Institutional FX trading volumes produce mixed results in August 2025

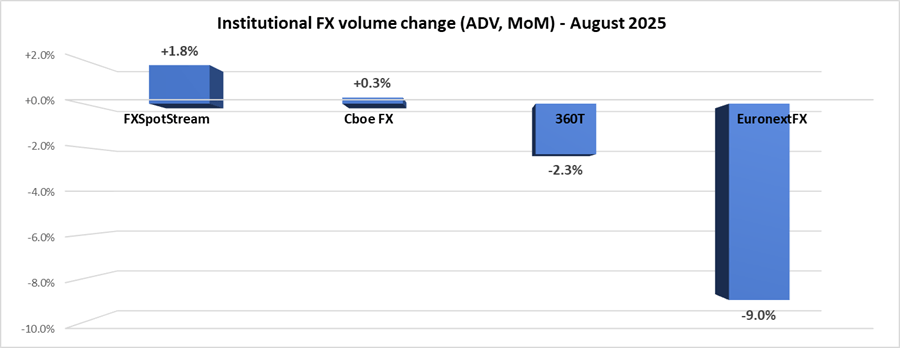

The fairly slow summer months continued into August for institutional FX trading venues. After seeing a 3% slowdown in July, it was something more of a mixed bag in August, although a fairly steep volume decline at EuronextFX skewed the overall average.

While FXSpotStream and Cboe FX saw modest MoM increases in August, 360T and EuronextFX reported larger declines in trading volume, leading to an average 2.3% decrease for the group as a whole.

Cboe FX (formerly HotspotFX)

- August 2025 average daily volumes were $47.72 billion, +0.3% from July’s $45.59 billion.

EuronextFX (formerly FastMatch)

- August 2025 ADV $23.41 billion, -9.0% from July’s ADV of $25.79 billion.

FXSpotStream

-

In August, FXSpotStream’s overall ADV was USD106.057billion, an increase of 1.76% MoM. This consisted of a Spot ADV of USD71.159billion and USD34.682billion in other products.

-

Year to date, FXSpotStream’s overall ADV (for the period January-August) is up 23.90% when compared to the same period last year, while Spot ADV is up 18.46% YoY over the same period.

-

Details of August total volumes can be found below:

- FXSpotStream’s Total ADV MoM (Aug’25 vs Jul’25) increased 1.76%

- FXSpotStream’s Total ADV YoY (Aug’25 vs Aug’24) increased 9.57%

- FXSpotStream’s Spot ADV MoM (Aug’25 vs Jul’25) increased 4.09%

- FXSpotStream’s Spot ADV YoY (Aug’25 vs Aug’24) decreased 2.69%

- FXSpotStream’s Other ADV MoM (Aug’25 vs Jul’25) decreased 2.70%

- FXSpotStream’s Other ADV YoY (Aug’25 vs Aug’24) increased 47.52%

360T

- Average daily volumes (ADV) at 360T came in at $32.65 billion in August 2025, down 2.3% from July’s $33.42 billion.