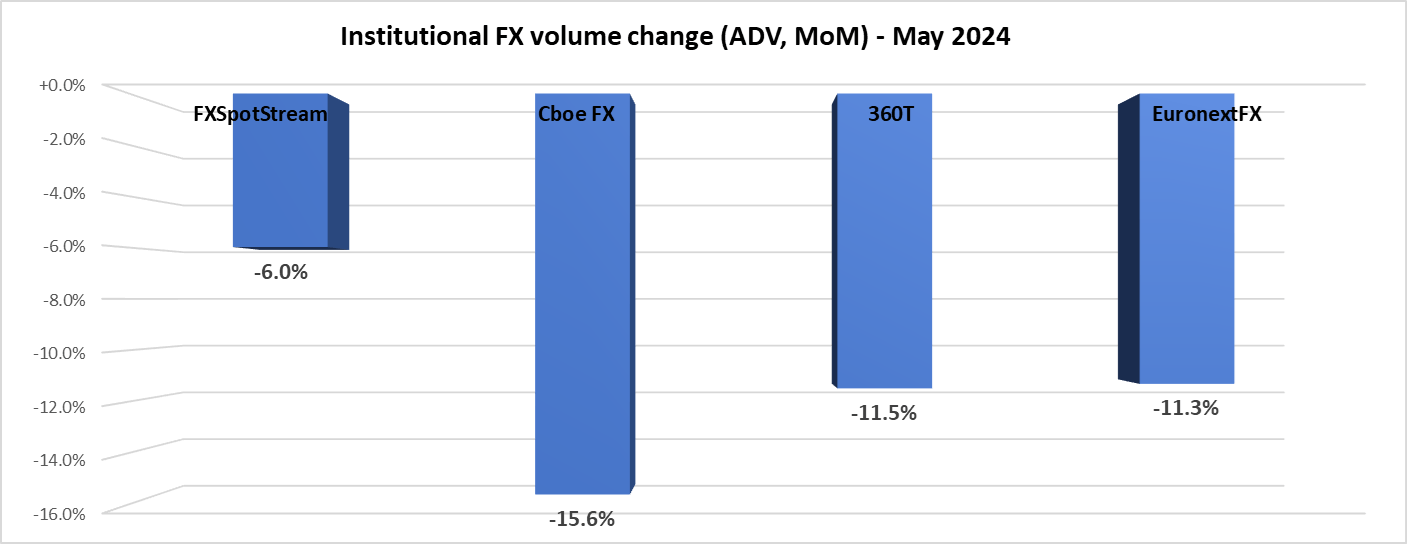

Low volatility leads to 11% decline in May 2024 institutional FX trading volumes

Following a record April for some of the leading players, institutional FX trading volumes took a step back in May 2024, as low currency volatility led to low levels of activity.

Overall, leading institutional eFX venues surveyed by FNG saw an average 11% decline in May trading volumes, with each of FXSpotStream, Cboe FX, 360T, and EuronextFX posting month-to-month volume declines of between 6% and 16%. As noted above, the decline in volumes is attributable mainly to relatively low currency volatility globally during May, as the bellwether EURUSD pair traded most of the month in a fairly tight 1.075-1.085 range.

Cboe FX (formerly HotspotFX)

- May 2024 average daily volumes were $42.21 billion, -15.6% from April’s $50.024 billion.

EuronextFX (formerly FastMatch)

- May 2024 ADV $25.430 billion, -11.3% from April’s ADV of $28.673 billion.

FXSpotStream

- May saw FXSpotStream register the second highest ever ADV on the service, in terms of overall volume and Spot. Overall ADV was USD86.381billion, after an all-time high last month. This consisted of a Spot ADV of USD62.432billion and other ADV of USD23.949billion.

- FXSpotStream’s Total ADV MoM (May’24 vs Apr’24) decreased 5.98%.

- FXSpotStream’s Total ADV YoY (May’24 vs May’23) increased 55.65%.

- FXSpotStream’s Spot ADV MoM (May’24 vs Apr’24) decreased 5.62%.

- FXSpotStream’s Spot ADV YoY (May’24 vs May’23) increased 41.59%.

- FXSpotStream’s Other ADV MoM (May’24 vs Apr’24) decreased 6.92%.

- FXSpotStream’s Other ADV YoY (May’24 vs May’23) increased 109.99%.

360T

- Average daily volumes (ADV) at 360T came in at $26.342 billion in May 2024, down 11.5% from April’s $29.760 billion.