eToro IPO filing reveals Revenue of $824M, Profit of $192M in 2024

Israel based, social trading focused online broker eToro has taken the next step in its plans to go public on NASDAQ, publicly filing an “F-1” registration statement with the US Securities and Exchange Commission.

While the filing is preliminary and does not yet specify important elements of the IPO such as the proposed valuation of eToro, size of the offering, and timing, it does disclose in detail eToro’s financial results for 2024 and the past few years, as well as the company’s plans for the near future.

Regarding the IPO itself, it will be led by investment banks Goldman Sachs, Jefferies (which interestingly owns eToro rival FXCM), UBS, and Citi. eToro plans to list its shares under the ticker symbol ETOR on NASDAQ.

eToro results

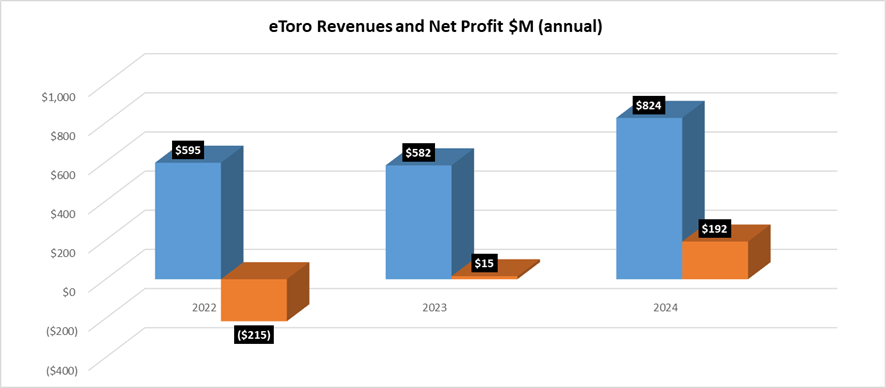

Overall, eToro reported Revenue of $824 million in 2024, up by 42% from from 2023. eToro earned a Net Profit of $192 million in 2024, versus near-breakeven ($15 million) in 2023, and a loss of $215 million in 2022.

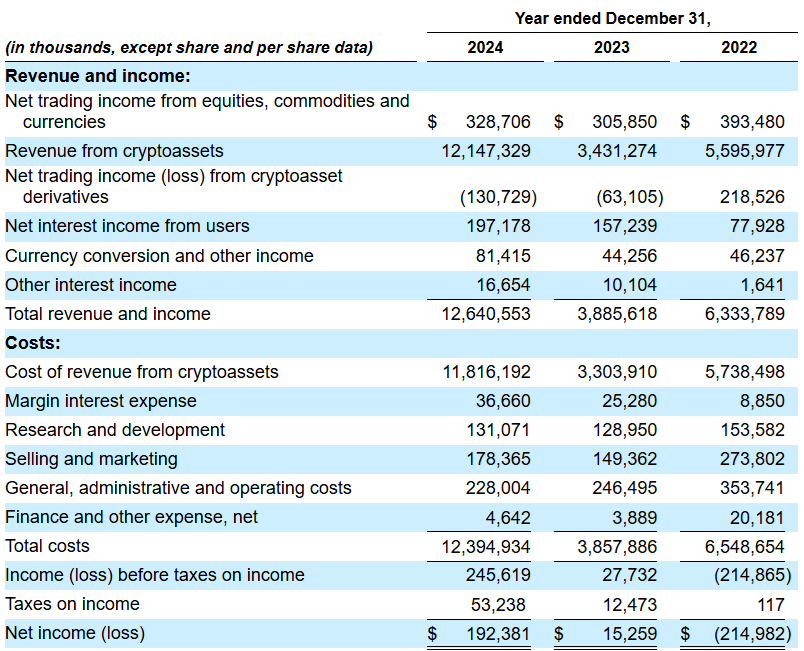

We’d note that these numbers weren’t that easy to discern from eToro’s filing document. The company reports “Revenue from cryptoassets” as part of its Revenues, but the “Cost of revenue from cryptoassets” offset is included in its Expenses section. We have netted one against the other to come up with a more realistic figure for company Revenues – otherwise eToro’s 2024 Revenues are shown as $12.64 billion, which we believe is misleading. The company’s full income statement data is included at bottom.

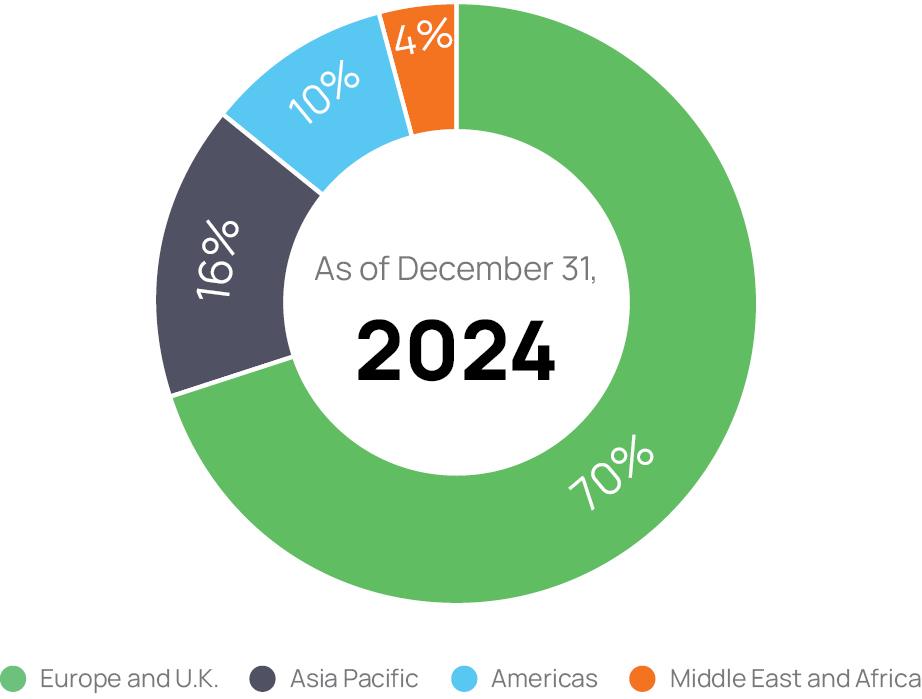

As of December 31, 2024, eToro had approximately 3.5 million Funded Accounts across 75 countries, although 70% of those were from clients in Europe and the UK (see more details below).

eToro crypto trading

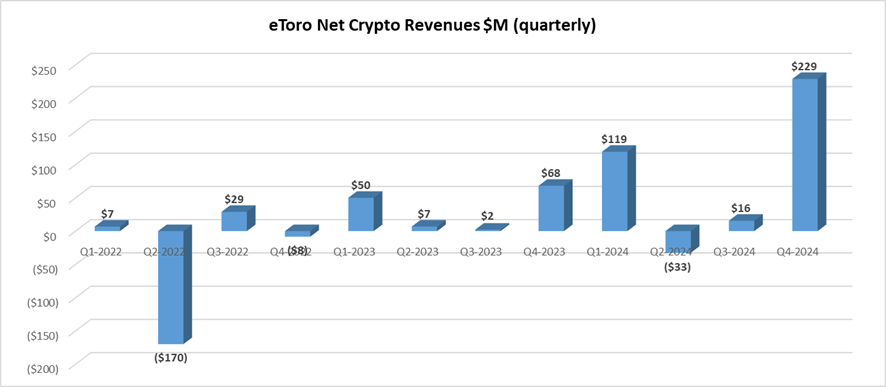

It becomes clear diving into the numbers that eToro’s growth is being driven by crypto trading. Crypto trading accounted for more than 40% of overall eToro Revenues in 2024, while eToro’s “core” Revenues from client trading in equities, commodities and currencies increased by just 7% in 2024, and was actually down from 2022 levels (see income statement data at bottom).

And that peaked in Q4-2024, with crypto surging after the November election of US President Donald Trump. More than 25% of eToro’s total Revenues – and likely more than 100% of its Net Profit – for all of 2024 came from Q4-2024 crypto trading.

eToro future plans

Regarding the future, eToro said that its strategy will be a combination of acquiring more users in existing markets, increasing its share of existing user assets, and moving into new markets.

eToro geographic distribution

eToro is still a very Euro-centric company, with 70% of funded client accounts located in Europe and the UK, and 16% in the Asia-Pacific region. Just 10% of client accounts are from “Americas” based clients, which includes the US.

The company reported in the F-1 that it continues to invest in growing its footprint in the Asia-Pacific region. Since launching in Australia in 2016, eToro has continued to grow its profile and presence. eToro believes that its acquisition of Australian investing app Spaceship, which closed in November 2024, will help the company continue to grow its market share in Australia. eToro Singapore has received an In Principle Approval for a Capital Markets Services license with the Monetary Authority of Singapore, which the company plans to activate in 2025 after meeting certain requirements.

eToro’s Americas business includes the United States and Latin America. Launched in 2019, its offering in the United States was initially limited to cryptoassets and social features including copy trading. Since then, eToro has expanded its US product offering to include equities, ETFs and options trading.

In November 2023 eToro launched in the United Arab Emirates, and the company is working to expand its presence in the Middle East, which eToro sees as having high growth potential.

eToro’s 2022-2024 income statement follows below. The company’s full’s F-1 IPO registration statement can be seen here on the SEC website.