DMA Prime selects TORA for multi asset OEMS and outsourced trading

San Francisco based trading technology company TORA has announced that DMA Prime a provider of execution and prime brokerage services to institutional asset managers in South Africa, has selected TORA’s OEMS and TORA’s outsourced trading service.

DMA Prime chose TORA’s OEMS as part of the rapid expansion of their outsourced dealing services in the region and the need for a scalable multi-asset global execution technology solution to help meet that growth. In addition, the execution desk at DMA Prime has also selected TORA’s outsourced trading desk to supplement their global market reach with TORA traders working in multiple time zones to execute orders.

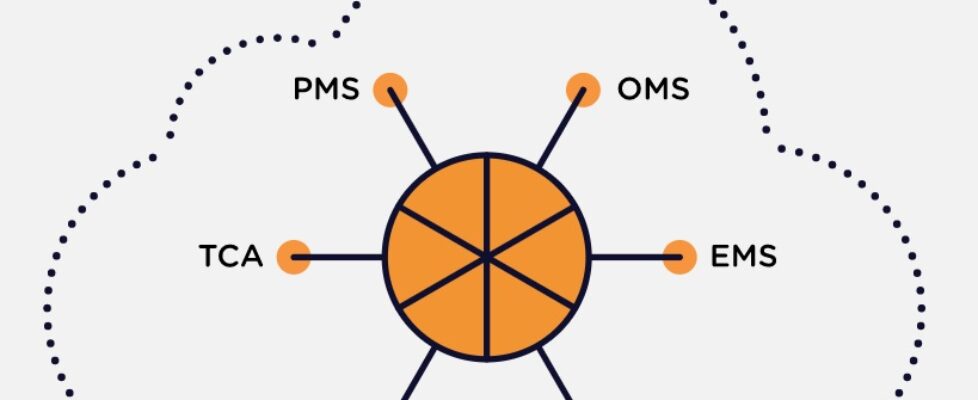

TORA’s OEMS provides advanced tools for clients trading equities, futures, options, bonds and FX in a unified system. The system delivers trading functionality including order execution, order allocation management, automated broker order routing, pre-trade risk controls, real-time position management and P&L tracking.

DMA Prime can now access the TORA FIX network to connect to global broker algo offerings, as well as use TORA’s equity pairs algos to improve execution quality and use the TORA TCA reporting suite.

Chris Jenkins, Managing Director at TORA commented:

“We are very pleased to announce DMA Prime as TORA’s first South African client, which is a milestone for us. We are passionate about being able to provide the latest trading technology that gives clients an added edge. We look forward to a long-term partnership with the team at DMA Prime.”

Justin Sage, Head of Institutional Trading at DMA Prime added:

“Against the backdrop of a very competitive landscape, TORA’s OEMS was the perfect choice for us. We really needed a global execution system that allows fast single-click trading and the ability to seamlessly connect to our existing in-house proprietary portfolio technology and liquidity providers.”

“What’s more by working with the TORA outsourced trading team, we can scale our trading operations significantly as our client base grows. Institutional investors in South Africa demand market-leading technology and high service levels, and we are comfortable that TORA will keep ahead of the curve with extensive inhouse development capacity and trading expertise to supplement our internal teams.”

South Africa is the continent’s largest savings market with an estimated ZAR 7.5 trillion AUM in regulated savings and investments (Collective Investments, Long term Insurance, The Public Investment Corp & Retirement Funds), a growth story that DMA Prime as a participant is very excited by. The South African Rand (ZAR) has been one of the best performing emerging markets currencies this year, a popular carry trade opportunity with attractive yields relative to developed economies and a tail wind from strong commodity prices.

TORA was one of the first in the industry to establish a cloud based OEMS over 16 years ago. The system offers multi-asset, multi-region trading technology that is compliant with MIFID II. TORA’s OEMS offers a wealth of functionality covering execution, allocations, risk control, real time positions-keeping and P&L monitoring. The platform can also provide detailed reports & analytics and has a broker-neutral equity pairs algo suite.

TORA is a leading global provider of advanced investment management technologies supporting the full trading lifecycle. With a full suite of cloud-based SaaS-delivered execution, analytics and compliance tools, as well as order, portfolio and risk management capabilities and a global FIX network, TORA’s products are utilized by hundreds of the industry’s leading hedge funds, asset managers, proprietary trading firms and sell-side trading desks globally. With headquarters in San Francisco, TORA has over 250 employees across offices in Hong Kong, Jersey, New York, Romania, Singapore, Sydney and Tokyo.

DMA is a group of companies licensed to provide financial services within their respective jurisdictions. DMA Prime is a division of DMA. The company’s proprietary technologies and strategic partnerships are helping institutional investors change with them. By connecting front, middle and back office, DMA helps investment managers deliver a delightful experience at every stage of the customer lifecycle. Led by a need to progress the industry in the customer’s favour, DMA has grown out of its headquarters in Johannesburg and expanded into Mauritius and the UK.