Exclusive: £10M in trader funds missing offshore from bankrupt CFDs broker City Credit Capital

FNG Exclusive… Further to our Reported First at FNG article from early July that FCA regulated CFDs broker City Credit Capital (UK) Ltd has been placed in administration, FNG has learned via regulatory filings that about £10 million in Professional Client money at CCCUK is missing offshore, and may not be recovered.

CCCUK Background

As we reported in July, City Credit Capital (which operated website cccapital.co.uk) and related “downmarket” brand CIX Markets (cixmarkets.com) were controlled by US entrepreneur Alfred Tang. The company had seen a significant downturn in activity over the past few years. In 2021 (the company has yet to release 2022 results) CCCUK did just £1.2 million in Revenues, posting a £3.8 million loss. As recently as 2017 CCCUK posted Revenues of £13.6 million earning profit of £725K.

Our initial report based on end-of-2021 data was that CCCUK / CIX Markets held £3.5 million in client funds. However an initial report from administrators Begbies Traynor indicates that the actual figure is much larger, with most of the funds unaccounted for after having been sent offshore by the company.

CCC Labuan related bankruptcy

According to Begbies’ initial investigation, the company’s largest trading counterparty was a related Malaysia based entity controlled by Mr. Tang named CCC (Labuan) Limited, which has also now taken steps to enter liquidation. CCC Labuan owed the company some £7.7 million. CCCUK had also provided a parent company loan of £3.1 million to CCC Labuan.

The administrator believes that the funds that CCCUK had invested in CCC Labuan were funds advanced to the company by its professional investors. As a result of the liquidation of CCC Labuan, the company was unable to repay funds to its professional investors in accordance with the terms of contracts. Begbies estimates that around £10 million remains due to various professional investors in this regard.

Following the failure of CCC Labuan, and the related inability of the company to return funds to its professional investors, CCCUK came under increasing pressure from professional investors to repay balances due. This culminated in the receipt of a statutory demand from one professional investor which CCCUK could not meet. Begbies said that had an administration appointment not been made, it is likely that the company would have been wound-up by one or more of its creditors.

Begbies noted that it has not, at this stage, investigated in any detail the transaction entered into with CCC Labuan or other group companies, though this is something that the administrators will be reviewing as part of their statutory duties.

CCCUK cash and client deposits

Begbies reported that just under £1 million (more precisely £989,874.79) was found in respect of the company’s cash at bank. A similar amount (£956,242.76) was received in respect of specifically segregated investor creditors client funds.

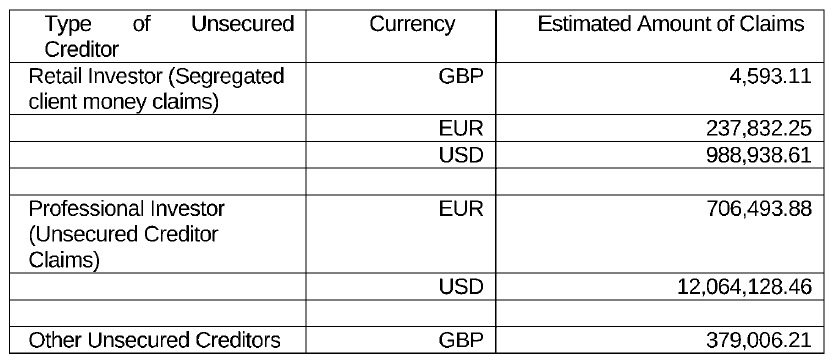

However a much larger amount of money is owed to creditors and the company’s (now former) clients. While most retail client funds seem accounted for, Begbies noted close to USD $13 million (about £10 million) in Professional Client claims against the company, with most of those amounts having been transferred to CCC Labuan, as noted above.

While Begbies said it envisages that all unsecured retail investor creditors will be repaid in full, it is uncertain of its ability to recover any Professional Client funds, which will depend on whether or not any money (and how much) can be recovered from CCC Labuan.

CCCUK’s largest Professional Client investors were listed as being Ayers Alliance, and Longchamp Absolute Return Unit Trust Fund.

The administrator anticipates providing an update on its efforts in about six months from now.

We will continue to follow this story as it develops.

September 5, 2023 @ 4:40 pm

the cash isnt in malaysia. it is in alfred tang’s pocket wherever he is now. typical offshore scam — take cash from clients in the ‘regulated’ company, move it offshore. if clients lose trading then broker keeps the money, if clients win then you keep the money anyway by declaring bankruptcy but the money is offshore and in the broker’s pocket, good luck finding him. how does the FCA allow this to happen in the first place?