CMC Markets sees 8% Revenue decline and 24% drop in Profit in 2H FY2025

Following a strong first half of fiscal 2025, London based online trading group CMC Markets plc (LON:CMCX) has reported its full year 2025 results (fiscal year ended March 31, 2025) indicating a slowdown in both top and bottom line results in the second half of the year, i.e. October 2024 through to March 2025.

CMC Markets management changes

The company also announced some senior management changes. David Fineberg, Deputy CEO of CMC since 2019, is stepping off the CMC Board and will transition into the newly created role of Global Head of Strategic Partnerships, with a focus on strengthening key institutional relationships and accelerating growth through partnerships such as Revolut and blockchain technology provider StrikeX.

Laurence Booth, CMC’s Global Head of Capital Markets, will join the Board and add the title of Executive Director, effective 5 June 2025.

Matthew Lewis, currently CMC’s Head of ANZ and Board Director, will also step down from the Board but will continue to focus fully on expanding the Group’s footprint across the ANZ region, particularly in stockbroking and digital asset services.

CMC Markets FY 2025 results

But back to CMC’s results…

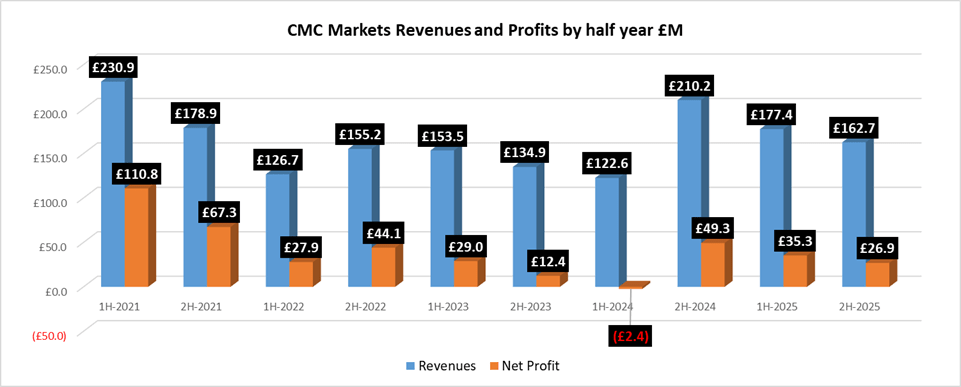

CMC reported Revenues of £162.7 million for the second half of FY2025, down for the second consecutive period, in what is a somewhat troubling trend for the online broker, which has come under pressure from its traditional competitors such as IG Group and Plus500, as well as from crypto exchanges such as Crypto.com and Kraken which have been expanding into “traditional” financial trading for retail clients.

CMC Markets’ Net Profit also declined for the second consecutive semi-annual period, coming in at £26.9 million in the second half of FY2025.

For the full fiscal year 2025, CMC Markets reported Revenue of £340.1 million and Net Profit of £62.2 million.

CMC Markets share price reaction

CMC shares reacted to the news by trading down about 12% as markets opened on Thursday. Interestingly, CMC Markets shares are almost exactly where they were at this time last year, at 284.5p (Wednesday’s closing price), although they have gone on somewhat of a roller coaster ride hitting as high as 349p in late 2024 and sinking as low as 183.4p earlier this year.

CMC Markets share price chart, past 12 months. Source: Google Finance.

CMC Markets future plans

CMC led off its results release by describing what it called a “three vertical future state”. In addition to its existing Direct-to-Consumer (D2C) brokerage platform and CMC’s B2B institutional services, the company noted the rise of Web 3.0 technologies, including decentralised finance and tokenisation, which CMC said represents a structural shift in global finance and is the future state.

In response, CMC is launching a third strategic vertical: Decentralised Finance (DeFi) and Web 3.0 capabilities, designed to position CMC at the forefront of the next generation of financial services. Key initiatives already delivered include the launch of 24/7 crypto trading, enhanced digital asset treasury and payment capabilities, and the post-year-end acquisition of StrikeX, bringing native blockchain expertise and infrastructure in-house.

CMC Markets’ full release on its FY 2025 results can be seen here.