ETX Capital posts 48% revenue rise in 2020, pivoting to neobank strategy

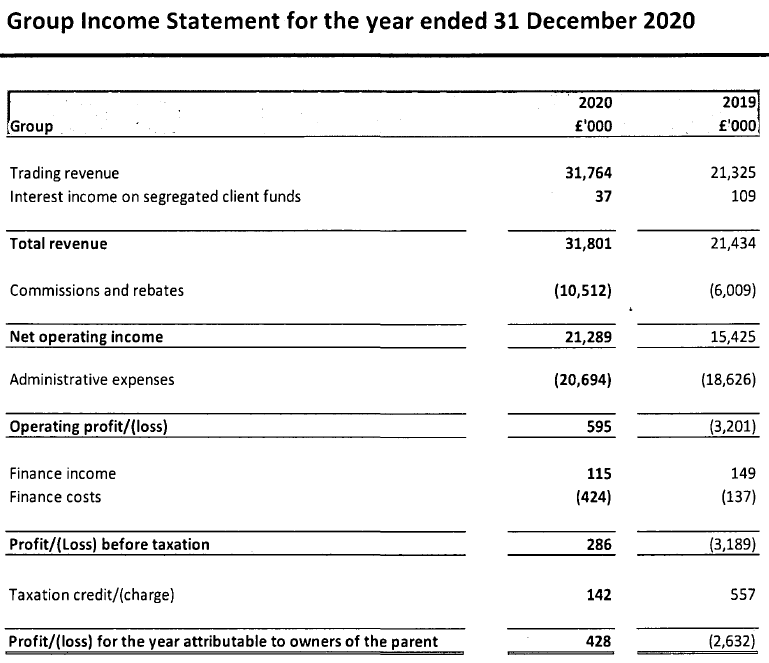

London based FX and CFDs broker Monecor (London) Ltd, which operates the ETX Capital brand, has reported its financial statements for 2020 showing a nice rise in revenues for its new ownership group. However a parallel growth in expenses left the company at basically breakeven for the year.

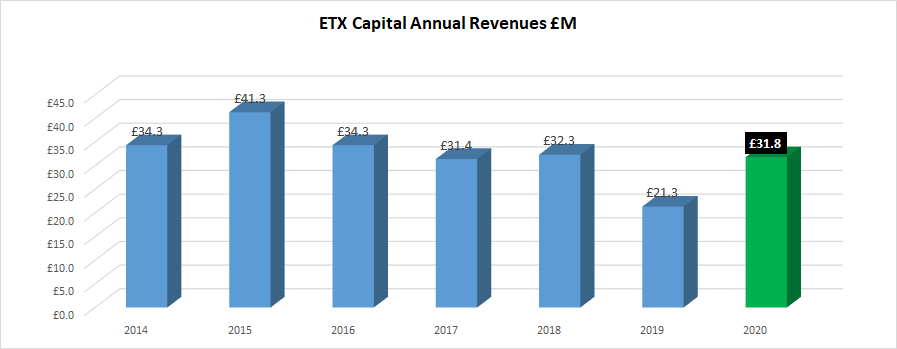

ETX Capital revenues were up 48% in 2020 over 2019, £31.8 million versus £21.3 million. However revenues remain below the £35-41 million range hit in 2014-2016 at ETX. Net profit for 2020 was £428,000, improved from a £2.6 million loss in 2019.

Client assets held by ETX Capital nearly doubled in 2020, £188.8 million versus £96.9 million in 2019. In terms of operating metrics, the company reported new funded accounts up 6% in 2020 to 2,936, and active accounts up 3% to 10,354 with the number of trades up 32%.

ETX was also helped by its growing investment banking / capital raising business, which generated £1.1 million in revenue for the company in 2020.

The company’s strategic focus continued to be on attracting higher value customers who generate a higher lifetime value. ETX has concentrated on maintaining a strong marketing message centred around a commitment to provide a personalised trading experience to its clients and providing the very highest levels of service. This has continued to deliver high value clients to the company and this was reflected in a continued significant proportion of revenues being generated from Professional clients at around 48% of spread. Professional clients are serviced by dedicated relationship teams, with a high level of personal contact key to delivering the company’s differentiated service.

ETX has continued to develop its iOS and Android mobile trading applications. In 2020 mobile app downloads increased by 40% to 7,769; the number of active traders using the apps has increased by 6% to 5,483; and the number of trades through the apps has increased by 43%. These increases in mobile app activity should be noted against the backdrop of almost no mobile marketing campaign spend in 2020.

Looking forward, ETX Capital referenced its recent acquisition of savings app Oval Money. Oval Money’s platform supports clients in setting smart rules for defining their savings habits and investment goals, making payments, and tracking spending. ETX’s current products and services will enable trading in the financial markets alongside savings, investments and payments through a single mobile app. The Oval acquisition supports the company’s neo-bank strategy of developing a combined platform that offers a broad range of financial services and products to a wider audience. The Directors anticipate that the acquisition will help to accelerate client growth, engagement and open the way to offering a new range of products and a broader spectrum of users.

ETX Capital was acquired in late 2020 by Swiss fintech investor Guru Capital SA, run by former Swissquote executives Ryan Nettles and Luca Merolla.

Monecor (London) Ltd’s 2020 income statement follows: