Exclusive: Market-maker XTX Markets sees 2019 Revenue up 11% to £339.8M

FNG Exclusive… Which firm is the largest market maker to the Retail FX and CFD industry?

It isn’t even close.

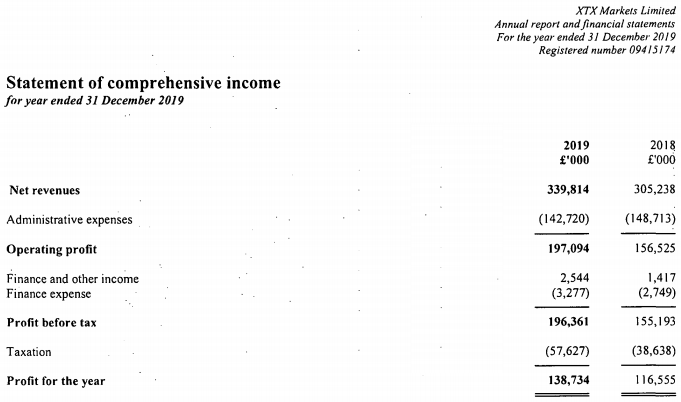

FNG has learned from regulatory filings that London based multi-asset market maker XTX Markets has continued on its amazing growth path, posting an 11% increase in Revenues during 2019 to £339.8 million (USD $447 million).

The company earned £138.7 million (USD $183 million) in Net Profit in 2019, up from £116.6 million in 2018, and paid out dividends of £83.6 million.

Not a bad year by any measure, considering that many if not most of XTX Markets’ clients saw declining trading volumes and revenues (and profits…) in 2019, after ESMA in the EU and the FCA in the UK enacted new rules in late 2018 governing leveraged off-market trading – including the capping of client leverage at 30x.

However XTX’s expansion plans, both internationally and into other asset classes beyond FX, paid dividends (literally!) for the just five-year-old company.

Founded in 2015, XTX exploded onto the scene in 2018 when the company produced Revenues of £305.2 million – nearly double 2017’s £154.6 million – and Net Profit of £116.6 million, as XTX expanded its footprint into new geographies and asset classes.

Based on surveys by Euromoney and Rosenblatt, XTX Markets is now the largest Spot FX liquidity provider globally, and and also the largest European equities liquidity provider.

XTX Markets is a quantitative-driven electronic market-maker covering a variety of financial instrument types. XTX partners with counterparties, exchanges and e-trading venues globally to provide liquidity in the equity, FX, fixed income and commodity markets. XTX was founded and is majority-owned by Russian-British mathematician Alex Gerko. Mr. Gerko, who holds a PhD in Mathematics from Moscow State University, started his financial career in equities and subsequently in FX at Deutsche Bank. Before founding XTX he headed up the market-making team at GSA Capital.

XTX has 66 employees in the UK and 134 employees worldwide with offices also in New York, Singapore and Paris. The company transacts about $200 billion daily in trading volumes across a variety of asset classes.

Regarding the post-year-end Coronavirus pandemic, XTX disclosed that as a technology driven organization the company already had well established remote working policies and disaster recovery plans. XTX stated that the company took early decisive steps to move to working from home, and it has continued to operate profitably and without any material business disruption. These moves have of course been robustly tested as a result of Covid-19, and during a time of extreme market volatility. The company said that it does not under-estimate the fact that this may need to be sustained for a prolonged period of time and remains vigilant to any improvements that can be made to ease remote working.

XTX Markets’ 2019 income statement follows: