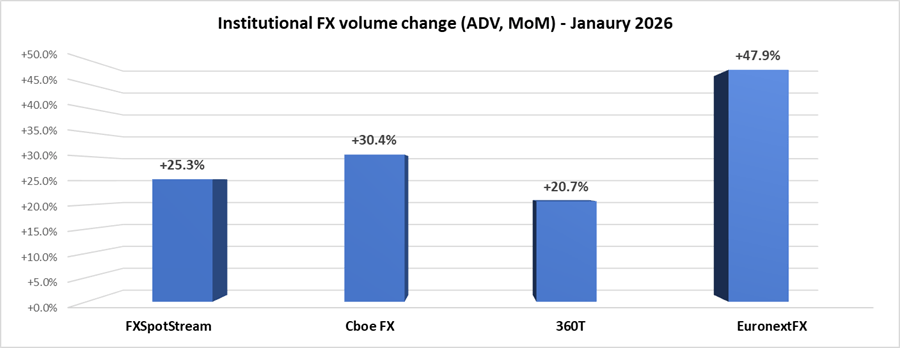

Institutional FX trading volumes soar more than 30% in January 2026 on heightened volatility

Some unprecedented volatility in the commodity and currency markets in late January led to a huge spike in institutional FX trading volumes to open 2026.

As the benchmark EURUSD soared to above 1.20 late in the month, tied somewhat to record silver and gold prices, currency trading rose to record levels at several eFX institutional venues.

Each of FXSpotStream, Cboe FX, EuronextFX and Deutsche Borse’s 360T saw month-over-month trading volume increases of 20%+ in January 2026, and that despite December 2025 being fairly strong, in line with volumes seen in November 2025.

Cboe FX (formerly HotspotFX)

- January 2026 average daily volumes were $63.30 billion, +30.4% from December’s $48.55 billion.

EuronextFX (formerly FastMatch)

- January 2026 ADV $34.89 billion, +47.9% from December’s ADV of $23.60 billion.

FXSpotStream

- Following a strong close to the previous year, January has set a new benchmark for FXSpotStream with an overall ADV of USD154.303billion, a record-breaking month for the Service. This milestone is a direct reflection of the continued support from clients and the strength of LP partnerships. Additionally, FXSpotStream also saw a high in terms of Spot ADV at USD108.093billion and USD46.210billion in Other Products.

- FXSpotStream’s Total ADV MoM (Jan ‘26 vs Dec ‘25) increased 25.31%.

- FXSpotStream’s Total ADV YoY (Jan ‘26 vs Jan ‘25) increased 52.42%.

- FXSpotStream’s Spot ADV MoM (Jan ’25 vs Dec ‘25) increased 36.75%.

- FXSpotStream’s Spot ADV YoY (Jan ‘26 vs Jan ‘25) increased 48.39%.

- FXSpotStream’s Other ADV MoM (Jan ‘26 vs Dec ‘25) increased 4.79%.

- FXSpotStream’s Other ADV YoY (Jan ‘26 vs Jan ‘25) increased 62.77%.

360T

- Average daily volumes (ADV) at 360T came in at $40.64 billion in January 2026, up 20.7% from December’s $33.65 billion.