GCEX sees Revenues up 64% in 2024 to £3.8M driven by Crypto CFDs trading

FX and digital assets institutional broker GCEX has released its 2024 financial results, indicating a rebound in Revenues following a disastrous “crypto winter” 2023 at the company.

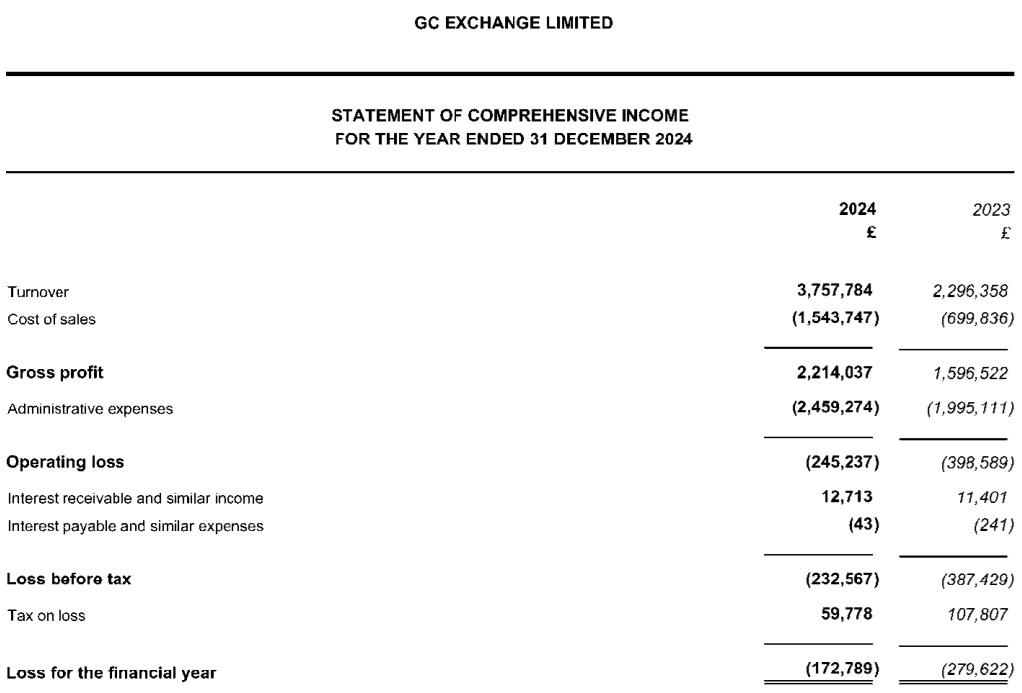

GCEX reported Revenues of £3.76 million in 2024, up by 64% from £2.30 million the previous year. The 2024 Revenue figure however is still below the £4.46 million that GCEX brought in during 2022.

GCEX reported a Net Loss for the year of £173K, improved from the company’s £280K loss in 2023.

The revenue growth at GCEX was largely driven by a 315% increase in the volume of crypto CFDs, reflecting a recovery in the market following the aformentioned “crypto winter.” The company has seen a positive revenue trend since the last quarter of the financial year, which is expected to continue into 2025.

Despite the significant increase in turnover, GCEX reported a pre-tax loss of £233K (2023: £387K), and a Net Loss of £173K. This was primarily attributed to a substantial rise in the cost of sales (+121%) and an increase in operational expenses (24%), notably froam intra-group expenses, consulting, staff costs, and foreign exchange revaluation losses.

In line with its strategy, the company has made efforts to diversify its client base and further develop its execution-only client offering. Additionally, it has enhanced liquidity in its FX and crypto businesses by adding new liquidity providers. On the technological front, the company launched a client portal, which not only improves the client experience but also streamlines internal operations.

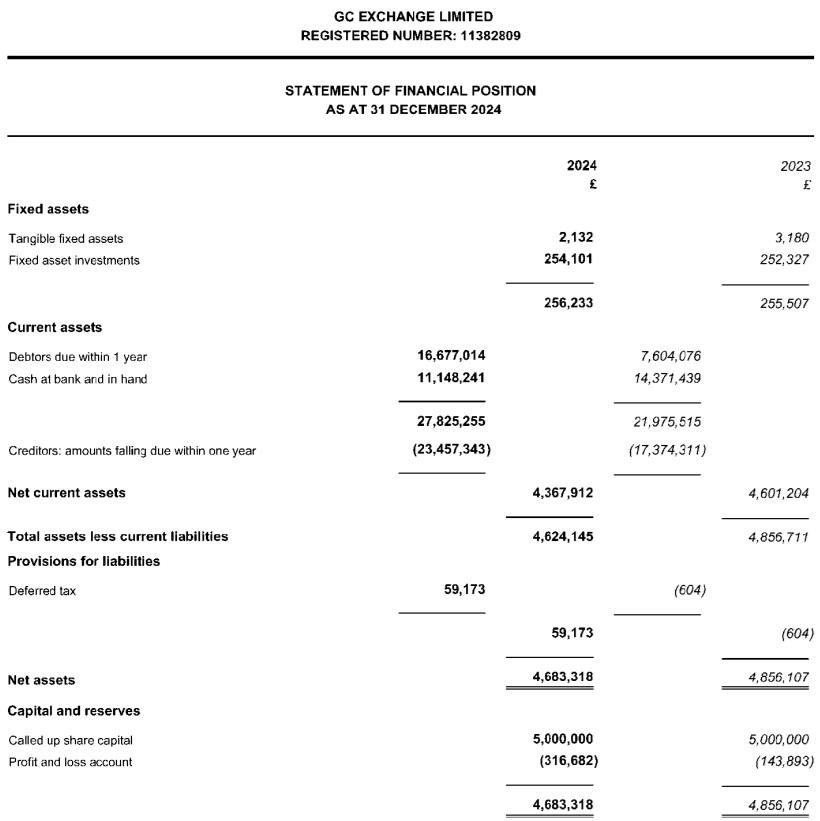

As of December 31, 2024, shareholders’ funds stood at £4.7 million (2023: £4.9 million). GCEX said it remains focused on its growth objectives, with particular emphasis on investing in business development, marketing, and strengthening its compliance team.

Founded in 2018 by former CFH Clearing (now Finalto) co-founder and CEO Lars Holst (pictured above), GCEX Group empowers institutional and professional clients to access deep liquidity in CFDs on digital assets and FX, alongside spot trading and conversion of digital assets. The company also offers a comprehensive range of Forex brokerage and crypto-native technology solutions under its XplorDigital suite.

Headquartered in London, with multiple offices across the globe, GCEX is regulated by the UK’s FCA, registered with the Danish FSA as a VASP and currency exchange and has been granted a Virtual Asset Service Provider license by the Dubai Virtual Assets Regulatory Authority. True Global Ventures are investors in GCEX.

GCEX’s 2024 income statement and balance sheet follow below.