Bitcoin Saved by Nvidia’s Earnings – But Can It Stay Above $90,000?

The following is a guest editorial courtesy of Carolane de Palmas, Markets Analyst at Retail FX and CFDs broker ActivTrades.

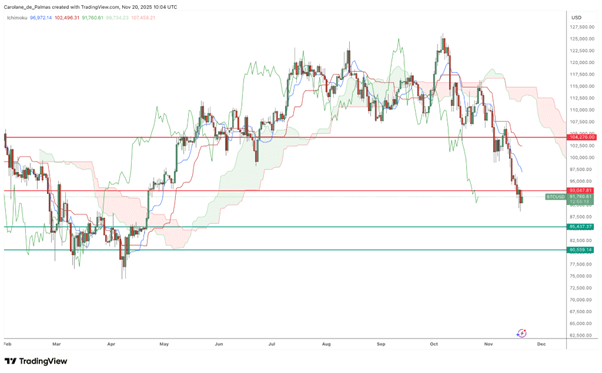

Bitcoin has endured one of its most turbulent months of 2025, erasing all year-to-date gains and falling nearly 28% from its early October peak above $126,000. The decline pushed the cryptocurrency to its lowest level since April, with repeated intraday breaks below $90,000 before stabilising near $92,000 today according to BTCUSD trading data from ActivTrades.

BTCUSD Daily Chart – Source: TradingView

Investors are now wondering whether this is a temporary pause or if the bearish movement will intensify. The recent swing in sentiment has been shaped by an unusual mix of events: a historic liquidation wave following Donald Trump’s unexpected tariff threats, heightened uncertainty surrounding the Federal Reserve’s next policy steps, and a late-stage recovery triggered by Nvidia’s outstanding earnings. Understanding how these events are connected helps clarify why Bitcoin fell so sharply and potentially what to expect now.

How Tariffs, Leverage, and Fed Uncertainty Triggered Bitcoin’s Recent Decline

Bitcoin’s downward spiral began abruptly on October 10, when the market experienced what has been called by many as the largest liquidation event in its history. The forced deleveraging was unprecedented in its scale and severity for the industry. According to market data, the size of liquidations reached nine times the volume recorded during the February 2025 crash and nearly twenty times the forced selling seen during the March 2020 Covid-era meltdown. Even the collapse of FTX in November 2022 was smaller in comparison. During a two-day period, Bitcoin fell more than 14% from the prior Friday’s high above $122,000, dropping to around $104,700 as more than $19 billion in leveraged crypto positions were unwound. Thin liquidity amplified every move, turning what initially appeared to be normal profit-taking into a brutal and cascading flash crash.

Why did Bitcoin prices fall? The catalyst was rather political. Late on October 9, President Donald Trump stunned markets by announcing a 100% tariff on all Chinese imports and threatening new export controls on critical U.S. software. His decision came in response to Beijing’s fresh restrictions on rare earth exports, a strategically sensitive segment of the global supply chain. China maintains a near-monopoly on the global rare earth supply chain, controlling approximately 70% of mining output and processing more than 90% of the world’s processed rare earths. Citing national security concerns, Beijing moved to tighten control over these vital minerals, which are indispensable components for electronics, electric vehicles (EVs), and advanced military technology. Trump immediately labelled the move “extremely hostile” and retaliated with sweeping tariffs aimed at all Chinese goods entering the United States.

The geopolitical shock rattled global markets. Tariffs of that magnitude implied higher costs across the global manufacturing sector, fresh stress on supply chains, and increased recession risks at a moment when many economies were only gradually regaining momentum. For risk-sensitive assets like cryptocurrencies, the announcement acted as a trigger for a sell-off. Investors began shedding high-beta holdings, concerned that an escalating U.S.–China conflict could undermine global growth and reduce liquidity. Bitcoin, despite its long-standing reputation as an alternative asset, still behaves more like a speculative vehicle during moments of acute macro uncertainty. As soon as traders began exiting leveraged long positions, the rapid liquidation of margin-dependent accounts pushed the market into a self-reinforcing downward loop.

The crash was exacerbated by structural factors within the crypto ecosystem. Many traders entered the week heavily levered, expecting a continuation of Bitcoin’s bullish momentum after its early-October rally. When prices unexpectedly fell, these leveraged investors faced immediate margin calls. Because crypto markets operate around the clock with no real circuit-breakers than traditional exchanges, the impact snowballed. Forced liquidations triggered further declines, which then prompted additional liquidations in a cascading pattern. CNN noted that the amount of leverage in the system worsened the crash significantly, as investors who had borrowed to amplify their exposure were among the first to be wiped out.

While markets eventually stabilised, Bitcoin failed to mount a meaningful recovery in the days that followed. The geopolitical shock had shaken confidence, but the next phase of uncertainty came from the Federal Reserve. Attention quickly shifted from tariffs to monetary policy, particularly the growing lack of clarity about whether the Fed would continue cutting rates before the end of the year. The minutes from the most recent Federal Open Market Committee meeting revealed deep divisions inside the central bank. Although officials approved a rate cut at their last meeting, the direction for December is far from clear. The minutes showed that several policymakers believe another cut could be justified in December, while many others stressed that no additional reductions are necessary in 2025.

The wording matters because in Federal Reserve terminology “many” represents a larger share of members than “several,” signalling that the committee may be leaning against delivering another cut this year. The document also highlighted the degree of disagreement, noting that participants held “strongly differing views” about what would be appropriate at the upcoming meeting. Regardless of the final decision, analysts expect at least three dissents, reflecting the most divided committee in years. The discord was worsened by the recent government shutdown, which postponed the release of critical employment and inflation reports. Without fresh labour and price data, each side of the debate lacked the evidence needed to shift its stance.

The absence of updated macroeconomic indicators quickly filtered into market expectations. Investors who had previously viewed a December rate cut as all but guaranteed were forced to reprice their outlook. Market-implied probabilities fell sharply, dropping to around one-in-three after the Department of Labor confirmed that the October employment report would not be available before the December meeting. Richmond Fed President Tom Barkin acknowledged that without compelling new data it becomes difficult for officials with entrenched positions to reach a consensus, hinting at a potentially volatile policy meeting ahead.

This monetary uncertainty weighed on Bitcoin. Lower interest rates typically support speculative assets by improving liquidity conditions and reducing the opportunity cost of holding non-yielding investments. With no clear signal from the Fed, traders are avoiding making large directional bets on cryptocurrencies. The combination of geopolitical stress, extreme leverage, and monetary policy confusion kept Bitcoin pinned near its recent lows, unable to stage a decisive rebound.

Nvidia’s Earnings Offer a Temporary Lifeline to Bitcoin

The dynamic shifted yesterday when Nvidia released its third-quarter earnings. At a moment when pessimism dominated risk markets, the AI chipmaker delivered results that exceeded even the highest expectations. Nvidia reported record quarterly sales of $57 billion, a 62% year-over-year increase, driven by explosive demand for advanced AI data-centre hardware. The company also issued strong guidance, forecasting $65 billion in revenue for the fourth quarter, higher than analysts’ already bullish consensus. The performance reassured investors that concerns about an impending AI bubble were overstated and that demand across the artificial intelligence ecosystem remains robust.

The market reaction was immediate. Nvidia shares gained more than 5% in after-hours trading, indicating the strongest post-earnings response in over a year. The company’s results triggered a broader tech-led rally, particularly in Asian equity markets, where investors had been on edge following several weeks of aggressive selling in high-growth names. The renewed optimism spilled over into digital assets. Bitcoin, which had spent several sessions under heavy pressure, found support and stabilised around the $92,000 mark. The connection is indirect but meaningful: the crypto market has become increasingly correlated with large-cap technology stocks, especially those tied to the AI boom. When sentiment toward the most influential tech companies improves, it often lifts appetite for speculative assets as well.

The optimism for a sustained recovery is limited by institutional investment patterns. Bitcoin ETFs reveal a more hesitant approach from large capital, particularly after BlackRock’s iShares Bitcoin Trust suffered its biggest single-day withdrawal—a significant $523 million outflow—on Tuesday. This suggests that while retail traders and algorithmic systems responded positively to Nvidia’s earnings, institutional investors continue to reduce exposure to crypto amid uncertainty. At the same time, gold prices have remained resilient, prompting some analysts to suggest that investors are rotating from Bitcoin into gold rather than treating the two assets as interchangeable hedges. This behaviour challenges the narrative that Bitcoin is emerging as a reliable store of value during periods of macro stress.

A clearer signal from the Federal Reserve, particularly if upcoming data supports a more dovish stance, could help rebuild confidence and attract inflows back into Bitcoin ETFs. Conversely, if the Fed adopts a more hawkish posture, risk assets could face renewed pressure. For now, Nvidia’s exceptional performance has interrupted the negative momentum and offered the market a window to reassess. Whether Bitcoin can convert this stabilisation into a sustainable rebound will depend on how the macro environment evolves over the coming weeks.

Sources: Reuters, The Guardian, CNN, Wall Street Journal, CNBC

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.