Devexperts adds spread betting to its DXtrade platform

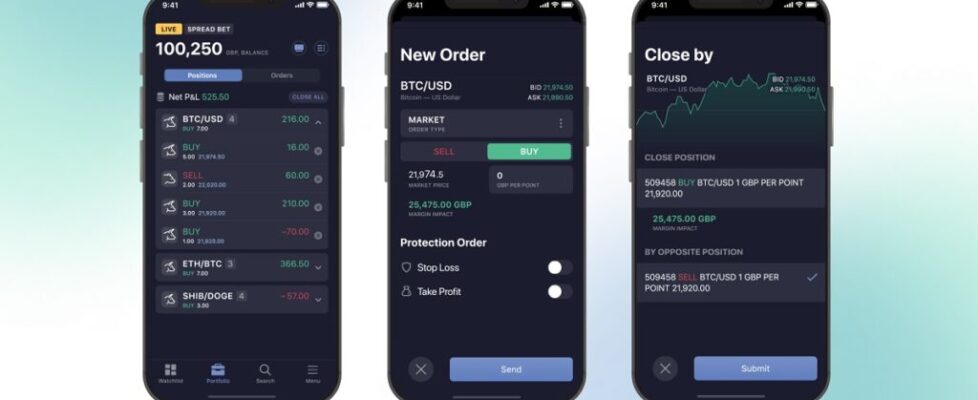

Trading platform and technology provider Devexperts has announced that it has enhanced its DXtrade trading platform by adding support of spread bets. Along with FX/CFD and Crypto, brokers licensing DXtrade can now offer spread betting to their traders.

Devexperts said that its decision to add spread betting to DXtrade was based on the high demand that the company has seen in the past months. For the UK brokers, spread betting is a tax-efficient instrument that is free from capital gains tax and stamp duty. It allows traders to benefit from price movements of numerous financial instruments, including stocks, indices, commodities, ETFs, FX, and cryptocurrencies.

Jon Light, VP of Trading Solutions at Devexperts who is overseeing the FX/CFD product line commented on the opportunity for the brokers looking to add spread bets:

Jon Light, VP of Trading Solutions at Devexperts who is overseeing the FX/CFD product line commented on the opportunity for the brokers looking to add spread bets:

“Adding spread bets is a great opportunity for the UK brokers as it can help diversify and expand their audience. It’s an equally beneficial instrument for established brokers looking to offer something new and for startups looking to target a certain client segment. As a broker using DXtrade, you can hedge spread bet client positions directly with the CFD market.”

DXtrade is a platform that offers brokers brand recognition and total control of their mobile applications. All trader facing frontends are branded with the customer’s logo, and the mobile apps are launched on app stores using a unique link for each broker. This provides brokers with the assurance that no one is able to take their apps down, because they are not sharing the app store link with other brokers. In addition, the platform is offered with 24/7 maintenance and support to brokers.

Driven by the market trends, Devexperts invests in the development of the platform according to what brokers need to attract and retain their users—and it can be delivered just within a week.

DXtrade is connected with several of the most popular liquidity providers and hubs, among which are GCEX, PrimeXM, OneZero, and Centroid. It is possible to connect DXtrade through the industry APIs with broker’s preferred LP. Clients will need no extra tools such as bridges, meaning no extra costs for unnecessary plugins while benefitting from single-tenant deployment.

The platform has a flexible layout where widgets can be set up individually for different trader groups. Brokers can either preset a number of layouts with charting, news feed, watchlists, etc., for their experienced traders, or offer a single fixed layout for novice traders with only necessary widgets open.

In addition, the platform retains traders by offering a trading dashboard that summarises their performance at a glance. Available metrics include intraday performance, risk/reward ratios, win rates and winning/losing trade holding times.

Another loyalty increasing tool for traders is an embedded Trading Journal. It logs all trade orders and lets them add notes or tags in order to better stick to their trading strategy and stay on track. Traders can also access account statements with a single click, enjoy fast transactions, access online chat support and receive real-time updates about market events.

Devexperts specialises in developing software solutions for the capital markets industry. Their clients are brokerage houses, exchanges and wealth management firms. Devexperts have developed numerous well-known trading platforms, used by US and EU brokers, with millions of people across the globe trading daily. Devexperts’ services include UI/UX design for trading apps, quality assurance of financial software, market data feeds, AR/VR data visualization, trading chatbots, and market analysis tools.

DXtrade is Devexperts’ SaaS trading platform ready for white-labeling for retail FX, CFD, Crypto, and Spread Betting brokers worldwide.