Institutional FX trading slows 3% in November 2025

Reversing a slight uptick in October, the institutional FX space saw a decline in trading activity in November 2025, with fairly little volatility present in the currency markets during the entire month.

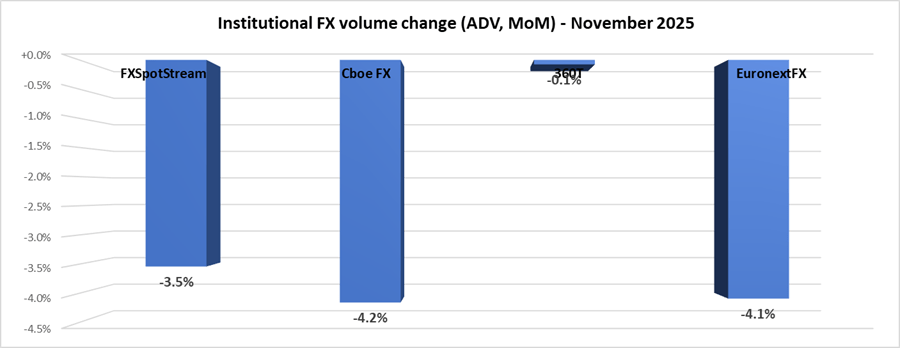

Overall, average FX trading volumes at FXSpotStream, Cboe FX, EuronextFX, and Deutsche Borse’s 360T declined by 3.0% MoM in November, with none of the aforementioned firms recording an increase in activity.

Cboe FX (formerly HotspotFX)

- November 2025 average daily volumes were $49.61 billion, -4.2% from October’s $51.76 billion.

EuronextFX (formerly FastMatch)

- November 2025 ADV $23.69 billion, -4.1% from October’s ADV of $24.70 billion.

FXSpotStream

- Following back-to-back record setting months in terms of ADV in September and October, FXSpotStream registered an overall ADV of USD125.026billion in November. This consisted of a Spot ADV of USD83.374billion and USD41.652billion in other products.

- Year to date, FXSpotStream’s overall ADV (for the period January-November) is up 25.45% when compared to the same period last year, while Spot ADV is up 18.75% YoY over the same period.

- Details of November total volumes can be found below:

- FXSpotStream’s Total ADV MoM (Nov’25 vs Oct’25) decreased 3.54%.

- FXSpotStream’s Total ADV YoY (Nov’25 vs Nov’24) increased 24.63%.

- FXSpotStream’s Spot ADV MoM (Nov’25 vs Oct’25) decreased 2.89%.

- FXSpotStream’s Spot ADV YoY (Nov’25 vs Nov’24) increased 15.35%.

- FXSpotStream’s Other ADV MoM (Nov’25 vs Oct’25) decreased 4.81%.

- FXSpotStream’s Other ADV YoY (Nov’25 vs Nov’24) increased 48.56%.

360T

- Average daily volumes (ADV) at 360T came in at $33.92 billion in November 2025, down 0.1% from October’s $33.95 billion.