eToro shares sink 12% as Q1 2025 Revenue and Profit decline

Online broker eToro’s first financial results release as a publicly traded company probably didn’t go as smoothly as the company had hoped, with the company reporting a decline in both Revenue and Profit for Q1 2025, as Crypto trading activity slowed at the beginning of the year.

eToro share price reaction

eToro (NASDAQ:ETOR) shares declined by 12% on Tuesday, and continued to decline in aftermarket trading, closing the day at $66.96 after earlier hitting an all-time high of just under $80 (or $79.96, to be exact). To be fair, eToro shares had climbed by more than 20% in the days leading up to the Q1 results announcement, and are still well above eToro’s $52-per-share IPO price from mid May.

eToro share price IPO to present. Source: Google Finance.

eToro Q1 2025 results

But back to eToro’s Q1 2025 results details…

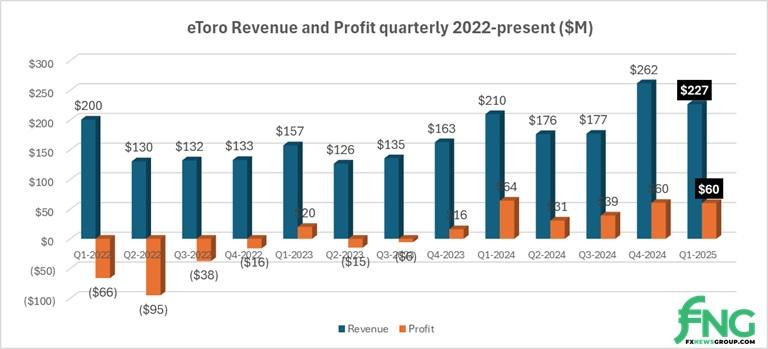

First, as we have described earlier, it is somewhat hard to discern what we view as eToro’s “real” Revenues, as the company reports gross “Revenue from cryptoassets” and “Cost of revenue from cryptoassets” separately, instead of netting the two to form “Net crypto revenue”, as it does with other asset classes such as equities, commodities, and currencies (and as do other online brokers). So the company reports inflated Revenues (in Q1, $3.76 billion) and Costs ($3.68 billion) figures. We have gone ahead and netted out the crypto costs, to get the following net Revenue and Profit figures for the company. (Net Profit figures aren’t affected by the calculation).

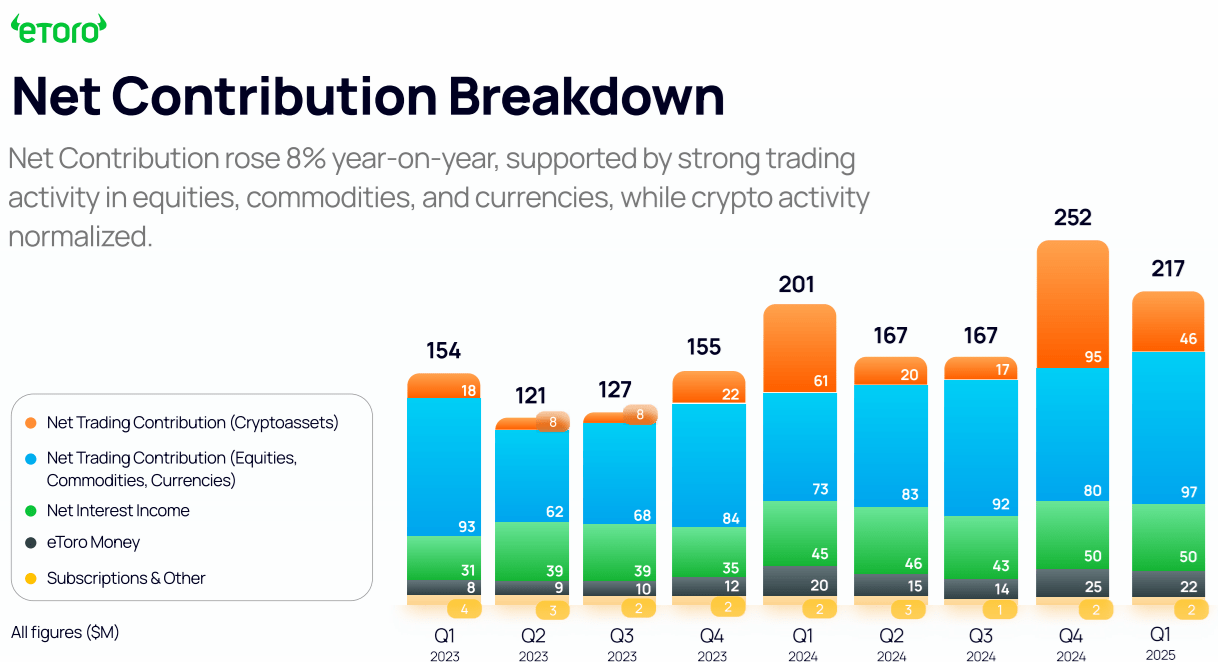

By our calculations, eToro Revenue declined by 13% in Q1 2025, coming in at $227 million, versus $262 million in Q4 2024. Net Profit at eToro was $59.95 million in Q1 2025, versus $60.41 million in Q4 2024 and $64.12 million in Q1 last year. The declines came as Crypto trading slowed, falling to 37% of overall Commissions at eToro versus 50% in Q4. eToro seems to do best when Crypto trading increases among its clients, with Q4 2024 and Q1 2024 being prime examples.

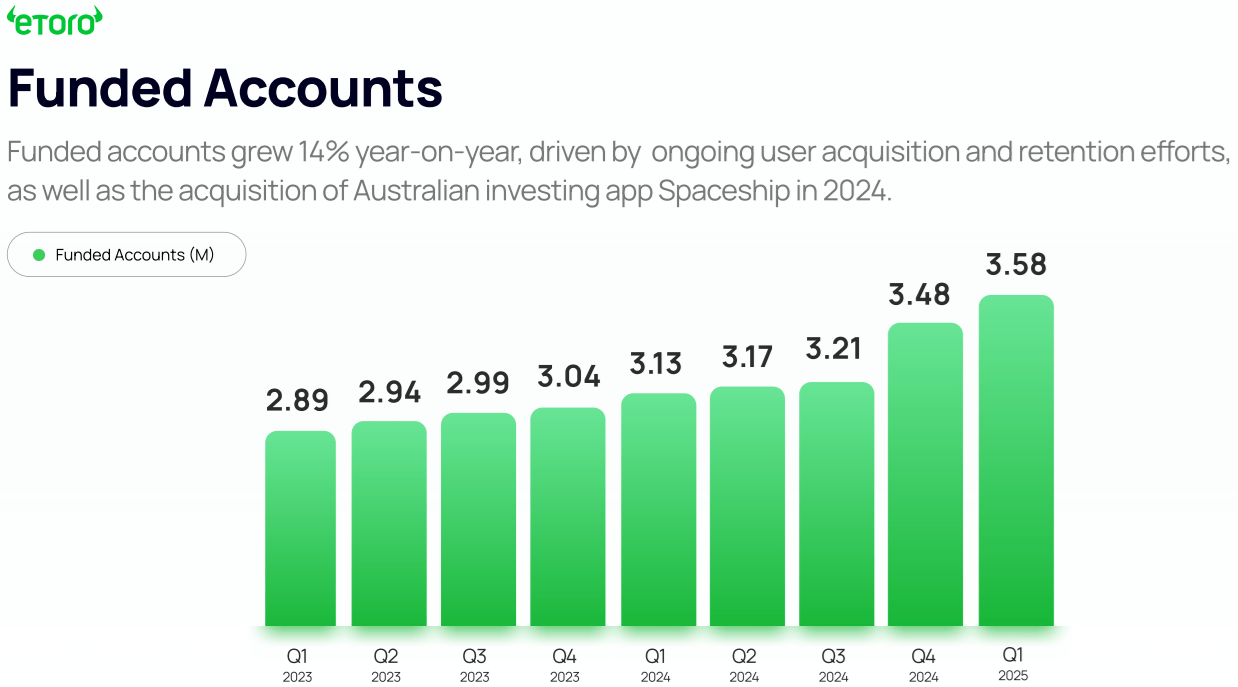

By a few other measures eToro had a solid Q1, and things seem to be going well into Q2. The number of funded accounts at eToro continued to climb, hitting 3.58 million, versus 3.48 million at the end of 2024. As of May 31, 2025 eToro had 3.61 million funded accounts, and $16.9 billion in Assets under Administration, up nicely from $14.8 billion as at the end of Q1 2025.

eToro’s full Q1 2025 results release and financial statements can be seen here.