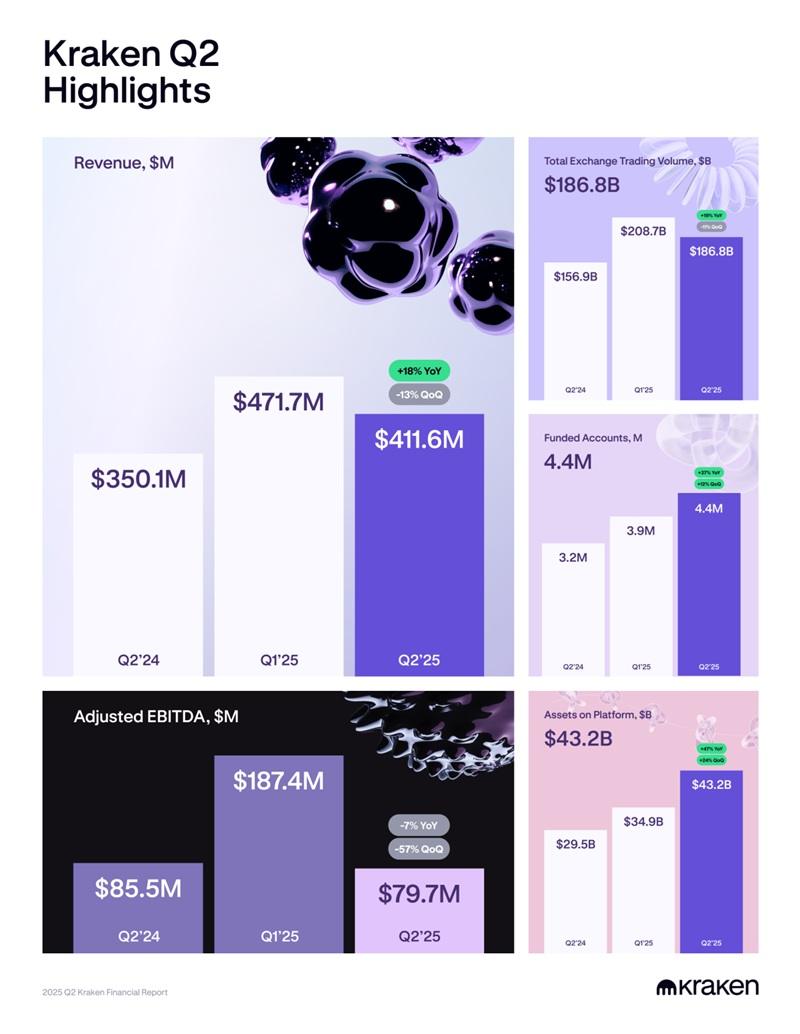

Kraken “in build mode” sees 13% decrease in Q2 Revenue to $412 million

US based crypto exchange operator Kraken, stating that it is “in build mode”, has released summary financial and operating information for Q2-2025, including a 13% QoQ decline in Revenues from $478 million in Q1 to $412 million in Q2.

Adjusted EBITDA came in at $80 million in Q2, down 57% from $187 million in Q1.

Kraken’s total exchange volume was $186.8B in Q2 2025, up 19% year-over-year. After a strong Q1, Kraken said that there was market turbulence related to US tariffs and broader macro uncertainties. Q2 volumes decelerated quarter-over-quarter (from $208.7B in Q1), as Q2 tends to be a seasonally lower quarter for trading activity across the industry.

Funded accounts at Kraken were 4.4M in Q2 2025, increasing 37% year-over-year. Assets on platform were $43.2B at the end of Q2 2025, increasing 47% year-over-year.

Kraken Q2 highlights

Kraken said that its Q2 financial performance remained resilient, highlighted by three key trends:

- Expanding volume market share: We continued to grow our share of spot volume. This was driven by continued investments enhancing product experience, as well as our strong position in stablecoins, where our share of stable-fiat spot volumes grew from 43% to 68%.

- Growth investment: As the TradFi and crypto markets converge, we are strategically investing in innovation and expanding our product suite to accelerate growth. In Q2, we supported faster product delivery and platform enhancements, alongside targeted marketing efforts that demonstrated strong, efficient ROI.

- Expense discipline: To fortify our business across all market cycles, we remain intensely focused on strengthening operating leverage to build a sustainable business.

Building on top of the pro-trader platform

Kraken said that Pro traders are the heartbeat of its platform. Their participation in the ecosystem and the liquidity they provide power the rapid development of more products for Kraken’s consumer and institutional businesses, which in turn fuel the overall ecosystem.

Kraken’s strategy was evidenced by several new products in Q2, including commission-free equities trading, tokenized assets and an all‑in‑one global money app.

The company also continued to enhance its pro-trader capabilities and offerings alongside the introduction of a full‑service prime brokerage and a white label solution for fully compliant crypto trading.

Professional product updates

Perpetual futures in Europe – We debuted Europe’s largest MiFID‑regulated crypto futures suite. We introduced 24/7 FX perpetual futures (EUR, GBP, AUD, JPY and CHF pairs) on Kraken Pro, widening derivative access under a trusted regulatory framework.

U.S. futures – We launched a regulated U.S. derivatives offering for U.S. users, providing direct access to crypto futures listed on the CME through our integrated Kraken Pro trading experience.

Institutional product updates

Kraken Prime – We opened a full‑service prime brokerage that unifies best‑execution trading, qualified custody, deep multi‑venue liquidity and 24/7 white‑glove support for institutional clients.

Kraken Custody – We added reward‑bearing USDG for institutional and HNWI clients and added custody support for SOL and XRP.

Kraken Embed – We launched a white label Crypto‑as‑a‑Service solution that lets banks, brokers and fintechs add fully compliant crypto trading within weeks. The second largest neobank in Europe — bunq — and Alpaca were the first partners to integrate the offering, and there are additional integrations in the pipeline.

Consumer product updates

Commission‑free equities trading – We introduced U.S. equities trading in the Kraken app for most U.S. states, giving clients the convenience of managing stocks and crypto side‑by‑side.

xStocks – We tokenized 55 blue‑chip equities and 5 ETFs on the blockchain, opening round‑the‑clock equity exposure for eligible clients outside the United States, with seamless on‑chain transferability.

Krak app – We launched an all‑in‑one global money app that lets clients pay, transfer and earn across 300+ crypto and fiat assets in more than 160 countries.

Dedicated Brazil offering – We added instant BRL funding via Pix, fully localised web and mobile apps, and 24/7 support in Brazilian Portuguese, bringing Kraken’s global platform closer to Brazilian users.

Kraken+ – We launched a premium membership that offers zero‑fee trading allowances, priority support and boosted USDG rewards. It has seen strong uptake with more than 100k subscribers with more than $1 billion on the platform from both new and seasoned investors.

Outlook: H2 2025 and beyond

Kraken said that its team is relentlessly focused on taking the company to the next level. That’s what clients demand and what the company is committed to delivering. In the second half of 2025, momentum is building across the global footprint: New licenses are being secured, local funding rails added, multi-asset experiences expanded and innovative products launched — all leveraging Kraken’s core infrastructure.

Key initiatives on the horizon include:

International equities — Extending commission‑free stock and ETF trading to major markets beyond the U.S., starting with the U.K., Europe and Australia.

Tokenized equities — Bringing tokenized equities to more jurisdictions and steadily increasing the number of our listed assets.

Kraken debit cards — Introducing physical and virtual debit cards, issued with Mastercard, to enable seamless in‑store and online spending of fiat and crypto through the Krak app.

NinjaTrader growth — Accelerating the platform’s reach into the U.K., Europe and Australia and enabling frictionless multi‑asset trading across Kraken and NinjaTrader ecosystems.