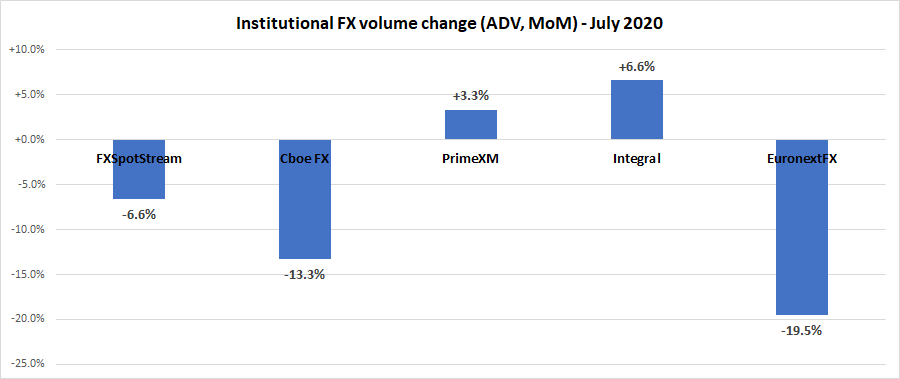

Institutional FX volumes show mixed results in July 2020

After a really crazy year for FX trading, it seems as some sense of normalcy has returned to the markets. While volumes hit all-time-high levels in late Q1 and throughout much of Q2 thanks mainly to Covid-19 fed market volatility, the usual summer slowdown seems to be here, at least in institutional FX trading.

Our monthly review of leading institutional FX and ECN platforms indicates that trading volumes in July were down on average about 6% from June levels, although some firms (PrimeXM and Integral) showed slight increases in July. PrimeXM’s, we believe, is due to an increase in Gold trading activity, while pure FX activity was lower than June as well.

The decreases were not unexpected though, as some of the world’s markets seem to be getting back to normal while as noted we’ve hit the usual summer weakness in activity.

Cboe FX (formerly HotspotFX)

- July 2020 total volumes $690.7 billion, or ADV $30.03 billion, -13.3% MoM

EuronextFX (formerly FastMatch)

- July 2020 ADV $17.7 billion, -19.5% MoM from June’s $22.0 billion.

PrimeXM

- PrimeXM recorded a total of $939.35 billion in monthly trading volume in July across the 3 Data Center locations, which was an 8% improvement comparing last month’s trading activities.

- The Average Daily Volume (ADV) in July was $40.84 billion, this represents MoM 3.29% increase on ADV.

- The total number of trades during July was 27.37 million, a slight drop of 3.32% which indicated the average trade size has increased MoM.

- 76% of the overall monthly traded volume was registered in the Data Center located in London LD4, more than $713 billion in notional value. The other 2 major Data Centers in TY3 and NY4 recorded a monthly trading volume of $119.08 billion and $106.70 billion, respectively.

- The most-traded instrument in July was XAUUSD with $217.5 billion which represented a substantial growth of 42% compared to June as the gold price has continued to make new highs over the last month; major FX pairs EURUSD and GBPUSD remained as the most popular trading instruments following XAUUSD with $169.3 billion and $123.6 billion.

Integral

- Today average daily volumes (ADV) across Integral platforms totaled $37.4 billion in July 2020. This represents an increase of 6.6% compared to June 2020, and an increase of 9.7% compared to the same period in 2019.

FXSpotStream

- ADV of USD40.414billion, an increase of 11.43% YoY vs July ’19..

- ADV MoM (July ’20 vs June ’20) decreased 6.64%, following our third highest month ever in terms of ADV.

- July registers as the fourth month of 2020 with an ADV over USD40billion, with March breaking the USD60billion mark for the first time ever.

- 2020 ADV (Jan-July) of USD42.969billion, is up 17.58% when compared to the same period during 2019 of USD36.546 billion