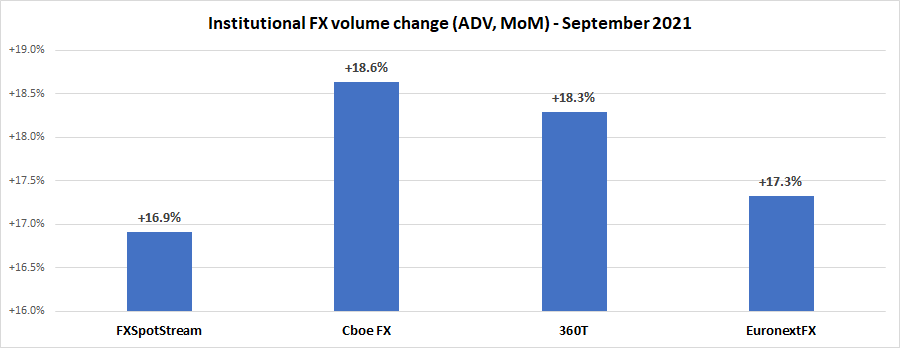

Institutional FX trading volumes rebound with a strong September, +18%

After a fairly slow summer that saw trading volumes decline by double digit percentage points across the board, leading institutional FX platforms have all reported a much better September to begin the usually-busy fall trading season.

Each of FXSpotStream, Cboe FX, Deutsche Borse’s 360T and EuronextFX saw healthy mid-teen percent increases in FX trading volumes, as compared to August. On average, FX trading volumes increased MoM by 17.8%.

Cboe FX (formerly HotspotFX)

- September 2021 average daily volumes were $34.30 billion, +18.6% from August’s $28.91 billion.

EuronextFX (formerly FastMatch)

- September 2021 ADV $18.54 billion, +17.3% above August’s ADV of $15.80 billion.

FXSpotStream

- FXSpotStream’s ADV MoM (September ‘21 vs August ‘21) increased 16.91% to USD48.353billion

- FXSpotStream’s ADV YoY (September ‘21 vs September ‘20) increased 10.64% to USD48.353billion resulting in a YoY increase every month so far in 2021 except one

- FXSpotStream’s Overall Volume YoY (September ‘21 vs September ‘20) increased 10.64% to USD1.064trillion, crossing the USD1trillion mark for the fifth time this year

- FXSpotStream’s ADV YTD (Jan-Sep ‘21 vs Jan-Sep ‘20) increased 13.10% to USD48.471billion when compared to the same period last year

360T

- Average daily volumes (ADV) at 360T came in at $22.63 billion in September, up 18.3% from August’s $19.13 billion.