larger than the £8.3 million loss the company advertised when it “released its 2023 results” via a media note distributed via CNBC back in April.

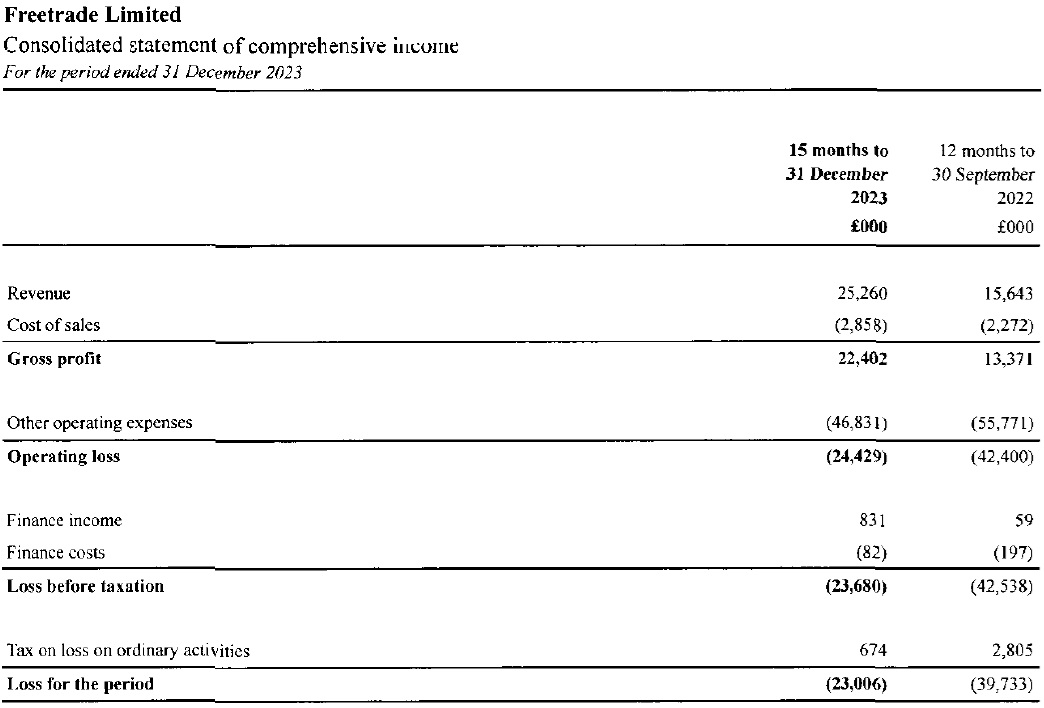

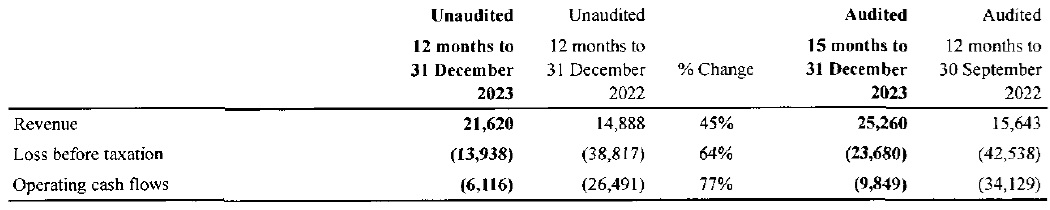

Freetrade changed its fiscal year end from September 30 to December 31 between 2022 and 2023, such that its filed 2023 financial results were for the 15 months to December 31, 2023, making a calendar-year 2023 (and comparison to calendar 2022) somewhat difficult.

However, digging into the fine print of the results, an unaudited calendar-year comparison revealed that Freetrade’s 2023 (12-month) Revenues were £21.6 million, up 45% from £14.9 million in calendar 2022. The company’s Net Loss before Tax in 2023 was £13.9 million, down £64% from a £38.8 million loss in 2022.

As the company’s financial statements show virtually no difference between Net Loss before Tax, and overall Net Loss (i.e. after tax), as Freetrade doesn’t yet pay any income tax, we can assume that the final 2023 Net Loss figure is very close to the £13.9 million pre-tax loss indicated above.

On an Operating Cash Flow basis things were somewhat better, with negative cash flow of £6.1 million in 2023, versus £26.5 million the previous year.

Again, in a LinkedIn post back in mid May linking to a CNBC article, Freetrade’s 2023 loss was a reported £8.3 million. It is possible that they meant something other than “Net Loss” or “Net Loss before Tax”, such as EBITDA, but that wasn’t indicated at the time.

Freetrade reported (in another brief LinkedIn post) about three weeks ago that in the first half of 2024 it had increased revenue by 34% (over 1H-2023), stating also that “we were profitable across the period.” We are unsure if they meant bottom-line net profit, or some other measure such as cash flow or EBITDA.

Freetrade is a commission-free stockbroker, providing an execution-only trading platform to retail customers. Freetrade’s mission is to get everyone investing, by lowering barriers, both cost and educational, to help anyone with the appropriate risk tolerance to put their money to work in the stock market and build long-term financial resilience.

At one point Freetrade had designs on becoming the “Robinhood of Europe”, alongside a few other neobroker startups such as BUX and FlowBank. However larger-than-expected losses and an ultra competitive environment have kept Freetrade mainly UK focused – it recently picked up the UK clients of Australia based Stake – while Amsterdam based BUX was scooped up by one of its financial backers, ABN Amro, and FlowBank was put into bankruptcy by Swiss regulator FINMA.

Back to Freetrade’s results, in the 15 month period to 31 December 2023, Freetrade said that cost of living pressures continued to provide a headwind in the direct-to-consumer (D2C) platform market in general. Trading volumes overall remained “resilient” throughout this period, with £3.4 billion in the 15 months to 31 December 2023 of executed trade orders placed by Freetrade customers on the platform, lower than the £3.6 billion in the 12 months to 30 September 2022.

Despite strong macroeconomic headwinds, reflected by reported net outflows from equity funds of £22.0 billion in 2023, and significantly lower marketing spend, cash and assets that customers have deposited and transferred into their Freetrade account continued to increase each month. Net funding increased by £240.2 million in the 15 months to 31 December 2023, lower than the £598.4 million in the 12 months to 30 September 2022.

For the first half of 2024, Freetrade stated that it had net inflows of £233 million, and passed £2.0 billion in total assets under administration (AUA).

Also in the first half of 2024 Freetrade co-founder and COO Viktor Nebehaj replaced Adam Dodds as CEO – Dodds had been the only CEO Freetrade had known since inception in 2016.

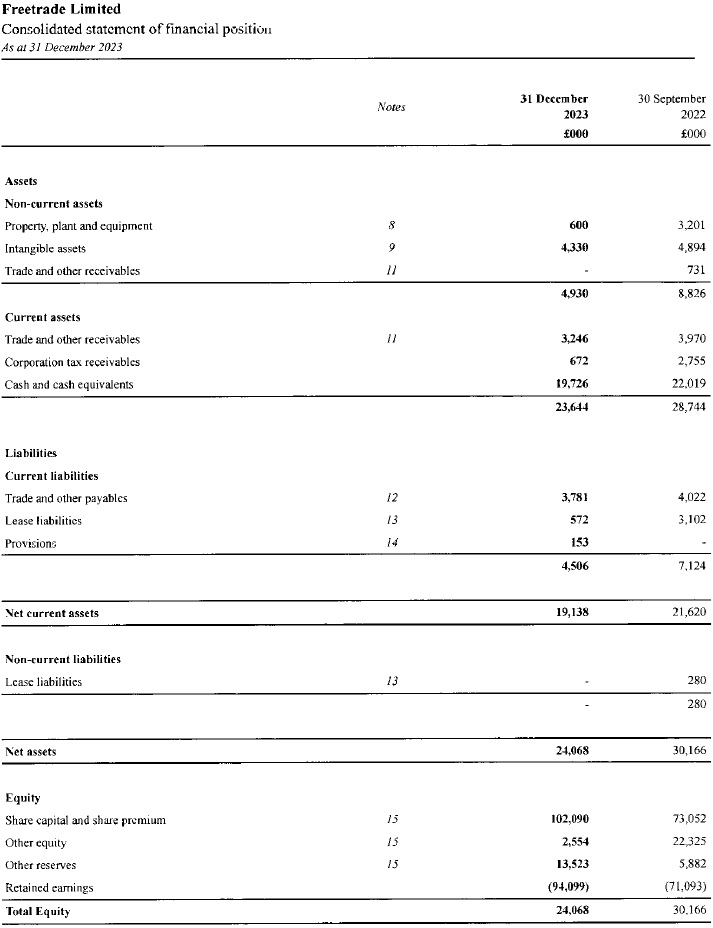

Freetrade’s 15-month financial statements to December 31, 2023 (income statement and balance sheet) follow below.