eToro IPO valuation: does $5 billion make sense?

FNG Exclusive Analysis… An alternative title to this article could have been something like: Why is online broker eToro going public in the US, when the vast majority of its business (70%) comes from clients in Europe?

The answer will become clear, once we take a look at the numbers.

eToro IPO filing

With about a week now to digest the eToro IPO filing which also included disclosure of eToro’s financial statements for 2024, the key questions remain 1) when is eToro going to try to go public (answer: probably soon), and 2) at what valuation.

Like with most things in finance, a successful deal comes down to price.

The eToro IPO filing did not give specifics as to what valuation it will try to achieve, or what size of offering it will pursue. But in the past, eToro CEO Yoni Assia has stated that he would target a valuation of at least $3.5 billion (i.e. the company’s valuation at its last fundraising), and more recent speculation was around a figure of $5 billion, which the company has neither confirmed nor denied.

eToro Revenue and Profit

The base figures to use in valuing eToro – Revenue and Profit – are a little murky, at least the Revenue figure. For some reason, eToro’s financial statements separated “Revenue from cryptoassets” as part of its Revenues, but the “Cost of revenue from cryptoassets” offset is included in its Expenses section.

We’ll explain.

If you purchase BTC on eToro at $100 and the cost to buy the crypto for you for eToro is $99, eToro’s revenue on the transaction is $1. Simple. However the current method used by eToro will book $100 as revenue, and $99 as cost, skewing wildly both Revenue and Expense figures.

When we summarized eToro’s IPO filing details (in our article linked to at the top), we netted the crypto “cost of revenue” from the “Revenue from cryptoassets”, to show a more realistic Revenue figure, and one more comparable to all the other publicly traded brokers we cover.

So instead of eToro’s reported $12.6 billion of Revenue and $12.4 billion of Costs for 2024, we got to $824 million of Revenue. The company’s Net Profit figure for 2024 ($192 million) remains the same.

eToro comps

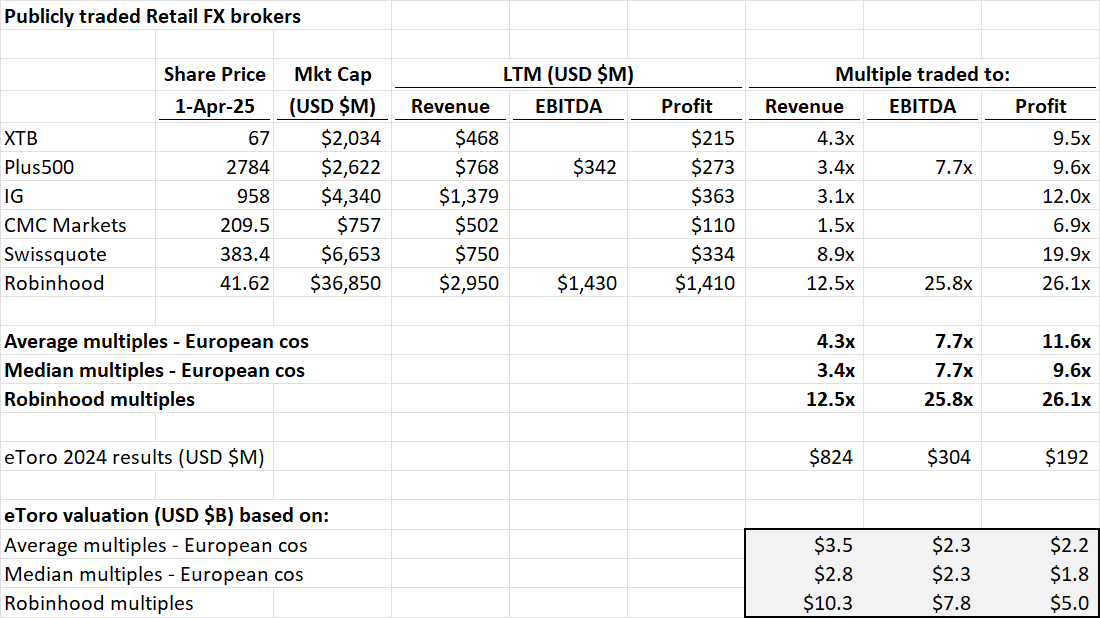

The key valuation metric used for any IPO is “comps”, or comparable companies, which are already publicly traded. We’ve grouped these comps into two groups – European and US, with the only real US comp being Robinhood.

A quick look at the comps table shows visually why eToro wants to go public on NASDAQ in the US. eToro wants its potential future shareholders to look at Robinhood as its main comp, and not the European/UK comps, companies like Plus500, XTB, and IG Group.

Robinhood is trading at multiples of Revenue (12.6x) and Profit (26.3x) that far eclipse the European/UK companies, by several times. Using Robinhood as a comp gets you to a valuation of between $5 and even $10 billion for eToro, while using European/UK comps gets you to somewhere between $2 to $3 billion.

We’d also note that several of the European/UK comps have seen their shares do very well over the past year, trading near 52-week highs, so these aren’t depressed valuations by any means.

So where does that leave eToro?

If eToro can convince its potential future shareholders that it should be valued “just like Robinhood”, despite less than 10% of its business coming from the US (the opposite of Robinhood), then it might achieve its targeted $5 billion valuation.

However we feel it more likely that overall, the market will place eToro in the Europe-UK basket, even if it trades on NASDAQ. From a size perspective as well, eToro is a lot more like its Israel-based counterpart Plus500. Revenue, EBITDA, and Profit at eToro and Plus500 are all in the same “ballpark”. And as noted above Plus500 shares have indeed done very well, up 50% in the past year.

But the Plus500 comparison leaves eToro at just a $2 to $2.5 billion valuation – without even taking into account an “IPO discount” typically used to get a deal done.