Institutional FX trading volumes rise 8% in September 2025, FXSpotStream sets record

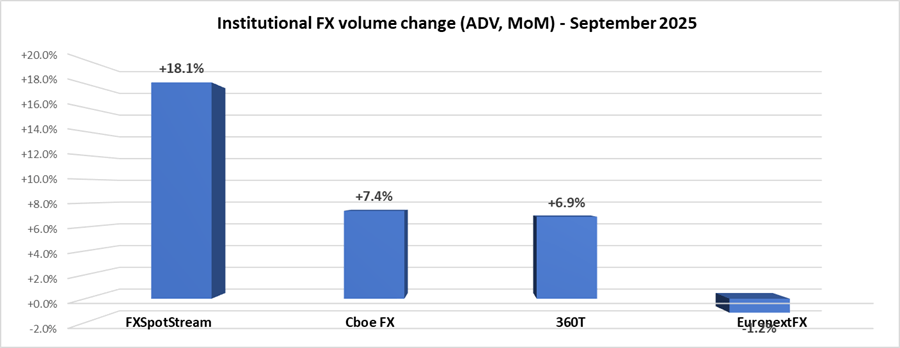

Following a fairly slow summer trading season, FX traders got back to work in September, with institutional trading volumes rising by an average of 8% MoM.

Each of FXSpotStream, Cboe FX and 360T saw increases of between 7-18% in trading activity during September – including record trading levels at FXSpotStream – while EuronextFX reported a slight 1% decline.

Cboe FX (formerly HotspotFX)

- September 2025 average daily volumes were $49.08 billion, +7.4% from August’s $47.72 billion.

EuronextFX (formerly FastMatch)

- September 2025 ADV $23.21 billion, -1.2% from August’s ADV of $23.48 billion.

FXSpotStream

- September’s overall ADV of USD125.260billion registered as a record ADV high for FXSpotStream, replacing the previous high of USD122.057billion set in April 2025. This consisted of a Spot ADV of USD82.187billion and USD43.073billion in other products, with record ADV months in Swaps, NDF and Algos.

- Year to date, FXSpotStream’s overall ADV (for the period January-September) is up 23.89% when compared to the same period last year, while our Spot ADV is up 18.04% YoY over the same period.

- Details of September total volumes can be found below:

- FXSpotStream’s Total ADV MoM (Sep’25 vs Aug’25) increased 18.11%

- FXSpotStream’s Total ADV YoY (Sep’25 vs Sep’24) increased 22.89%

- FXSpotStream’s Spot ADV MoM (Sep’25 vs Aug’25) increased 15.44%

- FXSpotStream’s Spot ADV YoY (Sep’25 vs Sep’24) increased 14.12%

- FXSpotStream’s Other ADV MoM (Sep’25 vs Aug’25) increased 23.55%

- FXSpotStream’s Other ADV YoY (Sep’25 vs Sep’24) increased 44.04%

360T

- Average daily volumes (ADV) at 360T came in at $34.89 billion in September 2025, up 6.9% from August’s $32.65 billion.