Inflation Eases, Growth Stalls: The RBA’s Next Move in Focus

The following is a guest editorial courtesy of Carolane de Palmas, Markets Analyst at Retail FX and CFDs broker ActivTrades.

After surprising markets last month by holding the cash rate at 3.85%, the Reserve Bank of Australia now finds itself under renewed pressure to act. Second-quarter data has painted a mixed picture—headline inflation is easing faster than expected, but economic growth has stalled, and early signs of labor market weakness are emerging. This combination is fueling expectations that the RBA will trim rates by 25 basis points to 3.60% at its August meeting, continuing its cautious pivot from the tightening cycle.

Markets have already priced in this move, along with another cut before year-end, marking a steady reversal from last year’s peak rate of 4.35%—a 12-year high reached in the fight against unexpectedly strong inflation. The question now is whether the RBA will move swiftly to support the economy or maintain a measured pace amid global monetary uncertainty.

RBA Set to Cut Rates as Inflation Cools and Growth Falters

Australia’s inflation pulse slowed sharply in the June quarter, delivering the weakest consumer price growth in more than four years and giving the Reserve Bank of Australia a much-needed reprieve in its fight against post-pandemic price pressures. Core inflation—a measure closely watched by policymakers—slipped to a fresh three-year low, with the trimmed mean rising just 0.6% over the quarter and 2.7% over the year. That’s down from 2.9% in March and sits comfortably near the midpoint of the RBA’s 2–3% target range.

The softer reading comes as a surprise to many on the RBA board, which had paused its rate-cutting cycle in July out of concern that core inflation might prove stubborn. While housing, food, and healthcare costs continued to rise, falling transport prices helped contain the overall increase. Temporary government rebates on electricity and childcare also played a role, pushing headline CPI growth to 0.8% for the quarter and 2.1% annually—the lowest since early 2020. But with those rebates set to expire, the RBA expects headline inflation to rebound toward 3% later this year before easing again in 2026.

For Governor Michelle Bullock, this latest data confirms the RBA has the space to “cautiously” reduce monetary restrictiveness, as Westpac economists put it. Markets are now betting on a 25-basis-point rate cut at this week’s August meeting, with more reductions likely in November, February, and May next year.

The case for easing goes beyond inflation. Economic growth has been underwhelming, with GDP rising just 0.2% in the first quarter—half the pace expected by economists—and holding at a subdued 1.3% year-on-year. This persistent sluggishness risks entrenching weak household spending, as uncertainty prompts Australians to save rather than spend.

The labor market, while still historically tight, is also losing some steam. June saw a meager increase of 2,000 jobs, far below the forecast 20,000, while unemployment ticked up to 4.3% from 4.1%. Employment growth is expected to ease to 1.0% by year-end, even as KPMG predicts the unemployment rate will remain at 4.3%—a level that still supports household resilience but does little to generate fresh inflationary pressure.

In the short term, lower rates could provide much-needed support to both the economy and the labor market, preventing further deterioration in hiring. However, economists stress that monetary policy alone will not be enough. Without long-term, productivity-enhancing reforms, Australia risks slipping into a pattern of slow growth and tepid job creation, even if inflation remains contained.

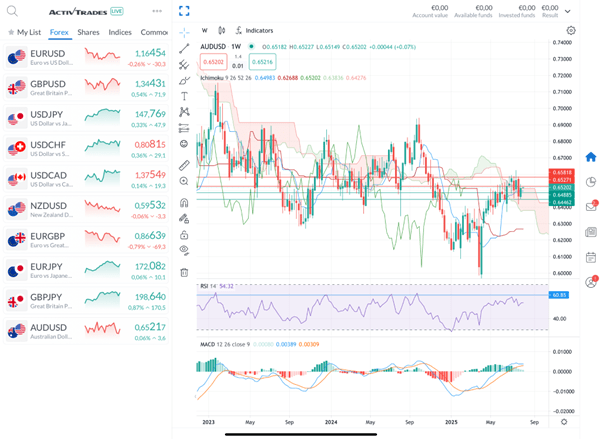

AUD/USD Weekly Technical Outlook – Ahead of the RBA Decision

Weekly AUD/USD Chart From ActivTrades

Since late 2024, the broader trend has shifted from a sharp downtrend into a gradual recovery phase. However, the rally has been choppy, reflecting the tug-of-war between rate-cut expectations and global risk sentiment. The recent consolidation around 0.6500 shows the market is waiting for a catalyst—likely the RBA meeting—to define the next directional move.

Price action remains near the boundary of the weekly Ichimoku Cloud, indicating the market is at a pivotal point. The fact that the pair entered the cloud earlier in Q2 but failed to decisively break above suggests ongoing uncertainty. A sustained move above 0.6520—the top of the cloud—would be a bullish signal, opening the door toward the 0.6700 zone. Conversely, a rejection here could send the pair back toward 0.6445 and potentially 0.6400, where recent support has formed.

The RSI (14) is hovering near 54, showing neutral momentum—neither overbought nor oversold—which gives room for movement in either direction, likely depending on the RBA outcome. The MACD indicator remains in positive territory with a slight bullish bias, but histogram bars are flattening, suggesting waning upside momentum ahead of the announcement.

Key Levels to Watch:

- Resistance: 0.6527 (Kijun-sen), 0.6580 (Cloud top), 0.6700 (May high)

- Support: 0.6488 (recent swing low), 0.6445 (Tenkan-sen), 0.6400 (June low)

Bottom Line

With inflation cooling faster than expected, growth stalling, and the labor market showing early signs of strain, the RBA appears on track for another rate cut—an event that could shape the next move in AUD/USD. The pair, now near 0.6520, is hovering above a cluster of key supports but remains capped by resistance from the Ichimoku Cloud and prior swing highs.

Technically, AUD/USD is at a pivotal juncture. The weekly chart shows price testing the upper boundary of its consolidation range and the Ichimoku Cloud, with the RBA’s decision likely to determine direction. A breakout above 0.6580 or a drop below 0.6445 could set the tone for the next major trend.

Sources: KPMG, Australian Bureau of Statistics, CNBC, Reuters, ING, ActivTrades

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.