MFP Trading’s Francois Nembrini on how Retail FX brokers can hedge with minimal cost

The issue of how Retail FX and CFD brokers can offload mismatched risk in their trading books without giving up all their spread (or, at least a good portion of it) has long been a key discussion item in the industry.

One of the executives who has been at it a long time, former FXCM and LCG trading head Francois Nembrini, now heads London based MFP Trading, which helps brokers do just that. We caught up with Francois, ahead of his appearance at next week’s Forex Expo event in Limassol.

FNG: Hi Francois, and thanks for joining us today. Please let us know more about MFP Trading – and what is Minerva?

Francois: MFP is a Forex (“FX”) execution specialist which focuses on finding the best execution setup and most relevant value-added services for each professional customer. We are an agency only FX broker which leverages high-quality technology, broad credit access to market through top-tier Prime Brokers and a wealth of experience in FX trading to offer premium spot FX execution. Minerva is our latest algo product allowing clients to trade without paying the spread.

Francois: MFP is a Forex (“FX”) execution specialist which focuses on finding the best execution setup and most relevant value-added services for each professional customer. We are an agency only FX broker which leverages high-quality technology, broad credit access to market through top-tier Prime Brokers and a wealth of experience in FX trading to offer premium spot FX execution. Minerva is our latest algo product allowing clients to trade without paying the spread.

FNG: Which problems do you see in the institutional FX liquidity landscape?

Francois: The main issues are twofold:

1. Concentration of market making into fewer banks/institutions

Technology has become very expensive to run a full FX market making business and less than 10 major players are really in competition anymore. We have seen a couple of non banks market makers popping up in the past years but it does not compensate for the many banks which have scaled down their market making efforts. Most banks focus on their franchise customers only and even large banks such as Citibank have reduced their market making service to a handful of platforms.

2. Increased regulation and monitoring which has reduced market makers trading strategies allowed.

Strategies trying to use information from directional flow (aka following what the client is doing) have been stopped/scaled down for compliance reasons – Focus is now solely on the easiest and most profitable strategies.

The result: Market makers focus on customers with “perfect attrition curves”.

The attrition curve answers the question: what happens to the market after the customer trades 1secs, 5secs, 10secs, 30secs, 1min, 5mins after the trade. Customers with perfect attritions curves on all timeframes (aka markets goes against the client on all timeframes in average) see extremely tight spreads because in average they do not get the market direction correctly from 1sec up to 5mins after their trades. Those type of attrition curves are very favorable to the market maker allowing him to sit on the trades for a long time without much risk. This allows the market maker to wait comfortably for another client to take the market maker out of the initial trade. The market maker will then make the spread or even more.

Customers with non optimal attrition curves on the other hand struggle to find liquidity and have to pay wider spreads as fewer LPs are ready to price them.

FNG: How does your firm intend to help retail FX brokers benefit from this situation?

Francois: Anybody seeing very tight spread like most retail / POP brokers should then ask himself: why are my orders so valuable that I see a better price than institutions? Should I change the way I hedge because I am leaving money on the table?

MFP’s Minerva is the tool you need to answer those questions and more importantly to act on them. Minerva allows you to look at your hedge trades attrition curves to decide which flow you should be managing like a top tier bank market maker and which flow you should externalize quickly. From there, thanks to its powerful order management system, Minerva FX allows you to monetize this information by placing orders at the right level automatically instead of paying the spread. Minerva will turn your hedging from a cost center to a profit engine.

FNG: How does MFP’s Minerva function?

Francois: Simply speaking, the system allows you to enter your hedging rules into its core and will then automatically input orders at the mid market into MFP trading institutional ECN (aka 10.5 in a 10/11 market). MFP will then display this order to its institutional customer base making sure that the order is at the top of each institutional customer aggregator so they will deal with Minerva’s order in priority. This process maximise trade matches and more importantly maximizes revenues generated on the trades. In the end Minerva’s client will trade at a better price for his hedges and MFP will share the brokerage it captured from institutional clients to Minerva’s user. Minerva’s users will then see both price improvements on their trades and will get a monthly brokerage check from MFP.

Let me give you a trade example.

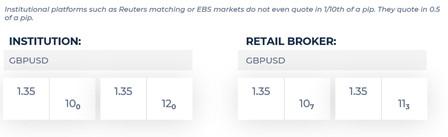

What do institutions and retail brokers see at the same time? Here in Cable, the institution might see 2pips spread while the retail broker sees 0.6 through his prime of prime provider.

The idea is to match interest between both parties.

In this example Minerva gave a 0.3 price improvement to the retail broker and generated $50 on the trade with the institution. This an extra $80 per million traded versus the scenario where the retail broker pays the spread.

FNG: Why would retail brokers pick MFP to do this rather than other firms?

Francois: Minerva technology is not trivial and few technology firms offer a similar solution. Minerva was built under the supervision of a quant who used to work in both top tier banks and high frequency trading firms in senior management positions. The technology’s design and its trading algos are very robust as they were battle tested many times.

Beyond the design, Minerva sits in the middle of MFP’s ECN institutional trading infrastructure and this is where all the strength of the product comes to life. Because Minerva technology will generate trades and hence revenues for MFP, Minerva technology is offered for free to its users. Pure technology firms cannot offer this option. The combo Tech + ECN allows Minerva users to immediately monetize the product through a very simple one stop setup.

It is also important to note that MFP’s team has collectively over 100 years of institutional spot foreign exchange expertise. Liquidity management and all its optimizations is a daily routine for MFP staff. When it comes down to maximizing profits generated by institutional clients, MFP’s team experience is extremely valuable in harnessing Minerva’s algos.

In the end, Minerva has a strong design, no cost to try and a team experienced to help you maximize profits you can extract from it. I believe this a very strong combination which makes MFP’s service valuable versus its competitors.

FNG: How can people learn more about Minerva?

Francois: Interested parties can simply contact us at ops@mfptrading.com or call us at +44 203 769 9884 to organize a demo of the product. We will also organize online webinars and workshop at different expos like the 31st of March at Forex Expo Cyprus. We will also attend liquidity panels at most Expos like the Forex Expo one.