FXSpotStream record leads strong institutional FX volumes showing in February 2025

Following a good start in January to kick off the year, institutional FX trading activity continued on an upward trend during the second month of 2025.

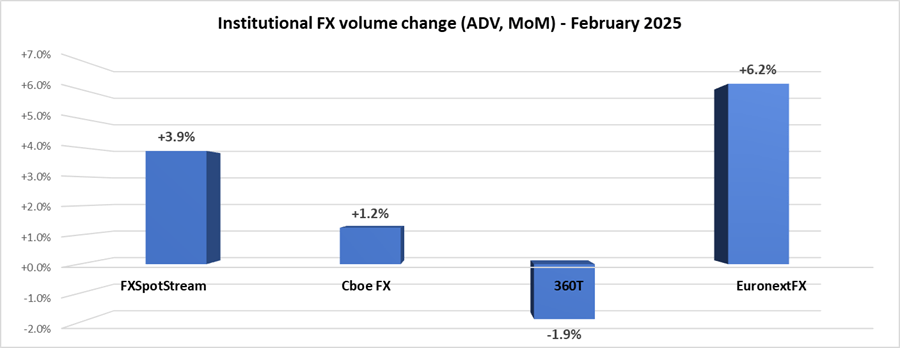

Average trading volumes at the leading eFX venues surveyed by FNG rose by an average of 2.4% in February 2025, following up a 16% jump in January. While FXSpotStream – sporting record trading volumes in February – Cboe FX and EuronextFX saw activity increases of between 1-6% during February, Deutsche Borse’s 360T reported a slight 2% decline, making it a mixed-results month in the sector.

Cboe FX (formerly HotspotFX)

- February 2025 average daily volumes were $48.04 billion, +1.2% from January’s $47.45 billion.

EuronextFX (formerly FastMatch)

- February 2025 ADV $29.44 billion, +6.2% from January’s ADV of $27.73 billion.

FXSpotStream

- February saw FXSpotStream set a new high in terms of Overall ADV at USD105.163billion. This marked a 3.88% increase MoM (when compared to January 2025) and 45.4% YoY (vs. February 2024). February’s ADV surpasses our previous high of USD101.925billion, set in September 2024.

- February’s Overall ADV consisted of USD75.132billion in Spot (a new high on the Service) and USD30.031billion across other products (including a new high in NDFs).

- FXSpotStream’s Total ADV MoM (Feb’25 vs Jan’25) increased 3.88%.

- FXSpotStream’s Total ADV YoY (Feb’25 vs Feb’24) increased 45.40%.

- FXSpotStream’s Spot ADV MoM (Feb’25 vs Jan’25) increased 3.14%.

- FXSpotStream’s Spot ADV YoY (Feb’25 vs Feb’24) increased 44.97%.

- FXSpotStream’s Other ADV MoM (Feb’25 vs Jan’25) increased 5.78%.

- FXSpotStream’s Other ADV YoY (Feb’25 vs Feb’24) increased 46.50%.

360T

- Average daily volumes (ADV) at 360T came in at $33.89 billion in February 2025, down 1.9% from January’s $34.54 billion.