Match-Trader platform September updates focus on Prop CRM

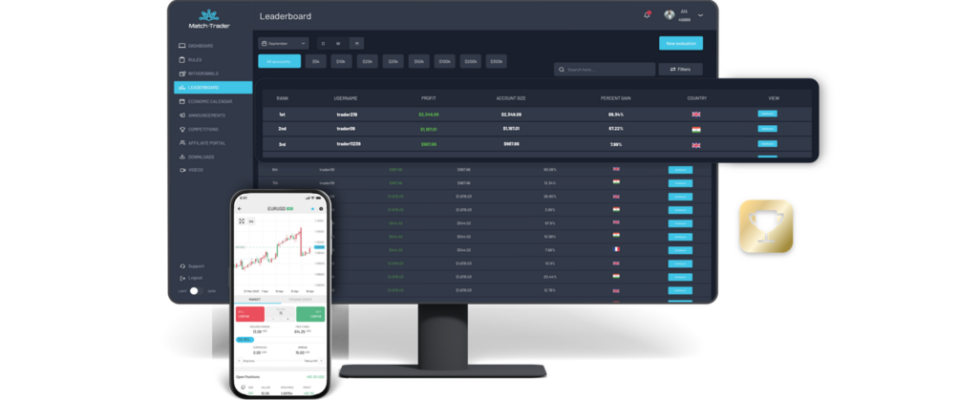

Multi-asset trading platform provider Match-Trade Technologies has introduced a series of updates to its Match-Trader platform during the month of September 2024, focused on enhancing the backend of its Prop Trading Solution, introducing significant upgrades to CRM functionality and streamlining workflows for Brokers.

With new features such as automated phase progression, customizable KYC settings, and real-time email notifications, Match-Trade said it is offering Forex Brokers and Prop Trading Firms greater flexibility and control over their operations. These updates are designed to optimize account management, improve user experience, and increase operational efficiency—key areas that can directly impact the success of your business. Dive into the details to discover how these improvements can benefit your firm.

Streamlined Challenge Management in Prop CRM

As part of its commitment to continuously enhance the functionality of its Prop Trading CRM, Match-Trade introduced a new feature that offers flexibility in managing trader challenge phases. This update enables both manual and automatic phase progression, giving Brokers greater control over how traders advance through challenge stages.

Key new features:

“Evaluation Requests” Tab

Match-Trade added a dedicated “Evaluation Requests” tab in the CRM, where administrators can review and approve requests for progression to the next challenge phase. This feature empowers Brokers to manually assess trader performance before allowing them to advance.

“Auto Evaluation” Parameter

Phase configuration now includes a new “Auto Evaluation” option. When disabled, traders who click “Progress to next phase” in the MTR will not automatically advance. Instead, their request is sent to the CRM for administrator approval.

Manual Rejection Process

If an administrator rejects the progression request, the account’s balance is reset to the initial balance, and trading days are cleared, ensuring full compliance with challenge rules.

Enhanced Notification System

Match-Trade has implemented a new notification system within the Match-Trader platform to improve communication with traders. Traders receive real-time updates on the status of their phase progression requests, ensuring they are informed throughout the process.

Benefits for Brokers:

The new “Evaluation Requests” tab in Prop Broker CRM provides Brokers with greater flexibility in controlling the phase progression process, allowing for a more detailed review of trader performance before moving to the next stage. Introducing the “Auto Evaluation” parameter will enable Brokers to decide which phases require manual verification and which can be processed automatically. This added layer of control ensures a more customized and precise evaluation process. The enhanced notification system in the Match-Trader platform also improves communication with traders, keeping them updated on their requests’ status, boosting transparency and engagement.

Customizable Daily Loss Reset time in Prop CRM

Match-Trade said it is continuously advancing its Prop Trading Solution to meet the evolving demands of the market. In the Prop section of the CRM system, Match-Trade has introduced a new “General Configuration” tab, giving Brokers the flexibility to customize the reset time for the Daily Loss Limit. This update allows users to choose any specific hour for resetting daily losses, moving away from the previously fixed reset time of 00:00 UTC.

Benefits for Brokers:

The ability to adjust the Daily Loss Limit reset time offers Prop Firms greater operational flexibility, enabling them to align the reset with their clients’ local time zones. This significant customization not only improves the user experience but also allows Prop Firms to cater to the specific needs of their traders, ultimately enhancing the efficiency and adaptability of the platform to meet diverse operational requirements.

Trading Days Adjustment in Account Management of Prop CRM

Match-Trade introduced a new feature that allows Brokers to modify the number of trading days directly from the Account Management tab in Prop CRM. Along with this enhancement, Match-Trade has updated the relevant endpoints to include the “tradingDays” value in the response for each account, giving Brokers the ability to both view and update this parameter seamlessly.

Benefits for Brokers:

This new functionality provides Prop Trading Firms with greater flexibility and control over user accounts by allowing them to manage the number of trading days directly from the CRM. It streamlines account management, making adjusting trading conditions and tailoring them to specific client needs easier, ultimately enhancing operational efficiency and control.

New KYC Settings for Individual Phases in Prop CRM

Match-Trade has shifted the KYC verification function from the overall challenge settings to each individual phase, giving brokers greater control over user verification. Now, each phase can have its own “KYC required” flag. If the flag is enabled for the first phase, clients must achieve verified status before purchasing the challenge. The KYC verification is triggered for subsequent phases when the trader tries to advance. If a trader doesn’t have Verified status, the transition will be rejected, or the request will be denied if auto evaluation is turned off. To keep traders informed, we have added specific notifications for KYC-related issues at every stage within the Match-Trader platform.

Benefits for Brokers:

By moving the KYC check to individual phases, Match-Trade not only allowed Brokers to better manage the verification process for users but also significantly improved the user experience. Clear error messages related to KYC help traders quickly understand why their progression to the next phase was denied, streamlining communication and ensuring a smoother journey for users.

Real-Time email notifications for critical account actions

Match-Trade implemented a new email notification system that automatically alerts both clients and administrators about key account events. These emails are triggered by critical actions such as:

- A request to move to the next phase

- Account progression to the next standard phase

- Account progression to the funded phase

- Account failure (burning)

Benefits for Brokers:

Email notifications offer numerous advantages, improving both operational efficiency and customer relationships. They provide immediate communication, ensuring clients and admins are promptly informed of crucial account events, which enables faster responses. This automation saves time by reducing the need for manual updates and minimizes the risk of missing critical information. It enhances transparency, building trust with clients by keeping them informed of important changes. Additionally, timely notifications help increase client engagement and understanding of account processes.

New and expanded endpoints in Broker API

Match-Trade introduced new and extended functionality within the Broker API, adding several new endpoints that provide greater flexibility for API queries. The newly added endpoints include:

- Close Partially – allows partial closure of an open position

- Add Note – enables adding a note to a specific position

- Add Task – creates a task for the account manager

These additions open up more possibilities for Brokers to manage tasks and processes through API integration.

Benefits for Brokers:

The expanded range of actions available via the Broker API offers brokers more powerful tools for managing operations efficiently. With new endpoints like “Close Partially,” “Add Note,” and “Add Task,” Brokers can now streamline workflow processes, automate task management, and control positions directly from the API without needing to access the Back Office.

Seamless CSV Export from IB Accounts Tab in Forex CRM

Elevating the functionality of its Forex CRM, Match-Trade introduced the ability to export data directly from the IB Accounts section into CSV files. This new feature allows users to quickly download comprehensive IB account data, offering a more efficient way to analyze and manage performance metrics. With just a few clicks, users of Forex CRM can easily extract and utilize data in external tools, making it simpler to maintain records and perform in-depth analysis.

Benefits for Brokers:

This addition empowers Brokers by providing greater flexibility in handling IB account data. The simplified export process enables quicker report generation, efficient performance tracking, and seamless integration with third-party analysis tools.

Streamlining workflow in Forex CRM

This September, Match-Trade also introduced the highly intuitive “Save Order” functionality across the Payment Gateways, Offers, Terms & Conditions, and Lead Assignment tabs of Forex CRM. This new feature allows users to seamlessly rearrange items within tables by simply dragging and dropping or using arrow keys. With this added flexibility, users can now organize elements to suit their workflow and preferences. Users can now organize elements in a way that best suits their workflow and preferences.

Benefits for Brokers:

This feature allows Brokers to streamline the organization of critical elements within the CRM system, making data management more efficient. By empowering Brokers with an intuitive tool to customize the order of items, we enable them to enhance the clarity and structure of their workflows.

Enhanced deposit and withdrawal views in Forex CRM

As part of its September updates focused on improving User Experience, Match-Trade added “Name” and “Surname” fields to the detailed views of deposits and withdrawals within Forex CRM. By placing these fields alongside the “Account” field, this enhancement ensures a clearer, more organized presentation of user data, creating a more intuitive and cohesive interface for Brokers.

Benefits for Brokers:

With the addition of “Name” and “Surname” fields in both table and detailed views, Brokers now have a more efficient way to manage and review client information. This update not only simplifies user identification but also enhances the consistency of data across the CRM, making it easier to access and verify details during transactions. Overall, this improvement contributes to a more fluid and user-friendly experience, enabling Brokers to manage their operations with greater precision and ease.