FX week in review: EU regulators examine social trading, Public.com becoming unicorn

While the last couple of weeks’ FX industry news coverage here at FNG focused on the #GameStop driven surge in retail financial trading worldwide – brokers raising margin requirements, limiting trading in certain instruments, and even halting new client signups – this past week we seem to be dealing more with the fallout, good and bad, of all that action.

And central to that fallout was pan-European financial regulator ESMA, with FNG breaking the story that ESMA alongside the individual EU country financial regulators is looking at some sort of regulation of social trading. Still early days, but ESMA rarely makes statements like it eventually did without some sort of plan to take action.

Also this week at FNG we had broker results, an online broker looking to join the $1 billion unicorn club, and of course a number of FX industry executive moves involving Markets.com, Accuindex, FXSpotStream and more – all reported first or exclusively at FNG!

Some of the top FX industry news stories to appear this past week on FNG included:

ESMA considering regulation of social trading. Reported First at FNG… The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has released a statement to highlight to retail investors the risks connected with trading decisions based exclusively on exchanges of views, informal recommendations and sharing of trading intentions through social networks and unregulated online platforms – or as we call it for short, social trading. The statement was issued as part of ESMA’s investor protection objective to safeguard retail investors. The announcement from ESMA comes two months after we exclusively reported that Australia’s financial regulator ASIC was also investigating copy trading, a form of social trading.

ESMA considering regulation of social trading. Reported First at FNG… The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has released a statement to highlight to retail investors the risks connected with trading decisions based exclusively on exchanges of views, informal recommendations and sharing of trading intentions through social networks and unregulated online platforms – or as we call it for short, social trading. The statement was issued as part of ESMA’s investor protection objective to safeguard retail investors. The announcement from ESMA comes two months after we exclusively reported that Australia’s financial regulator ASIC was also investigating copy trading, a form of social trading.

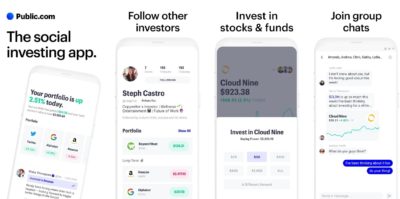

Public.com looking at $200M raise at $1.2B valuation. Reported First at FNG… FNG has learned from discussions over the weekend in venture capital circles and blogs that Jannick Malling’s app-based brokerage and social trading startup Public.com is looking to join the $1 billion unicorn club, by virtue of serious discussions being held to raise an additional $200 million at a valuation of around $1.2 billion. If concluded, that would represent a 4x increase in valuation for the Robinhood-challenging Public.com, since its $65 million financing round just last December, done at a valuation of about $300 million. The $200 million investment is being negotiated with public/private tech investment firm Tiger Global Management – whose previous investments include companies such as Airbnb, Yandex, Facebook, Uber, and LinkedIn.

Public.com looking at $200M raise at $1.2B valuation. Reported First at FNG… FNG has learned from discussions over the weekend in venture capital circles and blogs that Jannick Malling’s app-based brokerage and social trading startup Public.com is looking to join the $1 billion unicorn club, by virtue of serious discussions being held to raise an additional $200 million at a valuation of around $1.2 billion. If concluded, that would represent a 4x increase in valuation for the Robinhood-challenging Public.com, since its $65 million financing round just last December, done at a valuation of about $300 million. The $200 million investment is being negotiated with public/private tech investment firm Tiger Global Management – whose previous investments include companies such as Airbnb, Yandex, Facebook, Uber, and LinkedIn.

Plus500 eyes acquisitions, shares down 2% after posting Q4 / FY2020 results. Leading FCA regulated CFDs broker Plus500 released its full year 2020 financial results and 2021 outlook this morning, alongside a new share buyback program, basically extending the buyback effort the company launched last summer. For Q4 Plus500 revenue came in at $91.9 million – down from $216 million+ in each of the previous three quarters – and EBITDA was $19.9 million. The company’s Q4 EBITDA margin of 22% was well off the 59% margin overall for 2020. Markets seemed to take Plus500’s announcements in stride, with the company’s shares trading down slightly, by about 2% in early Wednesday trading on the London Stock Exchange. The reaction seems to be mainly to the company’s disclosures that its “new vision and strategy” to access future growth will likely include targeted M&A, and a quick year-to-date 2021 update.

Plus500 eyes acquisitions, shares down 2% after posting Q4 / FY2020 results. Leading FCA regulated CFDs broker Plus500 released its full year 2020 financial results and 2021 outlook this morning, alongside a new share buyback program, basically extending the buyback effort the company launched last summer. For Q4 Plus500 revenue came in at $91.9 million – down from $216 million+ in each of the previous three quarters – and EBITDA was $19.9 million. The company’s Q4 EBITDA margin of 22% was well off the 59% margin overall for 2020. Markets seemed to take Plus500’s announcements in stride, with the company’s shares trading down slightly, by about 2% in early Wednesday trading on the London Stock Exchange. The reaction seems to be mainly to the company’s disclosures that its “new vision and strategy” to access future growth will likely include targeted M&A, and a quick year-to-date 2021 update.

Exness kicks off 2021 with record active traders, Jan volumes $626B. Global Retail FX and CFDs broker Exness kicked off 2021 where it left off in 2020 – with a fairly impressive trading volumes figure for the month of January. Client trading volumes totaled $626.4 billion at Exness in January 2021, down 7% from December’s figure of $673.6 billion but still well ahead of the Exness’ average monthly volumes of $565 billion in 2020. Despite the slight downturn in volumes, Exness saw a record number of active clients during the month, at 164,862 – well above December’s 145,400 – as the global retail trading phenomenon also came to Exness, which recorded a high level of new client signups during the month.

Exness kicks off 2021 with record active traders, Jan volumes $626B. Global Retail FX and CFDs broker Exness kicked off 2021 where it left off in 2020 – with a fairly impressive trading volumes figure for the month of January. Client trading volumes totaled $626.4 billion at Exness in January 2021, down 7% from December’s figure of $673.6 billion but still well ahead of the Exness’ average monthly volumes of $565 billion in 2020. Despite the slight downturn in volumes, Exness saw a record number of active clients during the month, at 164,862 – well above December’s 145,400 – as the global retail trading phenomenon also came to Exness, which recorded a high level of new client signups during the month.

Among the top FX industry executive moves reported at FNG this week were:

❑ Exclusive: Samer Mourched out after just 3 months as COO at Accuindex.

❑ Exclusive: Elena Christodoulou moves from Tickmill to Markets.com to cover DACH region.

❑ Exclusive: FXSpotStream hires Yuta Inoguchi for Japan Bus Dev.

❑ Trading Technologies appoints Farley Owens as its President.

❑ Andrew Polydor named Head of Global Markets at TP ICAP.

❑ June Felix earns £22k in her first couple of months at RELX.