CMC Markets shares soar (again) to all-time high after rosy Trading Update

The good times continue to roll in the Retail FX and CFDs space.

CMC Markets, which over the last couple of years had been lagging peers IG and Plus500 among the “major” online CFD players in the UK, today released a trading update for the just-completed April-to-June-2020 quarter, which is its first quarter of fiscal 2021 (CMC has a March 31 fiscal year end).

And the market seemed to like what it heard. After releasing its full-year (to March 31, 2020) results a few weeks ago – which sent its shares up 29% at the time to a multi-year high – CMC shares traded up about another 10% in early LSE trading Friday morning, topping £3 for the first time. CMC went public at £2.40 a share in early 2016, and its shares have spent most of the time since then below that level.

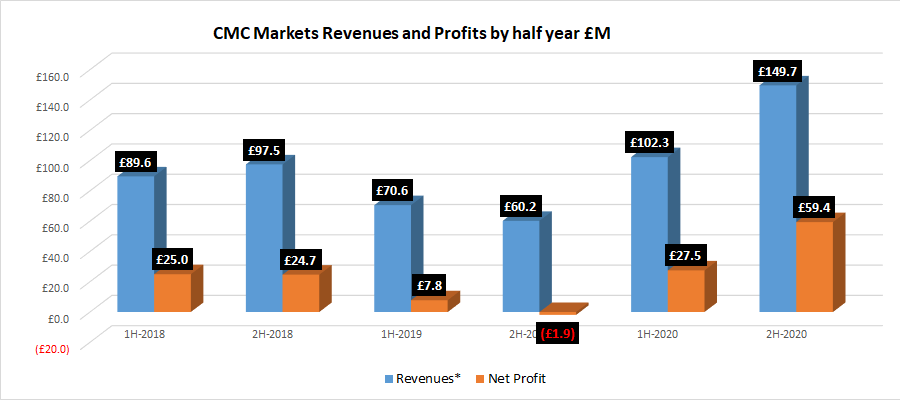

CMC indicated that its Revenues (or what it terms “net operating income”) for the quarter were greater than its Revenue for the full first half of last year, at £102.3 million. CMC didn’t say whether or not Revenues topped the £149.7 million of Revenue CMC brought in during the second half of fiscal 2020. Nor did CMC comment about profitability, although with Revenue figures like that profits are probably looking much better than last year as well.

CMC’s full Q1-2021 trading update release follows:

3 July 2020

CMC Markets Plc

Q1 2021 Trading Update

Continued strong trading performance

CMC Markets Plc (“CMC” or the “Group”), a leading global provider of online trading and institutional (“B2B”) platform technology solutions, today issues a trading update for the period from 1 April 2020 to 30 June 2020 (“Q1 2021” or the “period”).

Trading Update

CMC started the financial year from a position of real strength, with its continued investment in technology and ongoing strategy of targeting high quality clients, resulting in a consistently strong performance over a sustained period of time.

In Q1 2021, the entire business has continued to perform very well, with client trading activity remaining around double that of the same period in the prior year as stated on 11 June 2020 in our FY20 results. Client income retention for the period is materially higher than the 82% reported in H1 2020 and stockbroking net trading revenue also continues to benefit from the market conditions.

As a result, net operating income for Q1 2021 is in excess of that reported for H1 2020 of £102.3 million.

Our investment in technology continues to attract and retain clients, with market leading functionality and robust operational performance through these extremely high volume periods. Client acquisition and active client numbers remain at elevated levels.

The Board is confident that, even in the event that more normalised client trading activity returns, with the strong underlying performance of the business, 2021 net operating income will exceed the upper end of current market consensus*.

In light of this Q1 2021 update, CMC no longer intends to release the trading update scheduled for 30 July 2020. The Group is scheduled to release a H1 2021 pre-close trading update on Thursday 8 October 2020.

Forward looking statements

This trading update may include statements that are forward looking in nature. Forward looking statements involve known and unknown risks, assumptions, uncertainties and other factors which may cause the actual results, performance or achievements of the Group to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. Except as required by the Listing Rules and applicable law, the Group undertakes no obligation to update, revise or change any forward looking statements to reflect events or developments occurring after the date such statements are published.

* As at 2 July 2020, the Group compiled Full Year 2021 consensus is as follows:

· Net operating income of £245.9 million, ranging from £239.1 million to £255.5 million

· Profit Before Tax of £85.2 million, ranging from £75.8 million to £93.5 million