Stripe launches delegated authentication to improve payment conversion in Europe

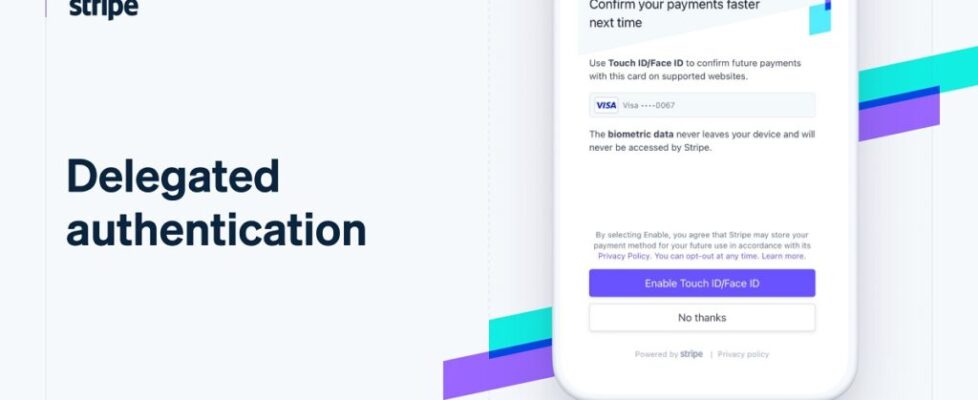

San Francisco and Dublin based Stripe, which builds payment infrastructure for the internet, has announced the launch of a delegated authentication feature to improve payment conversion rates in Europe. Stripe businesses can now have their customers authenticate purchases right inside a checkout flow.

Wise is the first card issuer to implement the feature. As a result, cardholders will no longer be redirected to their Wise app when authenticating purchases from millions of Stripe businesses. Instead, they will be able to use any biometric authentication method supported by the device they’re on, without ever leaving the checkout flow.

Erik Kaju, director of platform and spend at Wise said:

Erik Kaju, director of platform and spend at Wise said:

“We’re thrilled that Wise customers are the first to benefit from this new technology. It makes their lives far easier when making online purchases, whether they’re ordering a takeaway or shopping via TikTok. We’re proud to work with Stripe to solve this complex problem together.”

Strong Customer Authentication (SCA) is an EU regulation that was fully rolled out this year to reduce payment fraud. Issuers must now use two-factor authentication to prove the purchaser is who they say they are. If fraud occurs, the issuing bank is liable and the business is not exposed.

SCA has cut fraud, but has also reduced legitimate economic activity. Visa estimates that SCA-compliant transactions have suffered an 11% drop in conversion rates due to purchasers needing to shuffle between different apps at checkout.

The delegated authentication feature embeds biometric authentication into the merchant’s checkout, passing responsibility for authenticating transactions from card issuers to Stripe. On the backend, Stripe dynamically adapts two-factor authentication methods to suit a purchaser’s preferences and device capabilities. Users of the iPhone, for example, might be given the option to authenticate with Face ID.

As a result, purchasers are no longer directed away from the checkout page in the middle of a purchase, while merchants are still protected from online payment fraud.

Matt Henderson, EMEA business lead at Stripe added:

Matt Henderson, EMEA business lead at Stripe added:

“Every pound and euro counts, and Stripe is intensely focused on maximizing revenue for our users. Our delegated authentication feature is a powerful lever to increase the payment conversion of merchants on Stripe, which means more money into their topline without asking them to lift a finger. Across all SCA-covered transactions, this could save billions for businesses every year.”

Businesses like TikTok, Nando’s, and Deliveroo are already using Stripe’s delegated authentication when checking out Wise cardholders. SCA-relevant payments see a 7% lift in payment conversion, and the authentication process is four-times faster compared to purchasers being redirected to their banking app or sent a one-time passcode.