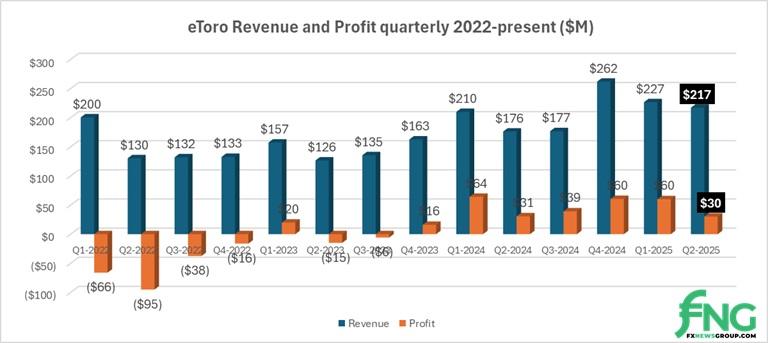

eToro revenues decline for second consecutive quarter in Q2-2025 as profits drop 50%

Social trading focused online broker eToro Group Ltd (NASDAQ:ETOR) has reported its results for the second quarter of 2025, during which it operated as a public company for the first time after the eToro IPO was priced in May.

eToro Q2 results

On the top line, eToro’s reported “Total revenue and income” fell by 44% from $3.755 billion in Q1 to $2.094 billion in Q2 2025. However due to the way eToro separates “Revenue from cryptoassets” (in Revenues) and “Cost of revenue from cryptoassets” (in Costs), as in the past we have netted the two to come up with what we believe is a more realistic Revenue figure for eToro, and more comparable to the other online broker results we cover.

That means, as per the chart above, Q2 Revenues at eToro came in at $217 million, off 4% from $227 million in Q1 – and well down from $262 million in Q4 2024.

On the bottom line, Net Income at eToro fell by 50% in Q2 2025, totaling $30 million versus $60 million in Q1. Q2 2025 was eToro’s least profitable quarter since 2023.

Funded accounts at eToro totaled 3.63 million as at the end of Q2 2025, versus 3.58 million in Q1.

Assets under Administration at eToro grew by a healthy 18% during Q2 2025, to $17.5 billion versus $14.8 billion at the end of Q1, as strong stock market and crypto valuations lifted the values of clients’ portfolios.

eToro share price

eToro shares, at yesterday’s closing price of $55.30, are near their lowest level since the company’s mid May IPO. eToro shares rose out of the chute and hit a high of $79.96 in early June, but have since slid by more than 30% to just above their $52 IPO price.

eToro share price chart, IPO to present. Source: Google Finance.

Yoni Assia, CEO and Co-founder of eToro commented,

Yoni Assia, CEO and Co-founder of eToro commented,

“I am proud of the eToro team for delivering another strong quarter, while meaningfully expanding our product innovation and geographical footprint. In the second quarter, we offered 24/5 trading for U.S. equities, introduced new long-term portfolios in partnership with Franklin Templeton, and launched savings products in France, all while strengthening our footprint in Asia through our new Singapore hub. These advancements reflect our commitment to making investing simpler and more accessible for our global community.

“Looking ahead, we are excited to continue developing technologies like tokenization and AI tools that we believe will transform how retail investors interact with the markets and create new opportunities for growth. As we continue to execute on our strategy, we remain confident in our ability to drive sustainable value for our users and shareholders.”

eToro’s full Q2 2025 results release can be seen here.