Exclusive: Finotec sees 46% rise in 2021 Revenues, profits flat

FNG Exclusive… FNG has learned via regulatory filings that FCA licensed institutional FX broker Finotec Trading UK Limited saw a healthy rise in activity for the second year in a row in 2021, although profitability remained low and relatively flat form 2020.

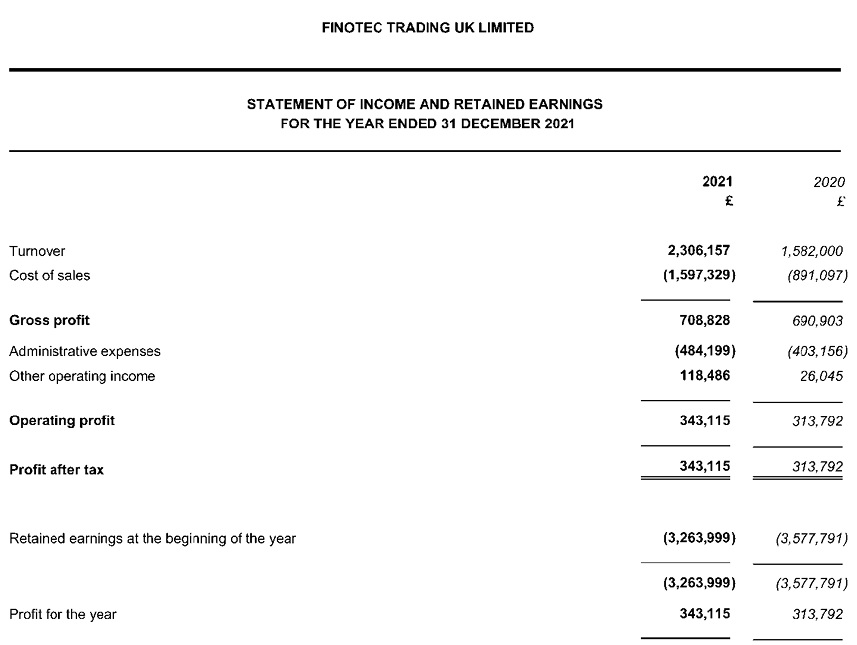

Overall, Finotec revenues totaled £2.31 million in 2021 (2020: £1.58 million). The company posted a modest net profit of £343,115 in 2021, similar to 2020’s 313,792.

Finotec is a long-established financial service intermediary and investment management firm, operating an execution only trading platform and specializing in OTC and exchange-based trading venues. The company’s target market is that of Professional Traders, Asset Managers and Hedge Fund Operators. Its service consists primarily of the consolidation of multiple liquidity sources offered via API connections.

In addition, Finotec offers investment management services including its own investment product to professional investors and family offices. Finotec does not onboard or service retail clients.

Finotec said that it continues to attract interest in its growing portfolio of higher tier products and services and has recently expanded into the provision of Hedge Fund solutions to regulated Asset Managers. Its Hedge Fund setup process can be ready in as little as two weeks and provides exceptional value when compared to mainstream solutions currently on the market, costing as little as 15,000 EUR to setup and from 2,000 EUR monthly service fee.

The company’s Hedge Fund solution is particularly aimed at Asset managers that have:

• Their own branded financial product,

• An amazing trading strategy,

• Connections to high-net-worth investors.

Additionally, Finotec continues to develop its own investment products, and offer attractive investment management services to professional clients.

Finotec’s minimum entry to any of its investment programs remains at $100,000, with clients paying a professional market standard execution fee, and a performance fee of between 20% to 30% depending on the investment product.

In addition, the company said that it is currently using its technology to provide a new Crypto CFD basket investment product. Due to the high volatility in this market, Finotec’s back test algorithm shows an annualised return of more than 65%, and while keeping a non-leveraged strategy, has the capacity to attract tens of millions in AUM.

Finotec’s target is to reach $US20 million Asset Under Management by the end of 2022.

Finotec is controlled by longtime Israel-based CEO Didier Essemini.

The company’s 2021 income statement follows: