Cornerstone FS sees 87% increase in 2022 Revenues driven by acquisitions

Payments fintech Cornerstone FS Plc (LON:CSFS), a cloud-based provider of international payments, currency risk management and electronic account services to SMEs, has released a Trading Update indicating increased activity for 2022.

As noted in Cornerstone’s half-year results report, the Group entered the second half of the year with strong trading momentum and Cornerstone said that this has been sustained through the period. As a result, the Group expects to report total revenue for 2022 of approximately £4.3 million, representing growth of 87% over 2021. This reflects significant organic growth as well as the contribution from Capital Currencies Ltd and Pangea FX Ltd, which were acquired during the year.

The growth in revenue was driven by clients that the Group serves directly, which is expected to account for approximately 78% of total revenue (2021: 56%). A key contributor to this was the Group’s Asia team that was brought on board in the second half of 2021 as well as the contributions from Capital Currencies and Pangea FX. The change to majority direct revenue has had a positive impact on the Group’s gross margin, which is expected to improve to approximately 61% for 2022 compared with 52% for 2021.

The company added that the Pangea FX acquisition has now been fully integrated and that Cornerstone has expanded its sales team, in line with stated strategy, and is experiencing the initial benefit from this action.

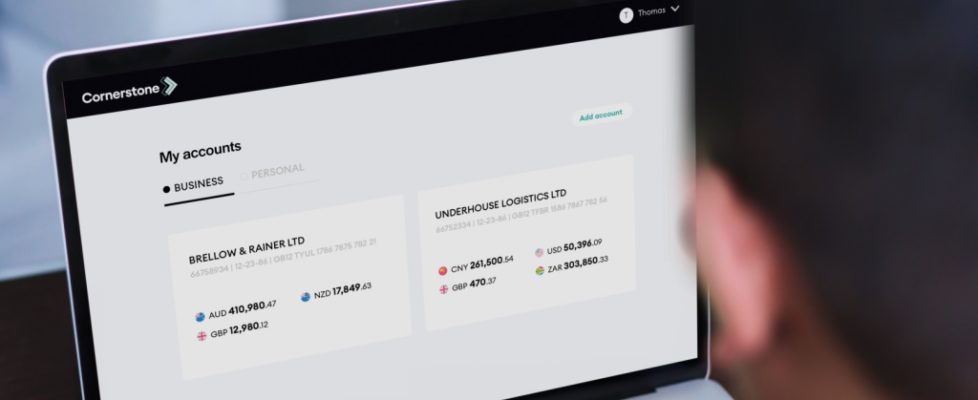

The Group’s strategy continues to be to increase its direct business and, in particular, it is focused on expanding the functionality of its digital account offering to enhance its competitive position as well as broaden the target customer base. The Group’s priority is to drive revenue growth, while maintaining tight control over costs, and the Board looks forward to updating the market on progress in due course.

About Cornerstone FS PLC

Cornerstone FS Plc is a payments focused fintech business that makes managing currency simple for SMEs. It provides international payment, currency risk management and electronic account services using a proprietary cloud-based multi-currency payments platform. These services are delivered directly and via white label partners on a SaaS basis to UK-based SMEs that engage in international trade. Cornerstone also serves some high-net worth individual clients. Headquartered in the City of London and with offices in Tunbridge Wells and Dubai, Cornerstone is listed on AIM under the trading symbol ‘CSFS’.