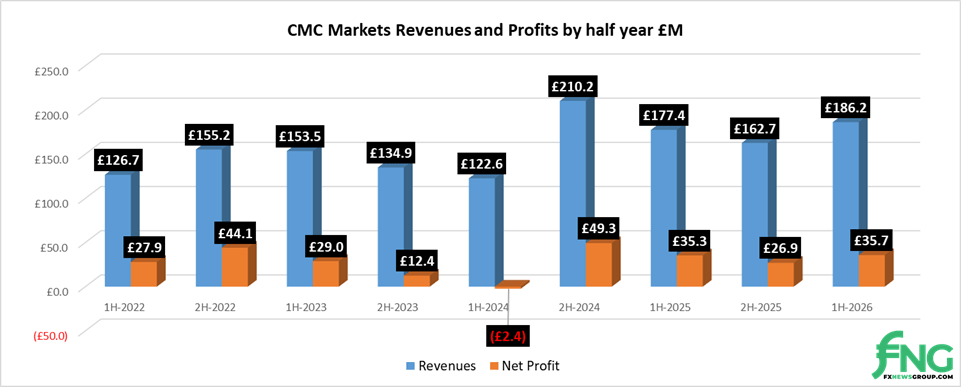

CMC Markets sees 14% rise in H1 2026 Revenues to £186M

Following a slowdown in the second half of fiscal 2025, London based online trading group CMC Markets plc (LON:CMCX) has reported its results for the first half of FY 2026 indicating a healthy increase in both Revenues and Profits. The company also raised its outlook for the full 2026 fiscal year.

CMC has a fiscal year end of March 31, so the H1 2026 results cover the six month period of April-September 2025.

Revenues at CMC Markets came in at £186.2 million in H1 2026, up by 14% from £162.7 million during H2 2025. Net Profit of £35.7 million was 33% better than H2 2025’s £26.9 million.

CMC financial highlights H1 2026

- Net operating income up 5% to £186.2 million (HY2025: £177.4 million) with increases in net trading and investing revenues

- Record half-year for Australian stockbroking with net operating income of A$65.9 million (HY2025: A$49.4 million), a 34% increase year-on-year and supported by a 14% increase in AuA to approximately A$91 billion

- Total operating expenses were £136.5 million (HY2025: £123.9 million), reflecting a further £5.2 million provision for industry-wide margin netting in Australia, concluding the remediation due on this matter. Excluding this, costs remained well managed and in line with internal expectations

- Profit before tax of £49.3 million (HY2025: £49.6 million) and profit before tax margin of 26.5% (HY2025: 27.9%) remain robust and primarily reflect impact of the Australian remediation charge

- Interim dividend of 5.5 pence per share (HY2025: 3.1 pence), up 77% year-on-year

Strategic & Operational Highlights

- Transformational Westpac partnership agreed, CMC’s largest institutional deal to date, providing fintech infrastructure, technology, and execution services and further cementing our position as Australia’s second-largest stockbroker

- Westpac agreement expected to expand the Australian customer base materially, and lift domestic trading volumes by approximately 45%, with significant opportunity for further upside. Launch will be in approximately 12 months

- Neobank API partnership continues to mature, with exponential account growth and rollout now live in over 30 European countries – many where CMC has no physical presence – extending the Group’s global reach and demonstrating the distribution power of our API technology

- Further partnerships at an advanced stage with a major international bank and UK retailer Currys, reinforcing CMC as the partner of choice and highlighting the diversity and scalability of our technology with blue-chip institutions

- New multi-asset platform set for December launch in the UK, with other regions to follow. This will be followed by the rollout of our “Super App,” designed to unify TradFi and DeFi within a single, scalable platform – marking the start of a three-phase development roadmap

- Robust product pipeline across trading, investing, and B2B platforms, via API connectivity to broaden CMC’s distribution reach, through products and partnerships

- FY2026 operating expenses expected to be marginally ahead of consensus1, predominantly due to the Australian remediation

- Operating expenses include temporary dual-running costs as the Group transitions key operational functions to lower cost jurisdictions, supported by a partnership with a leading global outsourcing provider

- These initiatives are expected to deliver meaningful efficiency gains, with lower overheads and improved profit margins expected to flow through over the next 12 to 18 months

CMC Outlook

- The Group enters the second half with strong momentum across all three verticals, supported by solid client activity and a healthy pipeline of B2B and D2C opportunities

- Third vertical advancing rapidly, with a successful live blockchain-based tokenised share trade, an up to €300 million Commercial Paper Programme, and the assignment of an investment-grade rating by Fitch – all completed post-period end and demonstrating tangible progress in the Group’s digital asset and funding infrastructure

- Momentum has accelerated across the business, with record client cash balances, rising activity levels and stronger performance metrics, particularly seen across the institutional B2B and API space

- As a result – and following a strong start to H2, including the significant growth of our neobank API business – the Group now expects net operating income to be approximately 10% ahead of current market expectations for FY2026

CMC Markets’ full release of H1 2026 results can be seen here.