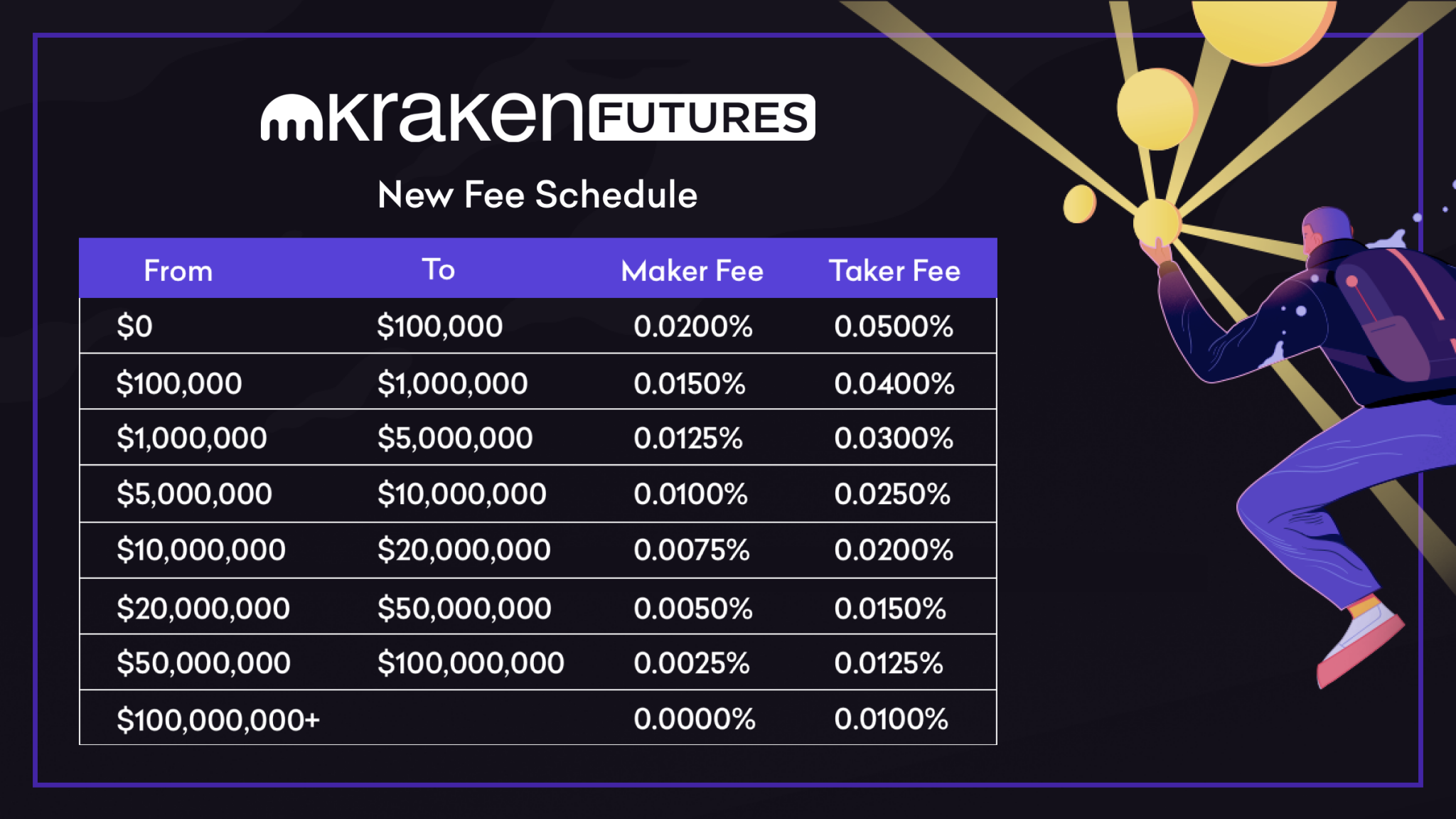

Kraken Futures moves from fixed-fee to volume-based fee tiers

Crypto Facilities Ltd, which operates the FCA regulated Kraken Futures Multilateral Trading Facility (MTF), has announced that starting October 2 Kraken Futures will reduce taker fees for all clients, by moving from a flat-fee model to volume-based fee tiers.

Kraken Futures stated that it is cutting taker fees by at least 33% FOR ALL CLIENTS (from 7.5bps to 5 bps).

Kraken Futures is the first regulated cryptocurrency derivatives exchange in Europe after it obtained a Multilateral Trading Facility (MTF) license from the UK’s Financial Conduct Authority (FCA).

The new reduced fee tiers are based on rolling 30-day trade volume as follows:

For Kraken Futures CEO Timo Schlaefer, this change in pricing strategy is central to his goal of ensuring an equitable market for all participants and driving growth:

“With this new structure, every client no matter how big or small will see dramatically lower taker fees. Lower fees for both individuals and institutions is expected to encourage flow and drive volume.”

“Kraken Futures has consistently grown in market share over the past year. Lowering the fees is the right thing for clients, and will help set the foundation for our next phase of growth.”

How will the migration to the reduced fee tiers work?

October 2 at 12pm UTC: the fee tiers will come into effect (and the Revenue Share Program will be discontinued – see below for details).

How will traders be assigned to fee tiers?

Fee tiers will be assessed in real time on a 30-day rolling basis, meaning that you will not have to wait for the month to end to jump up a fee tier and take advantage of lower rates if you have an increase in trading activity.

How can clients see their fee tier?

Clients will be able to view their 30-day volume and their fee tier in the platform or via the API.

What does this mean for the Kraken Futures Revenue Share Program?

The Revenue Share Program will operate as normal until the payment on October 2. After the October 2 payment, the Revenue Share Program will be discontinued and no further Revenue Share Program payments will be made.

Through its Revenue Share Program, first introduced In February 2019, Kraken Futures distributed 30% of its fees to all clients that traded on the platform every week. It was an uncapped program, and the company said it is proud to have distributed more than $5 million directly to its clients.

However, under the Revenue Share Program, a greater portion of rewards went to the most active traders. With the new reduced fees, the company is sharing the economic benefits of trading futures on Kraken more broadly with its client base. Therefore, it will be retiring the Revenue Share Program.

Does Kraken Futures charge any other fees?

It does not charge any other fees. However, positions opened in Perpetual contracts will accumulate a funding rate as an unrealized profit/loss (UPL). This is a user-to-user transfer.

When am I a Taker, when am I a Maker?

If you submit a market order, or a limit order that crosses the order book and is immediately matched, you pay the taker fee. If you submit a limit order that first sits in the order book for a period of time before it is matched, you pay the maker fee.